- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

CarGurus (CARG): Assessing Valuation as Shares Rebound on Renewed Marketplace Momentum

Reviewed by Simply Wall St

See our latest analysis for CarGurus.

CarGurus’ share price has continued to show resilience, with a recent 7-day gain of just over 3% helping the stock reclaim some ground after a dip in June. Short-term momentum is picking up, and the one-year total shareholder return of 14% hints at meaningful progress for those who have stayed patient, especially when you consider the company’s remarkable 162% total return over the past three years.

If you’re following CarGurus’ rebound and want to discover more in this space, take a look at See the full list for free.

Yet with shares not far off their analyst price target and new growth in profitability, some investors are wondering if CarGurus is still undervalued, or if the market has already priced in its future potential. Is there still a buying opportunity?

Most Popular Narrative: 6.6% Undervalued

CarGurus’ most popular narrative suggests its fair value sits noticeably above Monday’s closing price. This puts fresh attention on the underlying drivers that could soon reset expectations.

Expansion and deeper adoption of data-driven analytics tools and AI-powered solutions across the dealer base are creating higher engagement, improved retention, and more actionable insights. These factors are expected to drive sustained Marketplace revenue growth and support increasing margins as dealers see measurable ROI and make CarGurus central to their workflow.

Curious what’s fueling this premium? It hinges on bold growth bets such as sticky tech, better margins, and global expansion strategies not yet fully factored into consensus estimates. What kind of blockbuster trends and financial leaps are embedded in that target? See the full breakdown and the specific projections that could power the next move.

Result: Fair Value of $38.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying digital competition and challenges in expanding outside North America could threaten CarGurus’ growth path and put its premium narrative to the test.

Find out about the key risks to this CarGurus narrative.

Another View: Multiples Tell a Different Story

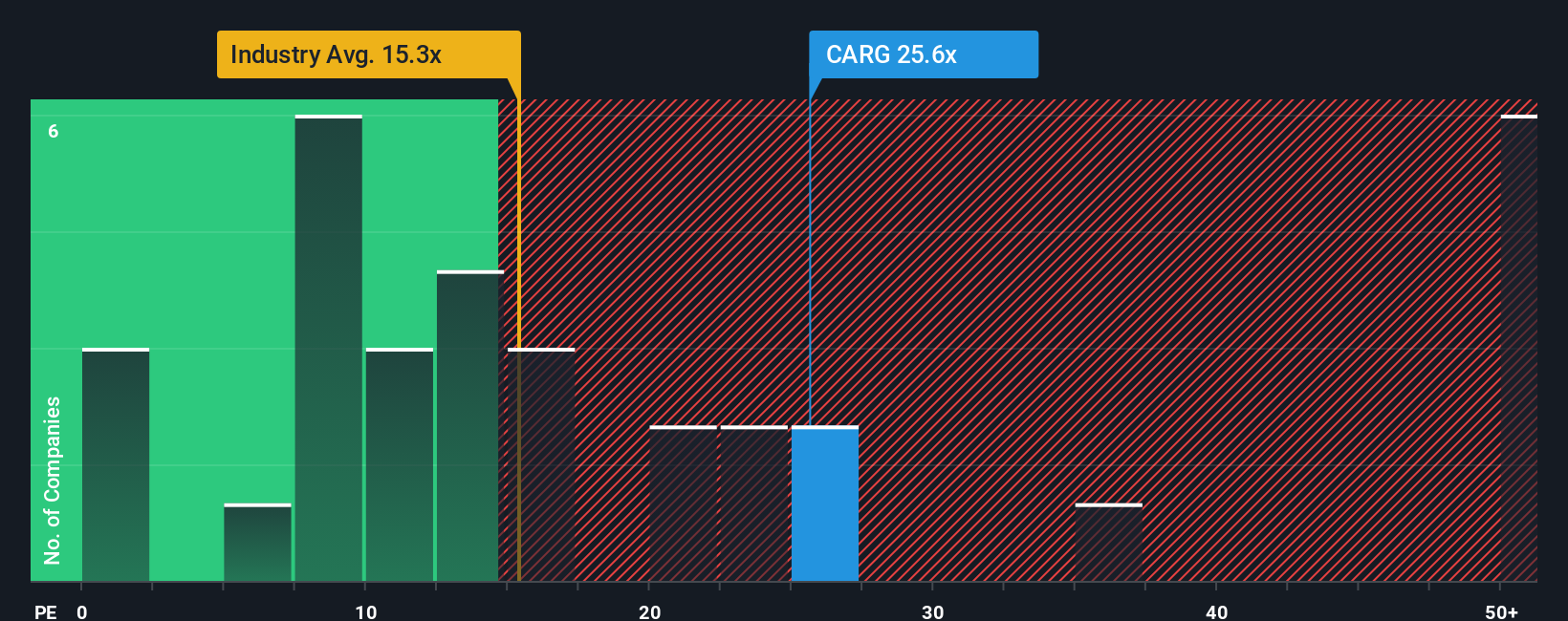

Looking beyond fair value estimates, CarGurus is currently trading at a price-to-earnings ratio of 27.6x. This is noticeably higher than the US Interactive Media and Services industry average of 15.7x and the peer average of 15.9x. The market’s fair ratio based on regression sits at 23.5x. This wide gap raises questions about valuation risk versus opportunity in the months ahead. Could high expectations be setting the bar too high, or does momentum justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarGurus Narrative

If you see the story differently or want to dive deeper into the numbers, you can quickly build your own take in just a few minutes with Do it your way.

A great starting point for your CarGurus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Ideas?

Smart investors always keep their radar sharp for tomorrow’s big opportunities. Check out these hand-picked stock ideas and don't miss the next wave of potential growth!

- Unlock value early and spot these 875 undervalued stocks based on cash flows offering robust cash flow potential. This is ideal for those looking to get ahead of the market curve.

- Ride the income trend and secure attractive payouts with these 17 dividend stocks with yields > 3%, delivering yields above 3% for reliable growth and stability.

- Catch game-changing trends and stay ahead of disruption by targeting these 26 AI penny stocks, which are at the forefront of artificial intelligence innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives