- United States

- /

- Media

- /

- NasdaqGM:GAMB

High Growth Tech Stocks to Watch in December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, but it has risen by an impressive 28% over the past year, with earnings projected to grow by 15% annually in the coming years. In this environment, high growth tech stocks that demonstrate strong revenue potential and innovative capabilities are particularly noteworthy for investors seeking opportunities in a dynamic sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 240 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Gambling.com Group (NasdaqGM:GAMB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gambling.com Group Limited is a performance marketing company serving the online gambling industry globally, with a market cap of $543.73 million.

Operations: The company generates revenue primarily through its Gambling Affiliation segment, which totaled $124.40 million. As a performance marketing entity, it focuses on connecting online gambling operators with potential customers.

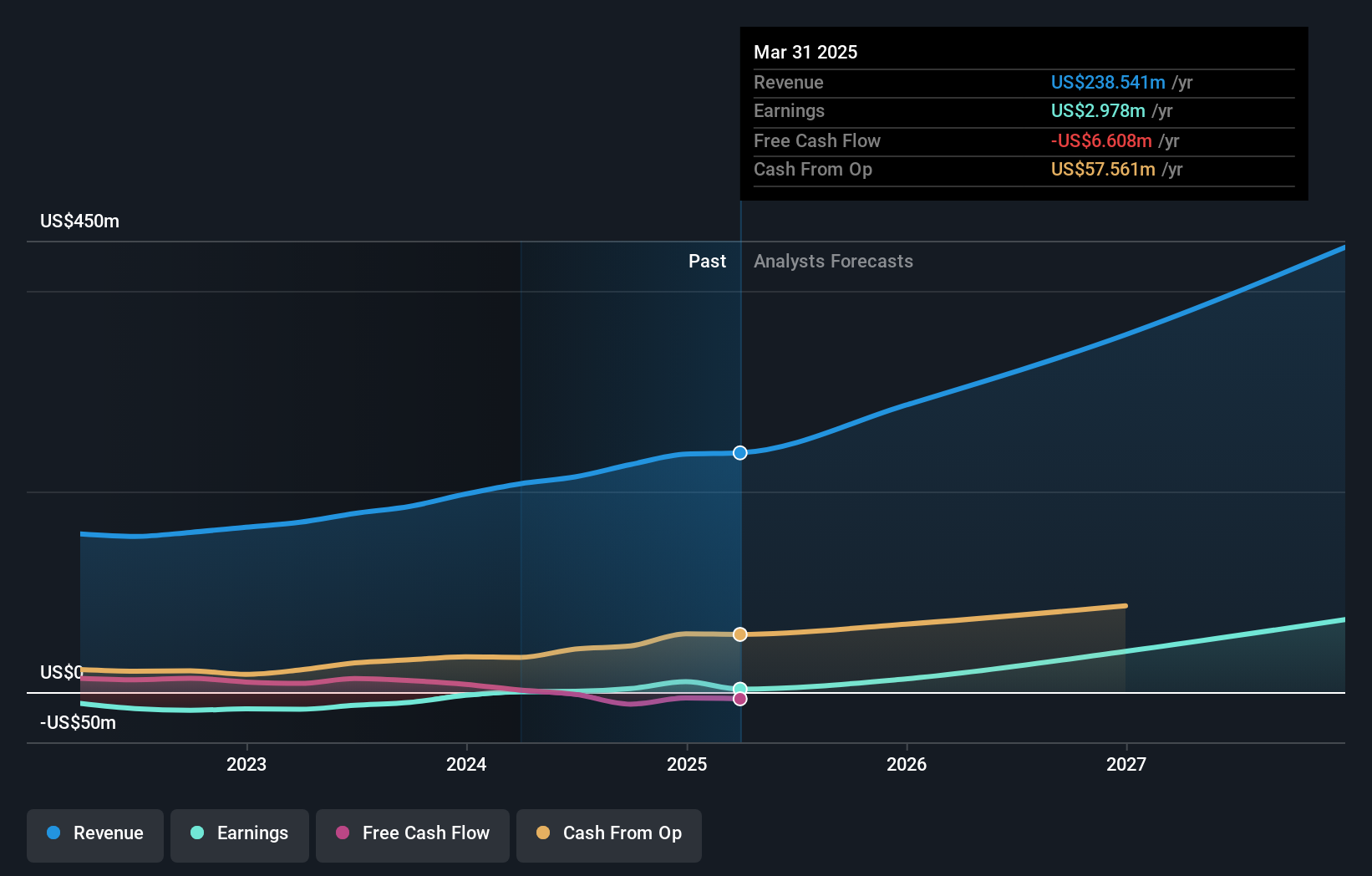

Gambling.com Group has demonstrated robust financial growth, with a notable increase in sales from $23.46 million to $32.12 million in the third quarter of 2024 alone, reflecting a year-over-year surge. This performance is underscored by an impressive net income rise from $5.01 million to $8.51 million over the same period, and earnings per share doubling from $0.13 to $0.24. The company's strategic maneuvers include an aggressive share repurchase program where it bought back nearly 1.8 million shares for approximately $17 million recently, signaling strong confidence in its operational stability and future prospects. Moreover, Gambling.com's revenue is expected to grow at 17.3% annually, outpacing the U.S market average of 9.1%, while its earnings are projected to expand by 19.1% each year—faster than the broader market’s growth rate of 15.3%. These figures illustrate not only Gambling.com’s ability to generate significant returns but also its potential for sustained growth amidst competitive pressures within the tech-driven online gambling sector.

- Click here and access our complete health analysis report to understand the dynamics of Gambling.com Group.

Examine Gambling.com Group's past performance report to understand how it has performed in the past.

Vericel (NasdaqGM:VCEL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vericel Corporation is a commercial-stage biopharmaceutical company focused on developing and distributing cellular therapies for sports medicine and severe burn care in North America, with a market cap of $2.84 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $226.84 million. It operates in the cellular therapies market for sports medicine and severe burn care across North America.

Vericel's recent performance and projections underscore its potential within the biotech sector, particularly in high-growth markets. In Q3 2024, the company reported a significant revenue increase to $57.91 million from $45.58 million year-over-year, alongside a reduction in net loss to $0.901 million from $3.66 million, reflecting operational improvements and market adaptation. Moreover, Vericel's R&D commitment is evident as it continues to invest in innovation despite financial pressures—a strategy that could enhance long-term viability and competitiveness in its niche of regenerative medicine. Looking ahead, Vericel maintains an optimistic revenue forecast for 2024, projecting growth between 20% to 23%, which outpaces the broader US market growth expectation of 9.1%. This projection is supported by an anticipated earnings growth rate of 51.6% per year, suggesting not only recovery but also potential leadership in emerging biotech trends.

- Get an in-depth perspective on Vericel's performance by reading our health report here.

Gain insights into Vericel's historical performance by reviewing our past performance report.

Enfusion (NYSE:ENFN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enfusion, Inc. offers software-as-a-service solutions tailored for the investment management industry across various regions including the United States, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of $1.37 billion.

Operations: Enfusion generates revenue primarily from its software-as-a-service solutions, specifically as an online financial information provider, with reported revenues of $195.16 million. The company operates across multiple regions including the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Enfusion's recent financial performance and strategic executive appointments underscore its evolving role in the high-tech sector. In Q3 2024, revenue climbed to $51.17 million from $44.36 million year-over-year, marking a growth rate of 16.7%, which surpasses the broader US market's expansion rate of 9.1%. This growth is complemented by a robust forecast in earnings, expected to surge by an impressive 74.8% annually over the next three years, reflecting both operational efficiency and strategic foresight in leadership enhancements—evidenced by key appointments like Arman Artuc as Head of Engineering and Jesper Cordes as Head of Client Services Americas. These moves are poised to further Enfusion's technological capabilities and client engagement strategies, potentially setting new standards within the investment technology landscape.

- Take a closer look at Enfusion's potential here in our health report.

Evaluate Enfusion's historical performance by accessing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 240 US High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GAMB

Gambling.com Group

Operates as a performance marketing company for the online gambling industry in North America, the United Kingdom, Ireland, rest of Europe, and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives