The CEO of Daily Journal Corporation (NASDAQ:DJCO) is Gerald Salzman, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Daily Journal

How Does Total Compensation For Gerald Salzman Compare With Other Companies In The Industry?

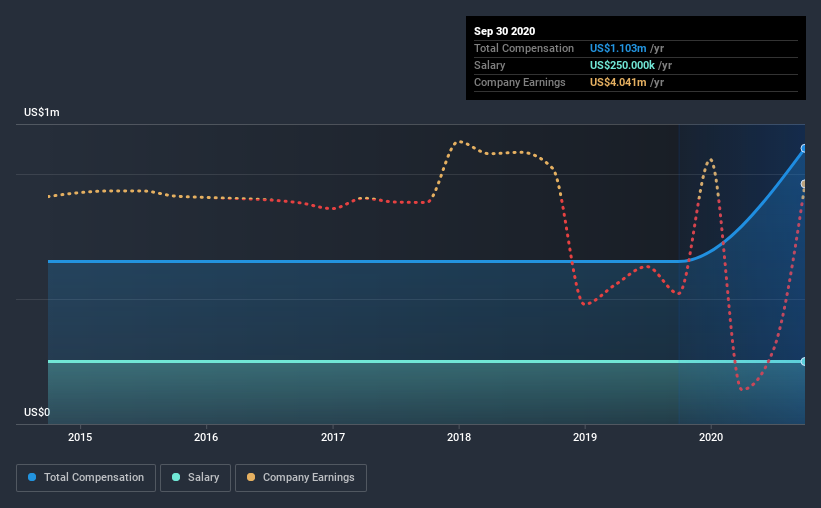

According to our data, Daily Journal Corporation has a market capitalization of US$475m, and paid its CEO total annual compensation worth US$1.1m over the year to September 2020. Notably, that's an increase of 70% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$250k.

For comparison, other companies in the same industry with market capitalizations ranging between US$200m and US$800m had a median total CEO compensation of US$2.3m. That is to say, Gerald Salzman is paid under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$250k | US$250k | 23% |

| Other | US$853k | US$400k | 77% |

| Total Compensation | US$1.1m | US$650k | 100% |

Talking in terms of the industry, salary represented approximately 23% of total compensation out of all the companies we analyzed, while other remuneration made up 77% of the pie. Daily Journal is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Daily Journal Corporation's Growth Numbers

Over the last three years, Daily Journal Corporation has shrunk its earnings per share by 65% per year. In the last year, its revenue is up 2.6%.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Daily Journal Corporation Been A Good Investment?

Boasting a total shareholder return of 59% over three years, Daily Journal Corporation has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As we touched on above, Daily Journal Corporation is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. And while EPS growth is in the red, shareholder returns have been great over the last three years, so that's certainly a bright spot! We would like to see EPS growth, but in our view CEO compensation is modest.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Daily Journal that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Daily Journal, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:DJCO

Daily Journal

Daily Journal Corporation publishes newspapers and websites covering in California, Arizona, Utah, and Australia.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026