- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (NasdaqGS:CMCSA) Faces Shareholder Proposal On Voting Structure Change

Reviewed by Simply Wall St

Comcast (NasdaqGS:CMCSA) experienced a 1.9% increase in its share price over the past week, coinciding with market dynamics driven by a strong jobs report and potential tariff talks between the U.S. and China. Amid this backdrop, activist John Chevedden's call for votes against several of Comcast's Governance Committee members stands out due to their stance on a voting structure proposal. While the broader market, including indices like the S&P 500 and Nasdaq, rose notably, the activist communication added a specific layer of interest for Comcast investors amid broader positive market sentiment.

We've spotted 2 risks for Comcast you should be aware of, and 1 of them is significant.

The recent call for governance changes by activist John Chevedden could underscore broader investor concerns about corporate governance, potentially influencing shareholder sentiment toward Comcast. While Comcast's shares increased by 1.9% in the past week, the company's total return, including dividends, was 8.35% over the past five years. This longer-term performance provides context to the more modest weekly gain and underscores the company's ongoing growth challenges and opportunities, particularly in comparison to the wider market which outperformed Comcast over the past year.

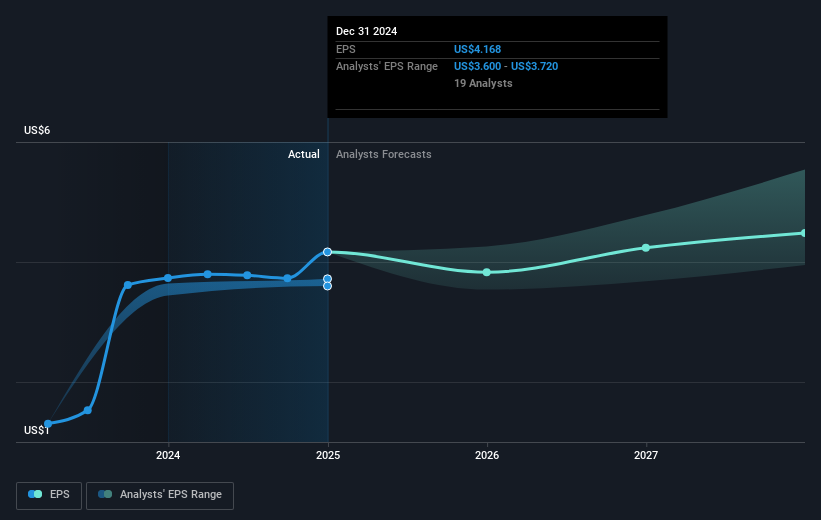

Compared to the US Market's 9.5% return over the last year, Comcast's shares have fallen short, highlighting potential operational and competitive pressures. These pressures are further emphasized in the recent earnings narrative, where projected revenue challenges in the broadband and media segments could weigh on future growth. The share price, currently at US$34.17, reflects a mere 2.5% gap to the bearish price target of US$35.06, suggesting limited market optimism aligned with analysts' cautious forecasts. The communication regarding governance could impact the revenue and earnings forecasts by triggering strategic shifts or altering investor confidence, thereby affecting capital allocation decisions essential for sustaining growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Comcast, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives