- United States

- /

- Media

- /

- NasdaqGS:CHTR

Charter Communications (NasdaqGS:CHTR) Plans To Enhance Spectrum Business Offerings

Reviewed by Simply Wall St

Charter Communications (NasdaqGS:CHTR) saw a 8% decline in its share price over the last quarter. This decline happened alongside a turbulent market environment, with the S&P 500 also dropping 12%, largely due to concerns over U.S. tariffs and global trade tensions. During the same period, Charter announced an executive promotion and plans to enhance offerings for Spectrum Business, which might have supported shareholder confidence amid broader market pressures. Meanwhile, the general market climate was dominated by volatility, contributing significantly to the company's share price movements despite positive fiscal year earnings and share buyback initiatives.

Charter Communications has 1 risk we think you should know about.

The recent developments surrounding Charter Communications come amid a challenging market environment, where share prices experienced an 8% decline over the last quarter. During this period, the broader S&P 500 fell 12%, reflecting general market volatility related to U.S. tariffs and global trade tensions. Despite this, Charter's initiatives to enhance its Spectrum Business offerings and executive promotions seem to have buttressed investor sentiment, potentially allowing for future growth and stability.

Over the past year, Charter's total return, including dividends, was 18.50%, providing a considerable contrast to the shorter-term market challenges. In comparison, the U.S. Media industry declined 12.3% over the previous year, indicating that Charter outperformed its industry peers. This resilience may be attributed to its investments in network expansion and the fast-growing Spectrum Mobile business.

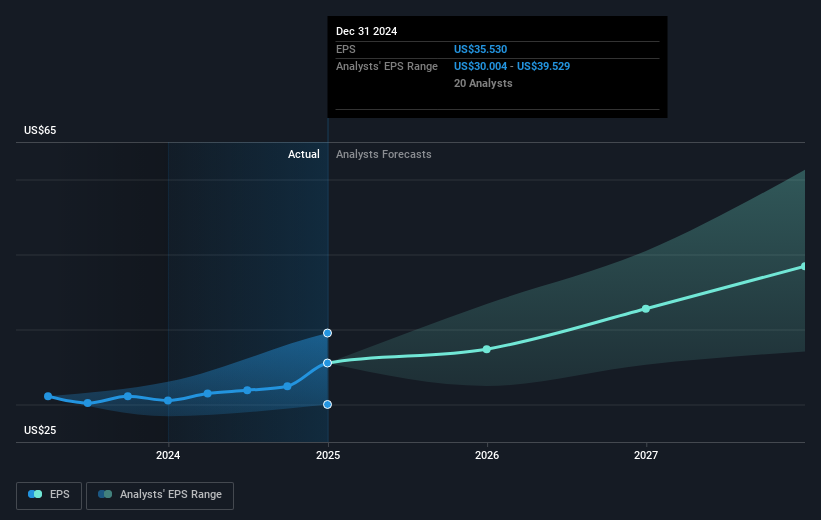

Looking forward, the company's news highlights, such as executive changes and strategic focuses, could play pivotal roles in shaping revenue and earnings forecasts. Analysts predict a slight annual revenue decline of 0.9% over the next three years, although profit margins are expected to rise to 10.5%. With these forecasts in mind, the current share price of $370.91 shows a 8.2% discount to the consensus price target of $404.01, suggesting potential for growth. However, this also reflects analytical confidence in Charter's ability to overcome the challenges posed by intense competition and regulatory factors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHTR

Charter Communications

Operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives