Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Criteo S.A. (NASDAQ:CRTO) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Criteo

What Is Criteo's Debt?

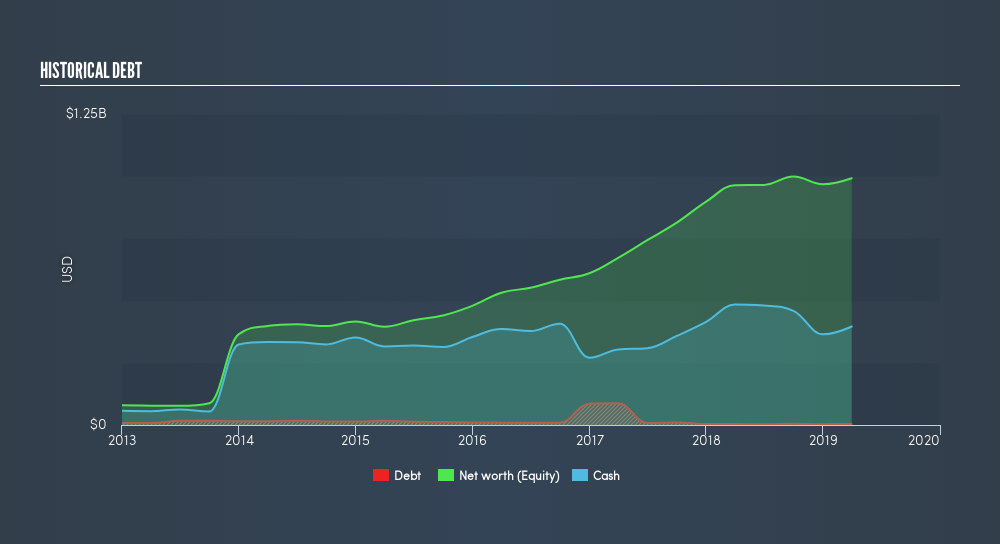

As you can see below, Criteo had US$3.88m of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. But it also has US$395.8m in cash to offset that, meaning it has US$391.9m net cash.

A Look At Criteo's Liabilities

The latest balance sheet data shows that Criteo had liabilities of US$564.9m due within a year, and liabilities of US$189.2m falling due after that. Offsetting this, it had US$395.8m in cash and US$456.4m in receivables that were due within 12 months. So it actually has US$98.0m more liquid assets than total liabilities.

This short term liquidity is a sign that Criteo could probably pay off its debt with ease, as its balance sheet is far from stretched. Criteo boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Criteo saw its EBIT drop by 5.8% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Criteo can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Criteo has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Criteo recorded free cash flow worth a fulsome 90% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to investigate a company's debt, in this case Criteo has US$392m in net cash and a decent-looking balance sheet. The cherry on top was that in converted 90% of that EBIT to free cash flow, bringing in US$121m. So we don't think Criteo's use of debt is risky. We'd be very excited to see if Criteo insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:CRTO

Criteo

A technology company, provides marketing and monetization services and infrastructure on the open internet in North and South America, Europe, the Middle East, Africa, and the Asia-Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives