- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

Did AI Innovations and Double-Digit Revenue Growth Just Shift CarGurus' (CARG) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, CarGurus reported 14% year-over-year Marketplace revenue growth, primarily driven by subscription-based listings and higher dealer engagement across both U.S. and international markets.

- The company also highlighted the rollout of new AI-powered innovations, such as the PriceVantage pricing tool and a personalized shopping assistant, which are supporting increased dealer efficiency and consumer interaction.

- We’ll explore how CarGurus’ focus on advancing AI-powered tools may influence its long-term investment narrative and growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

CarGurus Investment Narrative Recap

To be a shareholder in CarGurus, you generally need to believe in the company’s ability to drive sustained growth by deepening dealer engagement, scaling its AI-driven tools, and maintaining its position as a critical enabler of digital automotive commerce. The recent announcement of strong Marketplace revenue growth and AI product expansion aligns well with these catalysts; however, the impact on the most immediate risk, the winding down of CarOffer and its implications for revenue diversification and competitiveness, is not material in the short term but may influence longer-term perceptions. Among the company’s recent updates, the launch of new AI-powered features such as the PriceVantage pricing tool stands out as an important step in driving platform efficiency and value for both dealers and consumers, reinforcing Marketplace engagement at a time when this metric is a key catalyst for growth. The continued roll-out and dealer adoption of these tools will likely be watched closely as a measure of progress against ongoing sector competition and changing transaction models. However, investors should also be aware that as CarGurus shifts its attention away from the wholesale segment...

Read the full narrative on CarGurus (it's free!)

CarGurus' outlook projects $1.1 billion in revenue and $316.9 million in earnings by 2028. This is based on an annual revenue growth rate of 5.7% and an earnings increase of $187.1 million from current earnings of $129.8 million.

Uncover how CarGurus' forecasts yield a $40.29 fair value, a 12% upside to its current price.

Exploring Other Perspectives

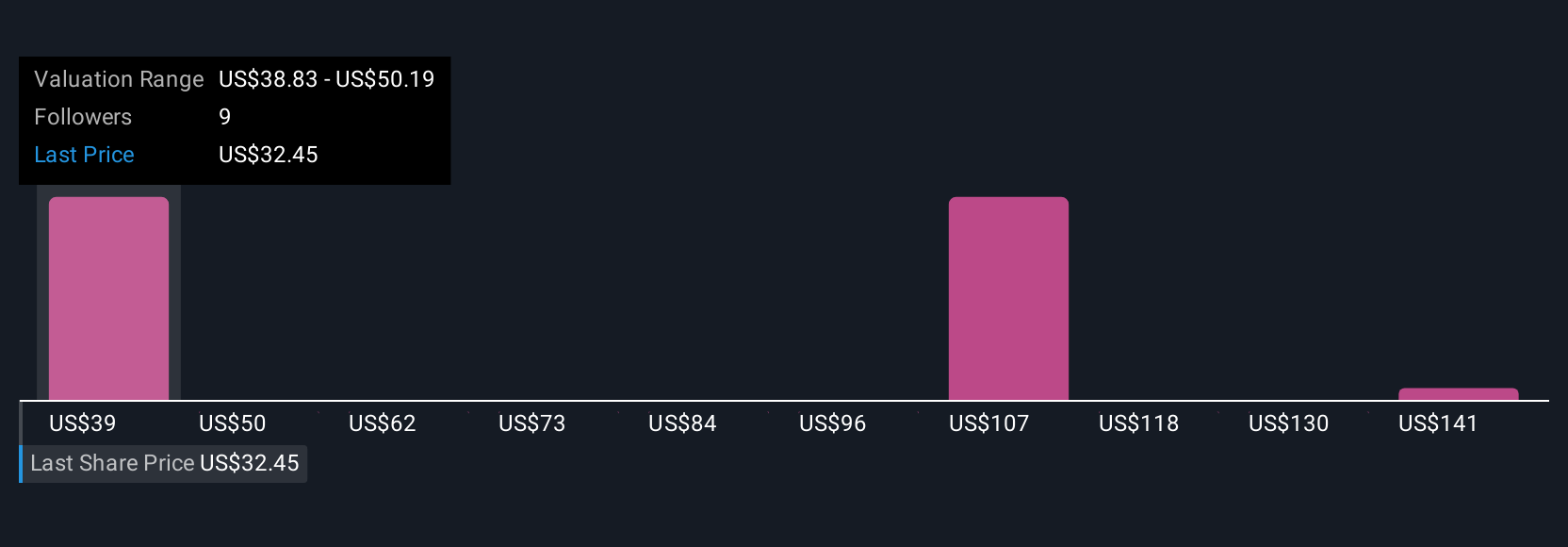

Six fair value estimates from the Simply Wall St Community range widely from US$40.29 to as high as US$152.39 per share. While adoption of AI-driven tools is highlighted as a catalyst, increasing competition and changes in digital auto retail could affect future revenue streams, consider exploring these differing viewpoints in detail.

Explore 6 other fair value estimates on CarGurus - why the stock might be worth just $40.29!

Build Your Own CarGurus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CarGurus research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free CarGurus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CarGurus' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.