- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BMBL

Can Bumble’s (BMBL) Shift to Profitability Reframe Its Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- Bumble Inc. recently reported third-quarter 2025 results showing improved profitability, despite sales falling to US$246.16 million from US$273.61 million in the prior year, and provided fourth-quarter revenue guidance in the US$216 million to US$224 million range.

- An additional shelf registration for US$127.2 million in Class A Common Stock was filed, connected to an employee stock ownership plan offering, underscoring Bumble's focus on employee incentives.

- We’ll assess how Bumble’s return to positive net income, despite lower revenue, may influence its longer-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bumble Investment Narrative Recap

To own shares of Bumble, you need to believe management can reignite growth by deepening user engagement and monetization, all while navigating a meaningful industry shift toward safety and authentic connections. The recent return to profitability in the third quarter, even as revenue dropped and guidance points to further declines, does not meaningfully shift the biggest near-term catalyst, Bumble’s progress on user quality and experience, or the biggest risk, which is ongoing revenue pressure from lower paying users as unhealthy accounts are removed.

Of the recent developments, the shelf registration for US$127.2 million in Class A Common Stock, related to the employee stock ownership plan, stands out as most relevant. While this move highlights Bumble’s continued commitment to incentivizing talent, the potential dilution is not considered a material factor for near-term results, especially compared to the headline risks from revenue weakness and user base changes.

On the other hand, investors should be aware that a sequential drop in paying users could indicate more than just a short-term adjustment, especially if…

Read the full narrative on Bumble (it's free!)

Bumble's narrative projects $914.2 million in revenue and $142.1 million in earnings by 2028. This assumes a 3.9% annual revenue decline and a $992.4 million increase in earnings from the current $-850.3 million level.

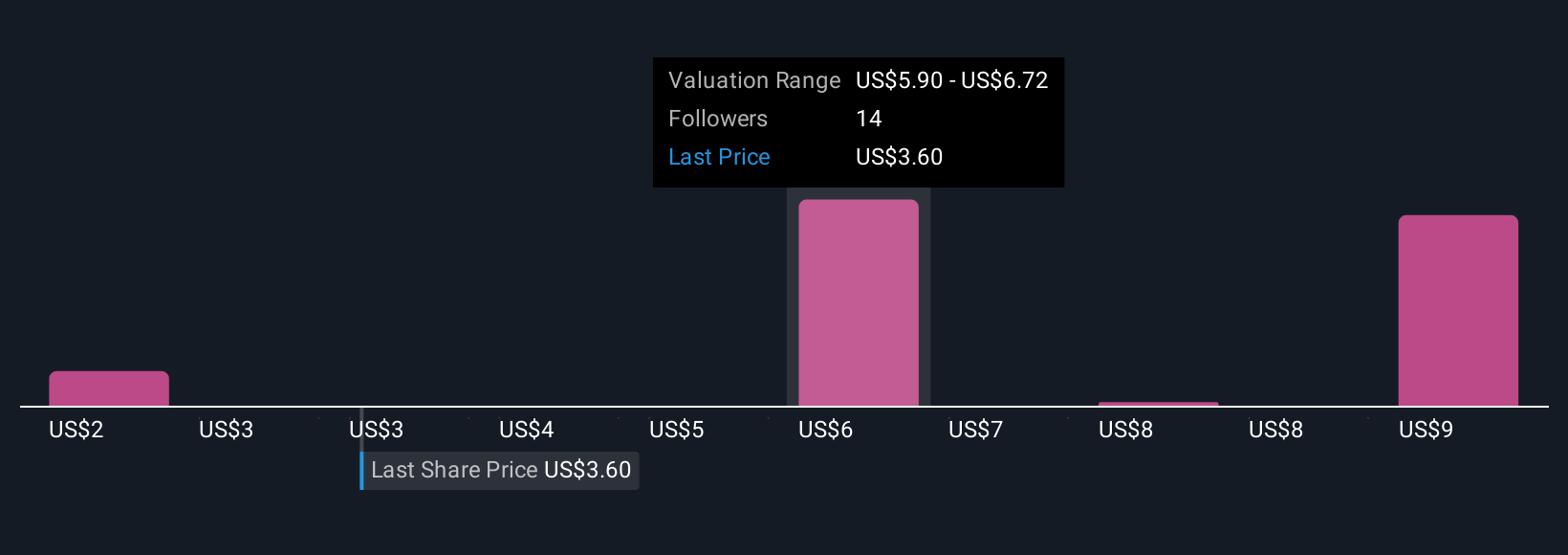

Uncover how Bumble's forecasts yield a $6.10 fair value, a 69% upside to its current price.

Exploring Other Perspectives

Four distinct fair value estimates from the Simply Wall St Community range from US$1.76 to US$10.16 per share. With current pressures on paying user growth, broader market participants may interpret Bumble’s earnings turnaround quite differently in terms of risk and future returns.

Explore 4 other fair value estimates on Bumble - why the stock might be worth over 2x more than the current price!

Build Your Own Bumble Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bumble research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bumble research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bumble's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BMBL

Bumble

Provides online dating and social networking applications in North America, Europe, internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives