- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms, Inc. (NASDAQ:FB) Looks Cheap, but Rising Expenses may Cap Gains

The mega-cap tech stocks have had a great year in 2021, with the two exceptions being Meta Platforms, Inc. ( NASDAQ:FB ).and Amazon ( NASDAQ:AMZN ). Meta’s underperformance appears to have more to do with ‘bad press’ than its financial performance. The stock price has actually shown relative strength over the last few weeks, so we decided to take a look at the opportunity Meta may offer.

What's the opportunity in Meta Platforms?

A question to answer is whether Meta Platforms' current trading price of US$335 reflects the actual value of the large-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at Meta Platforms’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

Our estimate of Meta’s fair value comes to about $680, which, if accurate would mean Meta is trading at a 50% discount. This would make sense when you consider that sentiment has been affected by reputational issues while the financial performance has remained strong. We can also look at the P/E ratio to get a sense of what the market expects.

Meta Platforms’s price-to-earnings (PE) ratio of 22x is higher than the US market median ratio of 17x, but lower than its industry peers’ ratio of 27.16x. This suggests that the market believes the Meta will grow earnings at a slightly higher than the US market, but underperform the US interactive media industry.

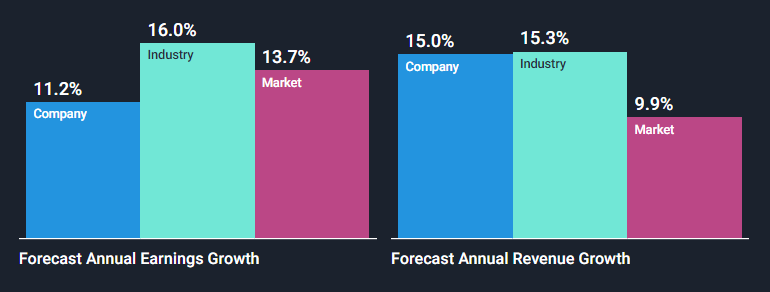

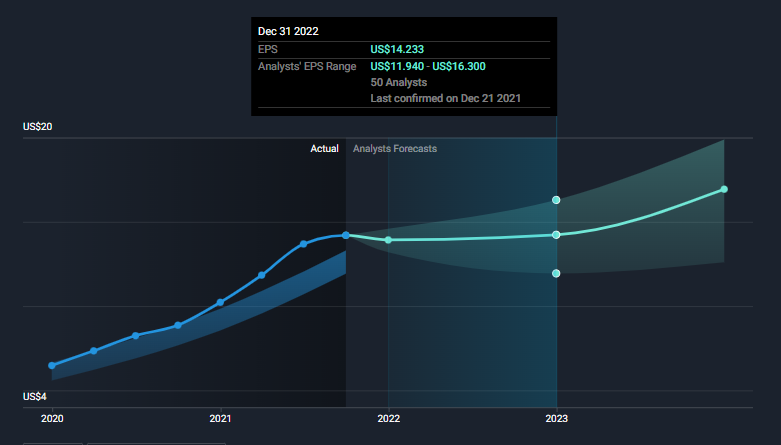

However, when we look at forecasts, we see that analysts expect Meta to underperform both the market and the industry on earnings growth. These growth rates are calculated by constructing a line of best fit through consensus estimates from 50 analysts.

Interestingly, analysts are also expecting Meta’s earnings growth to lag revenue growth. This implies that expenses are expected to grow faster than sales. A closer look at the range of analyst forecasts shows that a few estimates for 2022 are weighing on the average. If these analysts are correct, the stock may not be as cheap as it appears.

What does the future of Meta Platforms look like?

Meta’s revenue growth seems to be quite stable and there doesn’t seem to be any reason that it would change much in the next year or two - so expenses are the key to earnings growth. Meta has already indicated that it will be ramping up investment in its metaverse initiatives, so that accounts for at least some of the increase.

Besides potential antitrust lawsuits, Meta is also facing other lawsuits for up to $150 billion. There’s no indication of how much merit these lawsuits have, and if they do they are likely to take a very long time to play out. Nevertheless some analysts may be making some allowances for legal expenses.

The bottom line is that Meta does appear to be trading at a reasonable price, but if earnings don’t come in at the higher end of the range, sentiment could remain subdued in 2022.

If you are interested in understanding the company at a deeper level, take a look at our full analysis which includes some of the other factors to consider.

If you are no longer interested in Meta Platforms, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you're looking to trade Meta Platforms, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives