- United States

- /

- Media

- /

- NasdaqGS:FOXA

Fox (FOXA) and ESPN Offer US$40 Bundle Combining Streaming Platforms

Reviewed by Simply Wall St

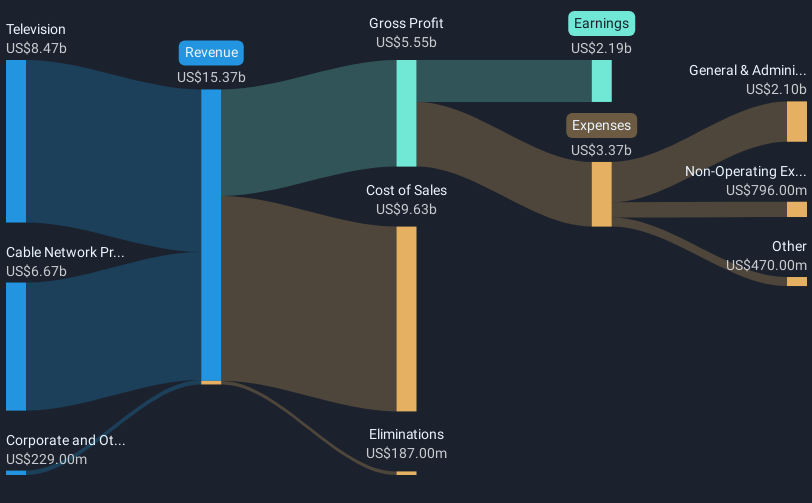

Fox (FOXA) recently announced a bundled streaming service with ESPN, offering combined access to extensive sports and entertainment content. This period also saw the launch of the FOX One streaming service and a quarterly earnings report showcasing improved sales and net income. Despite these developments, the company's share price experienced a marginal 1% decline over the past month, which can be seen as flat in comparison to the broader market's significant gains, as the S&P 500 and Nasdaq reached new highs. The company's initiatives likely provided some counterbalance to the overall market trends during this period.

Fox has 1 warning sign we think you should know about.

The announcement of Fox's bundled streaming service with ESPN and the launch of FOX One may have a meaningful impact on shaping the narrative surrounding the company's digital growth amidst a backdrop of shifting consumer trends. These initiatives could strengthen Fox's digital presence, potentially offsetting the challenges faced by the decline in traditional TV viewership and advertising revenue. Over the past five years, Fox’s shares have experienced a total return of 128.39%, highlighting a solid long-term performance. However, short-term, the company’s shares have slightly underperformed the S&P 500 and Nasdaq over the past month, which collectively posted significant gains, despite the recent announcement.

In the context of future revenue and earnings forecasts, the company's digital transformation and content bundling initiatives could provide new income streams, potentially altering the initial forecasts of slowed revenue and earnings. Analysts currently value Fox with a price target of US$60.25, against a current share price of US$54.50. This indicates a potential upside in line with market expectations, though the small discount to the price target may suggest limited perceived risk by analysts at present values. Such strategic moves and innovative offerings may thus complement Fox's focus on live news and sports content, possibly sustaining shareholder value even as the broader industry undergoes transformation.

Gain insights into Fox's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion