- United States

- /

- Entertainment

- /

- NasdaqGM:GAIA

Gaia (NASDAQ:GAIA) shareholders are up 13% this past week, but still in the red over the last five years

While not a mind-blowing move, it is good to see that the Gaia, Inc. (NASDAQ:GAIA) share price has gained 18% in the last three months. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. In fact, the share price has tumbled down a mountain to land 78% lower after that period. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Gaia

Gaia wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Gaia saw its revenue increase by 14% per year. That's a pretty good rate for a long time period. So the stock price fall of 12% per year seems pretty steep. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

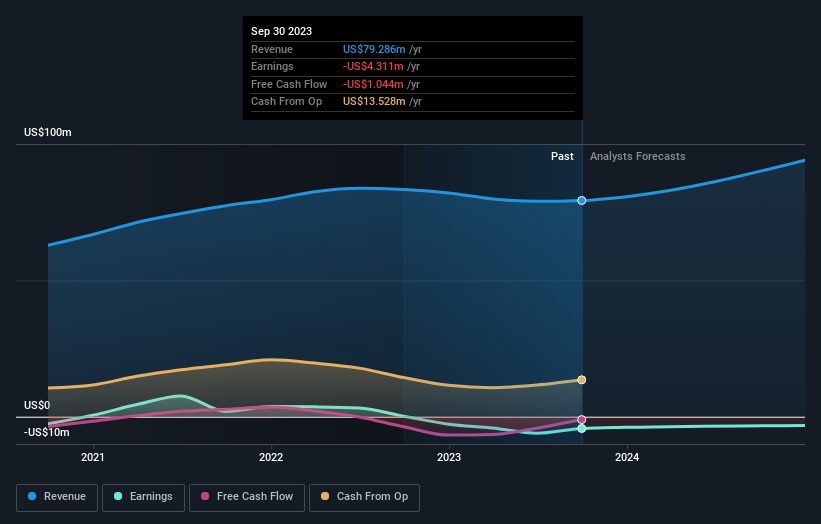

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Gaia provided a TSR of 5.5% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 12% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Gaia you should be aware of.

Gaia is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:GAIA

Gaia

Operates a digital video subscription service and online community for underserved member base in the United States, Canada, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives