- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

A Fresh Look at Alphabet (GOOGL) Valuation After New Salesforce Partnership and Gemini AI Expansion

Reviewed by Kshitija Bhandaru

Alphabet’s expanded partnership with Salesforce brings Google’s Gemini AI models deeper into enterprise workflows. This links Agentforce 360 with Google Workspace and broadens automation across sales and IT services. This move further positions Alphabet at the center of enterprise AI adoption, with clear implications for how businesses streamline operations.

See our latest analysis for Alphabet.

Alphabet has enjoyed strong momentum lately, climbing 36.9% in share price over the past three months and delivering a 55.7% total shareholder return for the year. Both figures far outpace the broader market. Recent headlines, including expanded enterprise partnerships and new AI-powered launches such as Waymo’s upcoming autonomous service in London, reinforce the company's position as a leader in tech and innovation.

If Alphabet’s AI-driven progress has your attention, this could be an ideal moment to see what’s happening across the broader tech landscape—See the full list for free.

Given this remarkable momentum, a key question emerges: has Alphabet’s recent surge left the stock undervalued, or has the market already priced in its future growth prospects and innovation pipeline?

Most Popular Narrative: 6.7% Overvalued

The latest narrative for Alphabet, according to Investingwilly, sets a fair value below the most recent closing price. This suggests that, although Alphabet's dominance and growth profile are impressive, the current market is placing a premium above what is considered reasonable by this popular viewpoint. What underpins this verdict? Let’s turn to the narrative for one of its most pivotal arguments.

Alphabet stands out among the Magnificent 7 as the most undervalued on a price-to-earnings (P/E) basis. Despite its consistent revenue and earnings growth, Alphabet trades at a discount compared to peers like Microsoft, Apple, and Amazon. The company’s substantial share buyback program underscores management’s confidence in its long-term prospects. In 2024, Alphabet repurchased approximately $17.6 billion worth of shares, enhancing shareholder value while reducing outstanding shares.

What’s the secret to this narrative’s valuation? Hint: it revolves around substantial earnings growth, healthy margins, and competitive multiples that even Alphabet’s largest rivals cannot claim. Want to see which projections are driving that calculation? You will have to go beyond the headline to discover the underlying assumptions and see how they compare to expectations for the rest of the Magnificent 7.

Result: Fair Value of $237.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing antitrust scrutiny and aggressive capital spending could challenge Alphabet’s growth narrative if regulatory or financial hurdles prove more persistent than expected.

Find out about the key risks to this Alphabet narrative.

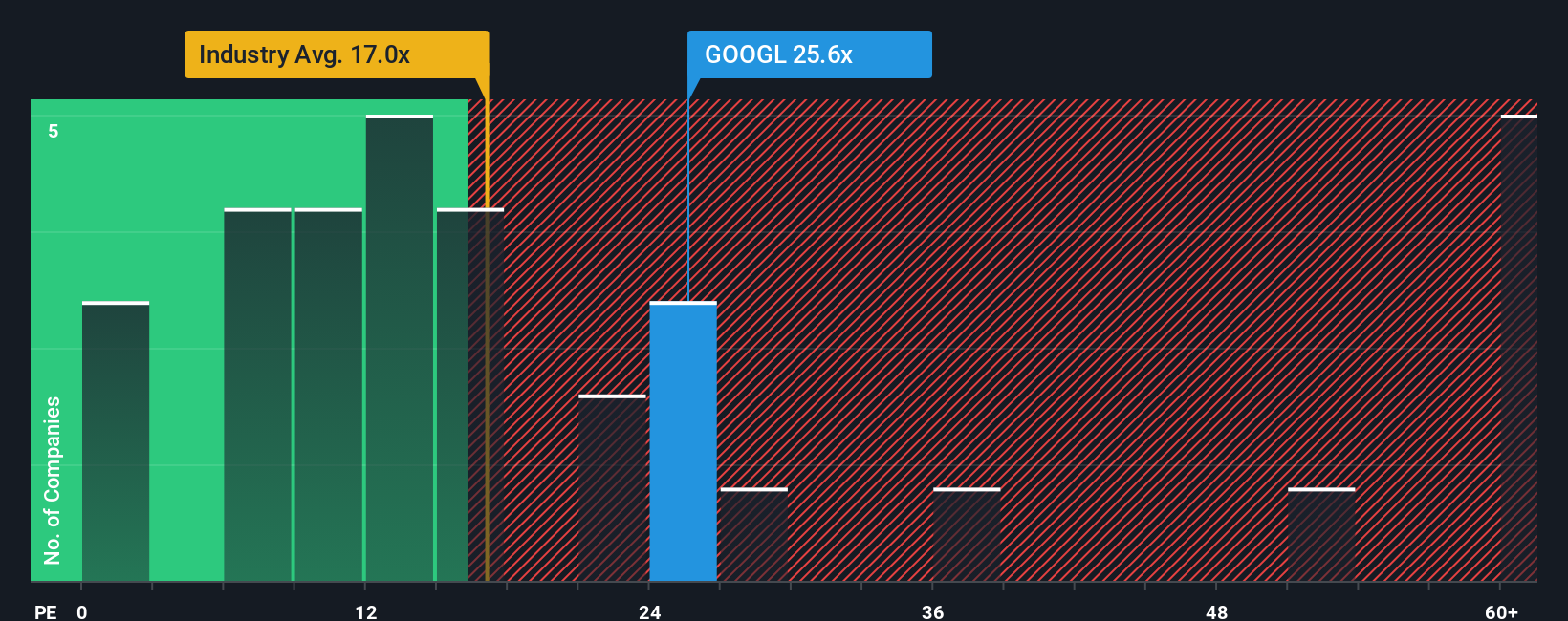

Another View: Multiples Offer a Mixed Message

Looking beyond fair value estimates, Alphabet's price-to-earnings ratio sits at 26.5 times. This is higher than the US Interactive Media and Services industry average of 15.4 but well below the average of its peers at 54. The fair ratio, meanwhile, is calculated at 41.7. This gap reveals that while Alphabet looks pricey versus its sector, the broader peer group and the fair ratio suggest there may still be room to grow. Is the market underestimating Alphabet’s true earning power, or is current optimism already accounted for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alphabet Narrative

If you are not convinced by these perspectives or enjoy independent research, you can analyze the data and craft your own take in under three minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alphabet.

Looking for More Investment Ideas?

Smart investors know that opportunity is everywhere. Don't let the next winning stock pass you by. Capitalize on powerful themes and markets shaping the future now.

- Uncover opportunities in resilient sectors by checking out these 18 dividend stocks with yields > 3% offering yields that stand out in today's market.

- Jump ahead of the curve with these 24 AI penny stocks at the forefront of artificial intelligence, transforming industries with innovative tech and clever automation.

- Capitalize on tomorrow’s breakthroughs by investigating these 26 quantum computing stocks that are fast-tracking the adoption of next-generation computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion