- United States

- /

- Media

- /

- NasdaqCM:CREX

We Wouldn't Rely On Creative Realities's (NASDAQ:CREX) Statutory Earnings As A Guide

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Creative Realities (NASDAQ:CREX).

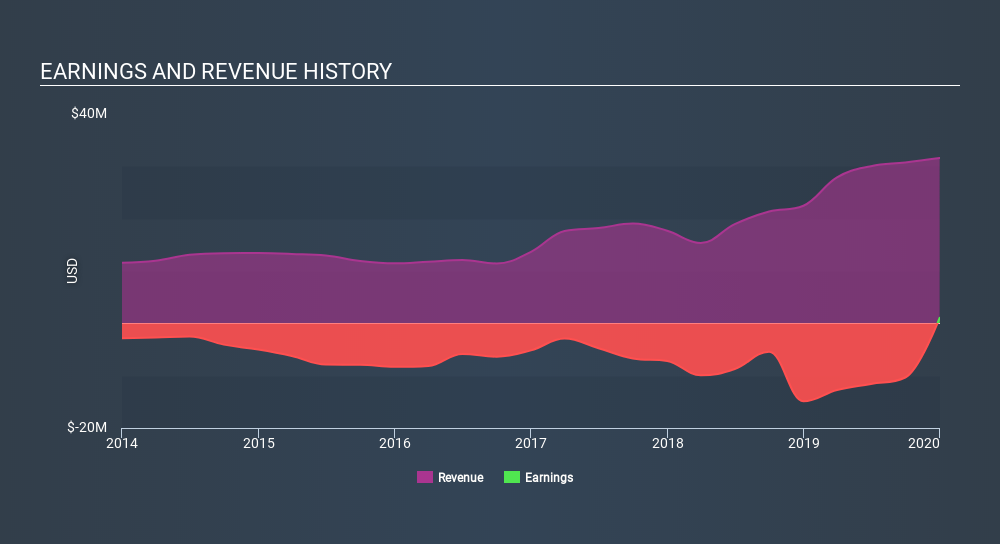

While Creative Realities was able to generate revenue of US$31.6m in the last twelve months, we think its profit result of US$1.04m was more important. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

See our latest analysis for Creative Realities

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. Therefore, today we will consider the nature of Creative Realities's statutory earnings with reference to its dilution of shareholders and the impact of unusual items. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Creative Realities expanded the number of shares on issue by 171% over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Creative Realities's historical EPS growth by clicking on this link.

A Look At The Impact Of Creative Realities's Dilution on Its Earnings Per Share (EPS).

Creative Realities was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

If Creative Realities's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

Finally, we should also consider the fact that unusual items boosted Creative Realities's net profit by US$2.3m over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. Creative Realities had a rather significant contribution from unusual items relative to its profit to December 2019. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Creative Realities's Profit Performance

In its last report Creative Realities benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. On reflection, the above-mentioned factors give us the strong impression that Creative Realities's underlying earnings power is not as good as it might seem, based on the statutory profit numbers. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Every company has risks, and we've spotted 4 warning signs for Creative Realities (of which 3 are significant!) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:CREX

Creative Realities

Provides digital marketing technology and solutions in the United States and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives