- United States

- /

- Media

- /

- NasdaqCM:DRCT

Direct Digital Holdings, Inc.'s (NASDAQ:DRCT) 31% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

Direct Digital Holdings, Inc. (NASDAQ:DRCT) shares have had a horrible month, losing 31% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 41% in the last year.

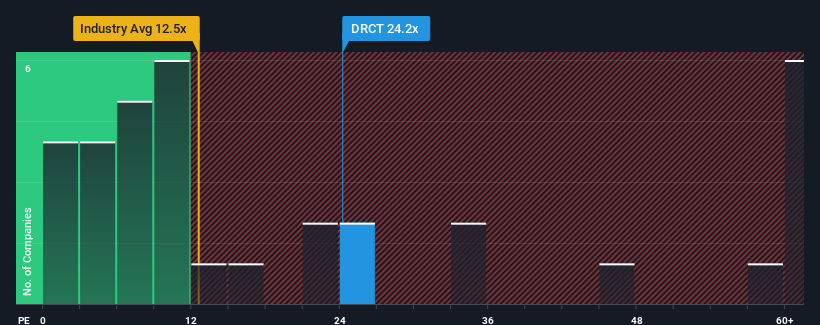

Although its price has dipped substantially, Direct Digital Holdings' price-to-earnings (or "P/E") ratio of 24.2x might still make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Direct Digital Holdings' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Direct Digital Holdings

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Direct Digital Holdings would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 58% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 14% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Direct Digital Holdings' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

There's still some solid strength behind Direct Digital Holdings' P/E, if not its share price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Direct Digital Holdings revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Direct Digital Holdings has 4 warning signs (and 2 which are significant) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DRCT

Direct Digital Holdings

Operates as an end-to-end full-service programmatic advertising platform.

Slight and fair value.