- United States

- /

- Entertainment

- /

- NasdaqCM:CURI

Revenues Not Telling The Story For CuriosityStream Inc. (NASDAQ:CURI)

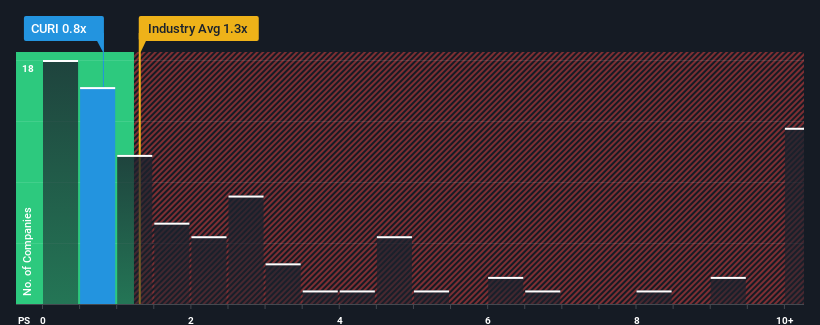

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Entertainment industry in the United States, you could be forgiven for feeling indifferent about CuriosityStream Inc.'s (NASDAQ:CURI) P/S ratio of 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for CuriosityStream

How Has CuriosityStream Performed Recently?

While the industry has experienced revenue growth lately, CuriosityStream's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CuriosityStream.What Are Revenue Growth Metrics Telling Us About The P/S?

CuriosityStream's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 7.8% decrease to the company's top line. Still, the latest three year period has seen an excellent 223% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 0.7% per year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 9.4% per annum, which is noticeably more attractive.

In light of this, it's curious that CuriosityStream's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that CuriosityStream's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - CuriosityStream has 3 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CURI

CuriosityStream

A media and entertainment company, provides factual content through multiple channels.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives