- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (CMCSA) Unveils Xfinity Mobile Arena, 10x Faster WiFi For Philadelphia Fans

Reviewed by Simply Wall St

Comcast (CMCSA) recently unveiled the Xfinity Mobile Arena, the first East Coast venue to feature a high-power WiFi network, which supports a superior fan experience with speeds ten times faster than existing setups. This technological advancement, alongside the company's expansion of services such as high-speed internet to rural Floridian counties and the introduction of a comprehensive World Soccer Ticket package, likely supported the 4.95% rise in the company's stock over the last month. While these initiatives align with broader tech-driven market trends, they may have complemented rather than diverged from wider market movements.

Find companies with promising cash flow potential yet trading below their fair value.

Comcast's recent initiative to launch Xfinity Mobile Arena and expand its high-speed internet services could influence its long-term revenue growth by attracting more customers, enhancing user experience, and potentially increasing subscriber numbers. However, with the broader narrative highlighting challenges like stagnant broadband growth and rising costs, these developments may only serve as partial counterbalances to the pressures Comcast faces. Over the past three years, the company's total shareholder return, including dividends, was 7.92%. This performance provides a broader context against its annual underperformance compared to the US market, which returned 17.5% over the past year.

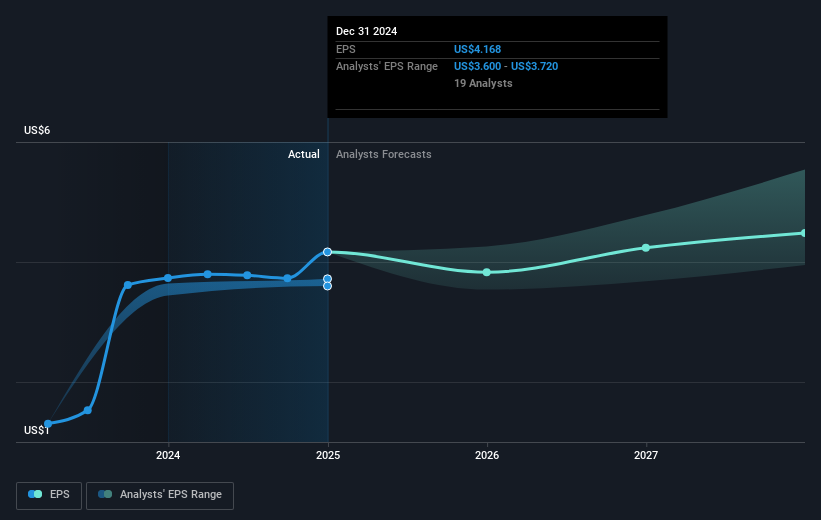

Despite the recent boost in its stock price, Comcast shares still trade at a discount to the consensus analyst price target of US$39.81, suggesting potential upside if the company can address its strategic challenges effectively. The current share price of US$34.13 reflects a 16.66% discount to the target, highlighting a cautious market sentiment amid concerns about future profitability. As Comcast pursues new technological advancements and market expansions, these efforts may impact its revenue and earnings forecasts, yet they must significantly overcome the hurdles of an increasingly competitive environment and regulatory headwinds to change the trajectory noted by bearish analysts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion