- United States

- /

- Entertainment

- /

- NYSE:EDR

Exploring Three High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.6%, yet it remains up by 24% over the past year with earnings expected to grow by 15% per annum in the coming years. In this environment, identifying high growth tech stocks that align with these positive earnings projections can be crucial for investors seeking opportunities in a dynamic sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.51% | 54.38% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Blueprint Medicines | 22.63% | 55.38% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

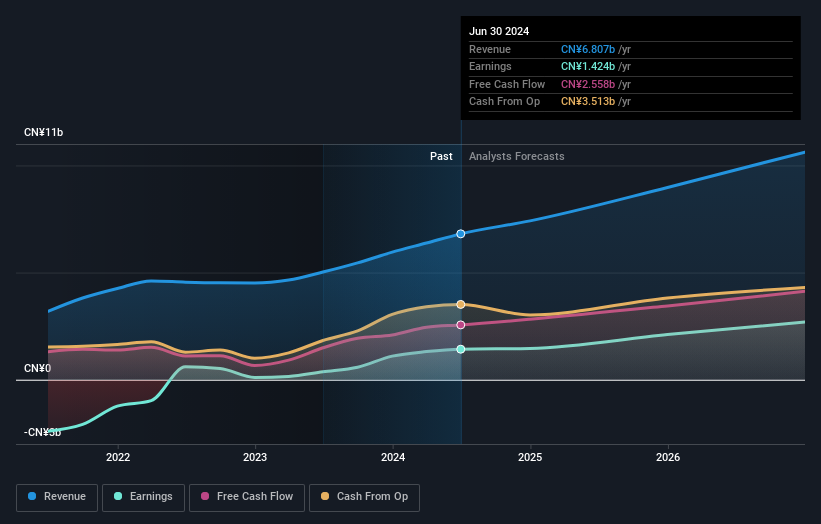

Kanzhun (NasdaqGS:BZ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kanzhun Limited, with a market cap of $5.99 billion, operates in the People's Republic of China offering online recruitment services through its subsidiaries.

Operations: Kanzhun Limited generates revenue primarily from its online recruitment services, amounting to CN¥7.11 billion. The company operates within the Internet Information Providers segment in China.

Kanzhun has demonstrated robust financial performance, with its revenue and earnings growth significantly outpacing the broader U.S. market. In the past year alone, earnings surged by 151.4%, starkly contrasting with a -2.5% dip in its industry sector. This growth trajectory is underpinned by an aggressive R&D investment strategy, which not only fuels innovation but also solidifies Kanzhun's competitive edge in interactive media and services. Moreover, recent corporate actions including a substantial share repurchase program highlight confidence in ongoing fiscal health and operational stability, positioning Kanzhun favorably for sustained upward momentum in a dynamic tech landscape.

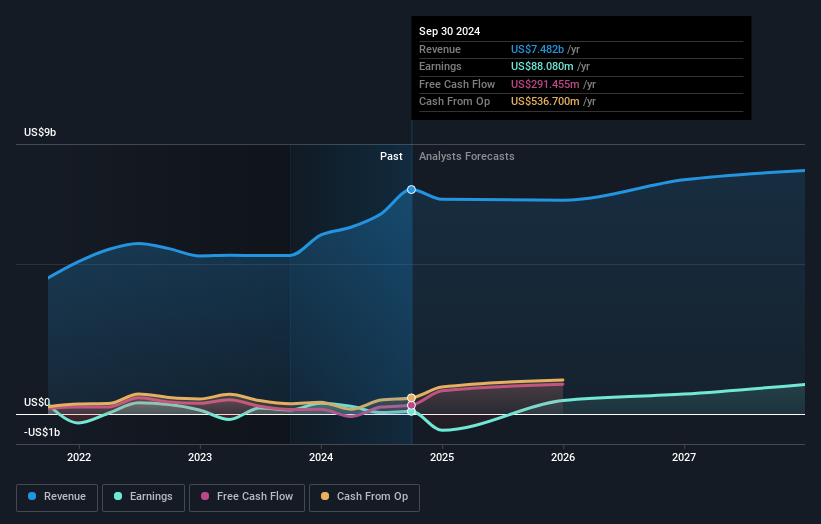

Endeavor Group Holdings (NYSE:EDR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Endeavor Group Holdings, Inc. is a global sports and entertainment company with operations in the United States, the United Kingdom, and internationally, and it has a market cap of approximately $14.65 billion.

Operations: Endeavor Group Holdings generates revenue primarily through its Owned Sports Properties segment, contributing $2.96 billion, and its Events, Experiences & Rights segment, adding $2.53 billion. The Representation segment also plays a significant role with $1.61 billion in revenue.

Endeavor Group Holdings, despite a challenging financial year with a net loss widening to $616.53 million from a previous profit, has shown resilience through strategic divestitures and robust event management. The company's recent decision to potentially sell high-profile events like the Miami Open underscores its focus on optimizing its portfolio. This move, coupled with a consistent dividend payout of $0.06 per share, reflects strategic financial management amidst operational hurdles. With an expected earnings growth of 41.8% annually, Endeavor is navigating through its current complexities by leveraging its diverse entertainment assets and exploring growth avenues in lucrative event segments.

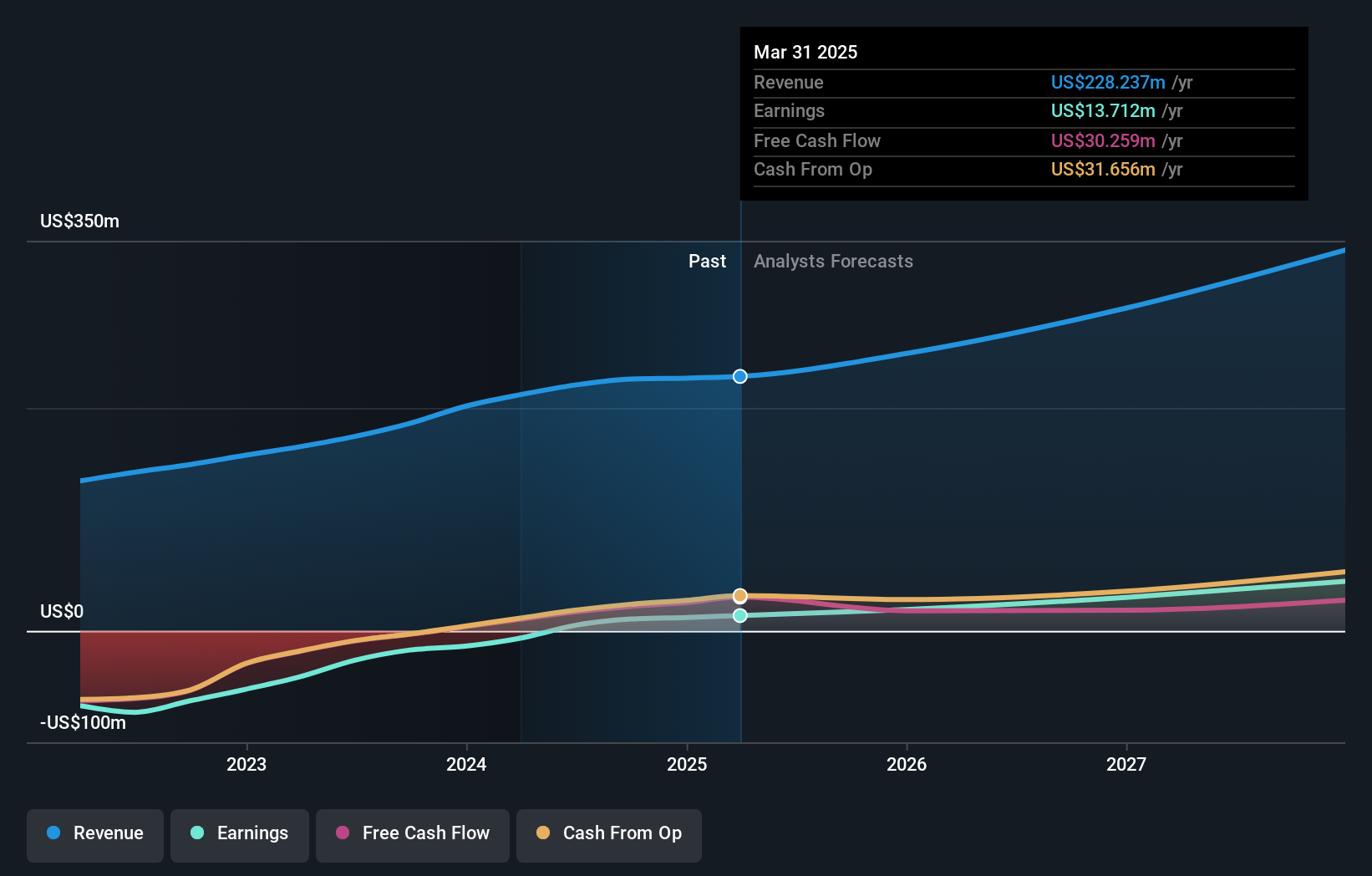

VTEX (NYSE:VTEX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VTEX offers a software-as-a-service digital commerce platform tailored for enterprise brands and retailers, with a market cap of $1.09 billion.

Operations: The company generates revenue primarily through its internet software and services segment, amounting to $225.91 million. With a focus on enterprise clients, it provides tailored digital commerce solutions that support the growth of brands and retailers.

VTEX, transitioning into profitability this year, demonstrates robust growth prospects with a forecasted revenue increase of 15.9% annually and a significant earnings surge of 36% per year. This performance is complemented by strategic share repurchases totaling $30 million, underscoring confidence in its financial health and future. The company's recent guidance suggests an ambitious target for FX neutral revenue growth up to 19.5%, positioning it well within the competitive tech landscape marked by rapid innovations and evolving consumer demands.

- Delve into the full analysis health report here for a deeper understanding of VTEX.

Gain insights into VTEX's historical performance by reviewing our past performance report.

Where To Now?

- Reveal the 234 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavor Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EDR

Endeavor Group Holdings

Operates as a sports and entertainment company in the United States, the United Kingdom, and internationally.

Reasonable growth potential and slightly overvalued.