- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (NasdaqGS:CMCSA) Expands High-Speed Internet Access in Georgia for US$48 Million

Reviewed by Simply Wall St

Comcast (NasdaqGS:CMCSA) recently expanded its digital infrastructure in Southeast Georgia, connecting thousands of homes and businesses to high-speed Internet, which might have contributed to a 5% increase in its share price over the last week. This expansion aligns with product innovations like the Tri-Band WiFi 6E Gateway, aimed at boosting their market presence. The broader market also showed strength, with a 3% rise amidst major indices working to end multi-week losing streaks. Comcast's performance stands out during a week where other major stocks, including Nike and FedEx, faced challenges, further highlighting the company's solid position.

Comcast's total shareholder return over the past five years was 12.96%. This period captures several impactful developments. Comcast expanded its digital infrastructure, connecting numerous communities in regions like Southeast Georgia and Maryland, which strengthened its presence. Additionally, the launch of innovative products like the Tri-Band WiFi 6E technology and the Sports & News TV package has enhanced service offerings, possibly attracting more customers. Another significant move was the increased focus on business services through acquisitions like Nitel, targeting a larger market share in that sector.

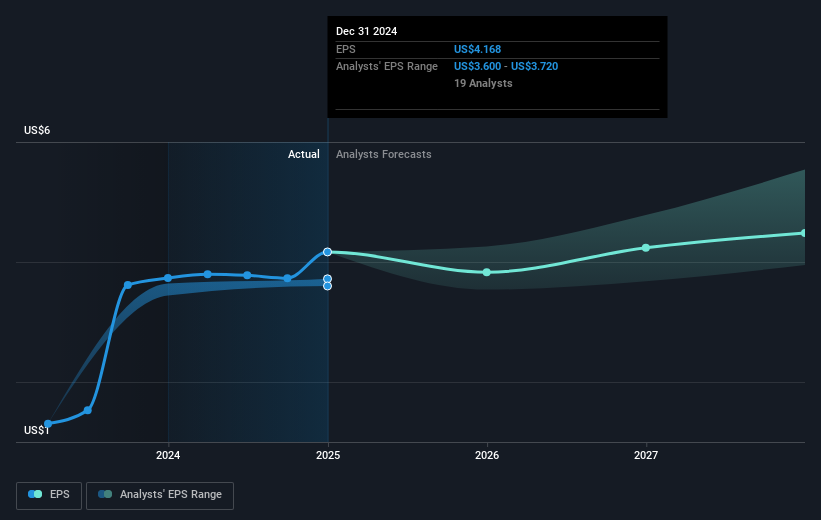

Financially, Comcast has maintained a stable performance, with Q4 2024 revenue reaching US$31.9 billion. A notable financial activity during this time was the completion of a buyback program, where 49.5 million shares were repurchased, potentially boosting shareholder value. Despite these efforts, Comcast underperformed the US Media industry, which declined by 6.1% over the past year, and also lagged behind the broader US market, which saw a 7.6% rise.

Explore historical data to track Comcast's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Comcast, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives