- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (CMCSA): Evaluating Whether the Recent Stock Weakness Signals an Undervalued Opportunity

Reviewed by Kshitija Bhandaru

Comcast (CMCSA) has seen its stock slide again, leaving investors to wonder what is behind the move and whether there is something beneath the surface that warrants a closer look. There is no single event making headlines, but these kinds of steady declines often catch the attention of anyone who follows the company. Right now, the real question is whether this trend is a sign of deeper issues or simply short-term noise that could present an opportunity.

Broadly speaking, Comcast’s share price has lagged this year, with declines stacking up not just over the past month but stretching through the first half of the year. Over the past year, shares are down around 20%, and the performance has been soft on a multi-year view. Despite annual revenue inching up, net income has moved in the opposite direction. This is just another factor that has weighed on sentiment recently. It is fair to say that the stock’s momentum is fading, even as the rest of the market finds its footing.

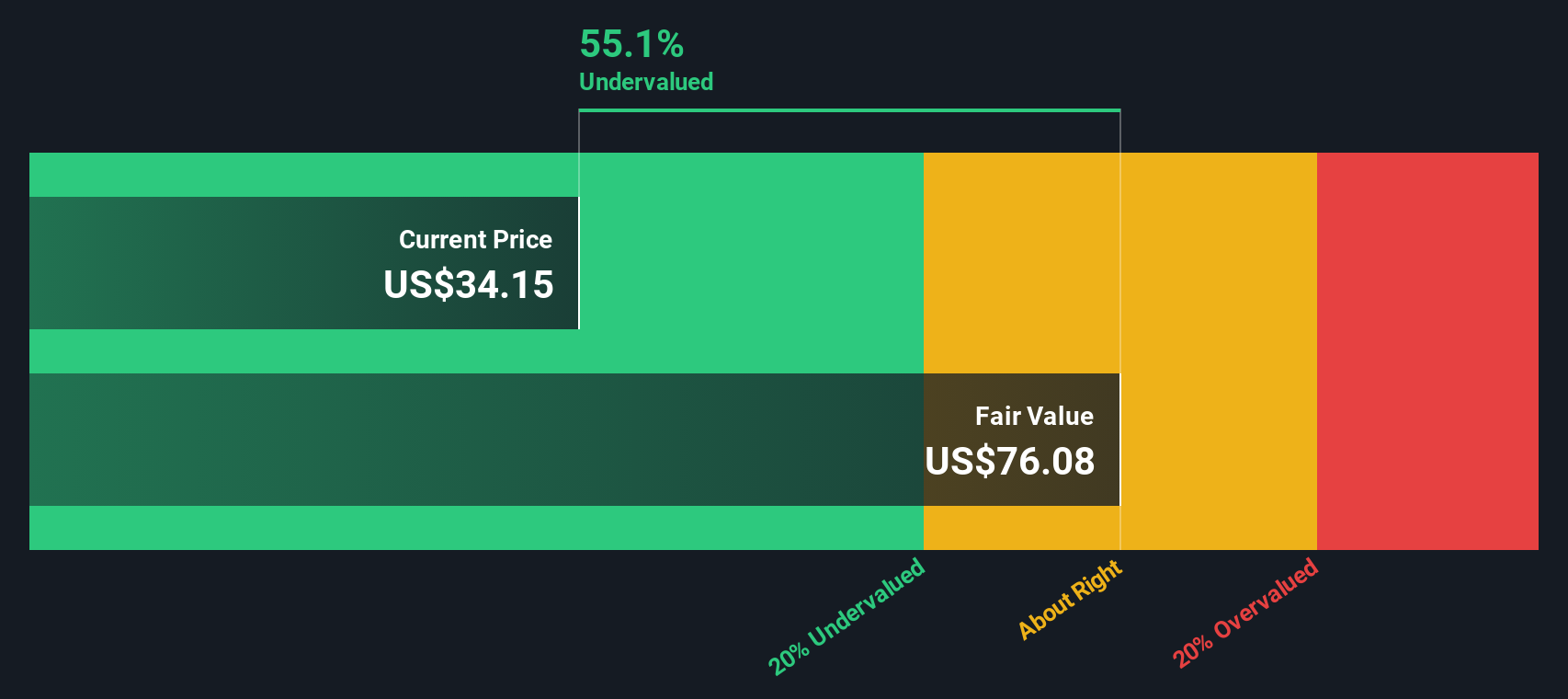

After such an extended pullback, investors are now left to ask: is Comcast undervalued at these levels, or is the market simply factoring in concerns about future earnings growth?

Most Popular Narrative: 20.8% Undervalued

According to the most widely followed narrative, Comcast is currently seen as significantly undervalued compared to its fair value. This offers potential upside for investors who believe in its projected growth and operational strategies. The analysis uses a discount rate grounded in established reports to estimate fair value.

Comcast's ongoing investments in network innovation, including rapid deployment of DOCSIS 4.0, expansion of gig+ broadband speeds across its footprint, and strategic focus on delivering intelligent WiFi and seamless mobile integration, are aligning with persistent increases in high-speed internet demand driven by hybrid work, connected homes, and cloud applications. This is likely to sustain subscriber growth and support ARPU expansion, directly benefitting revenue and margin durability.

Curious how analysts arrive at this double-digit discount? The narrative points to a unique combination of future revenue gains, ambitious margin expectations, and a bold profit multiple rarely seen in the traditional media sector. Wondering which assumptions drive such a high intrinsic value? Dive deeper to discover if the numbers behind this bullish outlook truly add up.

Result: Fair Value of $39.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying broadband competition and rising content costs could derail these optimistic forecasts, particularly if subscriber growth and margins come under further pressure.

Find out about the key risks to this Comcast narrative.Another View: SWS DCF Model Signals Even Stronger Value

While analysts rely on future earnings and price targets, our DCF model offers a different perspective that points to even deeper value for Comcast. Could the market be missing something fundamental in its current assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comcast for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comcast Narrative

If you want to dig deeper or think a different story fits the numbers, you can easily shape your own perspective in just a few minutes. Do it your way

A great starting point for your Comcast research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Use the powerful Simply Wall Street Screener to spot compelling investments tailored to your interests and strategy.

- Tap into unstoppable trends in artificial intelligence by spotting the most promising companies shaping the future of tech with AI penny stocks.

- Catch undervalued gems trading below their true worth by uncovering standout opportunities using undervalued stocks based on cash flows.

- Collect steady income and maximize returns by hunting for companies with robust payouts through our dividend stocks with yields > 3% tool.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion