- United States

- /

- Media

- /

- NasdaqCM:DRCT

Investors Appear Satisfied With Direct Digital Holdings, Inc.'s (NASDAQ:DRCT) Prospects As Shares Rocket 77%

Direct Digital Holdings, Inc. (NASDAQ:DRCT) shares have continued their recent momentum with a 77% gain in the last month alone. This latest share price bounce rounds out a remarkable 650% gain over the last twelve months.

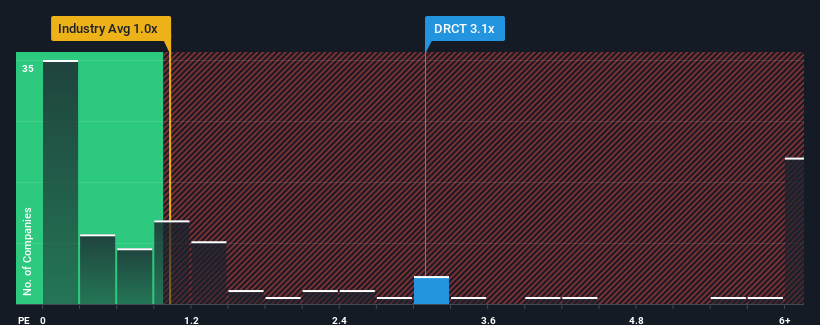

Following the firm bounce in price, you could be forgiven for thinking Direct Digital Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.1x, considering almost half the companies in the United States' Media industry have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Direct Digital Holdings

How Direct Digital Holdings Has Been Performing

Direct Digital Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Direct Digital Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Direct Digital Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 105% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 55% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 3.9% growth forecast for the broader industry.

With this information, we can see why Direct Digital Holdings is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Direct Digital Holdings' P/S?

Direct Digital Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Direct Digital Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Media industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 2 warning signs for Direct Digital Holdings that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DRCT

Direct Digital Holdings

Operates as an end-to-end full-service advertising and marketing platform.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives