- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOG

Alphabet (NASDAQ:GOOG) appears reasonably valued - but has set itself a very high base to beat in 2022

Alphabet Inc’s (NASDAQ:GOOG) share price rallied to a new high yesterday after the company announced strong third quarter financial results. The share price initially traded lower in late trade on Tuesday, as some investors reacted to slowing revenue at YouTube and Google Cloud. Investors have since decided to focus on the big picture, and the fact that the company grew quarterly revenue by a staggering $19 billion in the last year. However, the company has now set itself a very high base to beat in 2022.

Highlights from the quarter included:

- Revenue up 41% year-on-year to $65.12 billion, and $2 billion ahead of consensus estimates.

- EPS up 71% year-on-year to $27.99 and $4.87 ahead of estimates.

- Net Income up 68% year-on-year to $18.9 billion.

- Google Cloud revenue up 44.9% to $5 billion, but $100 million below estimates.

- YouTube Ad revenue up 43% to $7.2 billion, but $220 million below estimates.

See our latest analysis for Alphabet

Alphabet’s Valuation

In August we looked at Alphabet’s valuation. At the time when we discounted cash flow forecasts from analysts who cover the stock, we estimated the fair value at $4,575 a share. At the time the stock was trading at 40% below that level and we said that like many holding companies the discount may remain in place.

Since then forecasts have continued to rise and the estimated value is now $4874.99. So, while the stock price has risen it remains 40% below the estimated value.

The stock’s PE ratio of 27.5x is currently well-below the industry average of 36.2x, meaning that it is also trading at a more reasonable valuation than its peers. However, given that Alphabet’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

Can we expect growth from Alphabet?

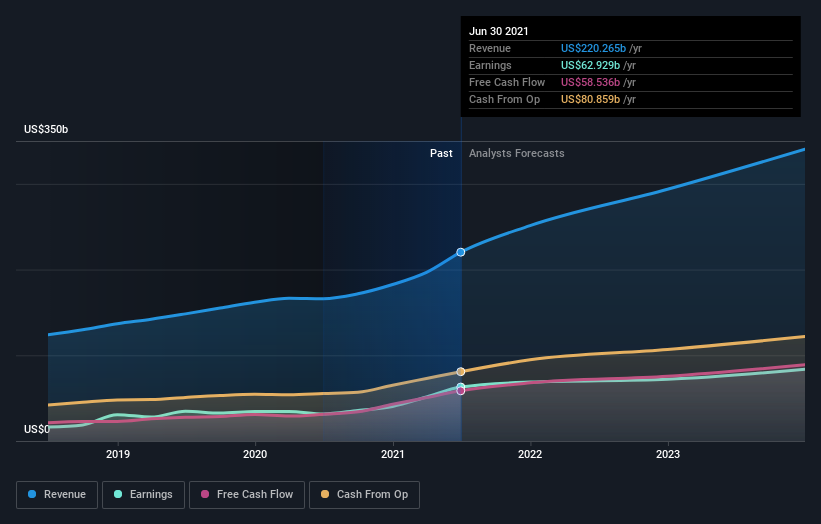

Analysts are expecting earnings growth to average 12.4% over the next 3 years - but that includes an expected slowdown to just 4.4% in 2022, before an increase to 18% and 14% in the following years. Next year’s slowdown will primarily be a result of the very high base that has been set over the last few quarters.

So, while the big picture remains very positive, there’s a strong likelihood that sentiment weakens next year as growth slips into the single digits. If you look at a long term chart of the share price you will see that the price often consolidates, either by trading sideways for several months, or falling 10 to 20% before rebounding.

Key Takeaways

Alphabet has been an incredible stock to own for a long time. The company is also a key player at the forefront of several key growth industries, and the long term picture remains bright. But, in the medium term, there is a reasonable chance the share price underperforms the market - though this would offer an opportunity for accumulation.

Analysts will be updating their models for Alphabet in the next few days - you can keep track of what analysts are forecasting by clicking here.

If you are no longer interested in Alphabet, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:GOOG

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026