- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BMBL

Bumble (BMBL) Is Down 23.2% After Weak Q3 Revenue and User Declines—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Bumble Inc. recently reported its third-quarter 2025 results, revealing a year-on-year revenue decline to US$246.16 million and a significant fall in paying users, while providing weaker-than-expected guidance for the upcoming quarter.

- Despite improvement from a very large net loss a year ago to a US$37.34 million profit this quarter, the company is emphasizing long-term user quality and AI-driven product development over short-term growth, signaling a shift in operational priorities.

- We will now examine how these weaker revenue results and user declines may impact Bumble’s investment narrative going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bumble Investment Narrative Recap

To own shares in Bumble, investors need confidence that the company’s focus on a higher-quality user base, improved safety, and AI-driven features can reignite long-term engagement and return to growth. The recent revenue drop and sharp decline in paying users directly impact the most important short-term catalyst, stabilizing user trends, but also spotlight the key risk of ongoing headwinds from ecosystem clean-up and weaker near-term guidance. The scale of these declines is material and could affect sentiment until signs of user recovery become clearer.

Among the events, Bumble’s newly announced Q4 revenue guidance of US$216 million to US$224 million is especially relevant. This projection falls below analyst expectations, reinforcing concerns about near-term demand and leaving investors focused on whether upcoming AI platform improvements and product launches can reverse user and revenue declines as next year unfolds.

In contrast, what remains crucial for investors to watch is how persistent headwinds in paying user growth and weakened revenue guidance may signal ongoing volatility going forward...

Read the full narrative on Bumble (it's free!)

Bumble's outlook anticipates $914.2 million in revenue and $142.1 million in earnings by 2028. This reflects a 3.9% annual decline in revenue and a $992.4 million improvement in earnings from the current -$850.3 million.

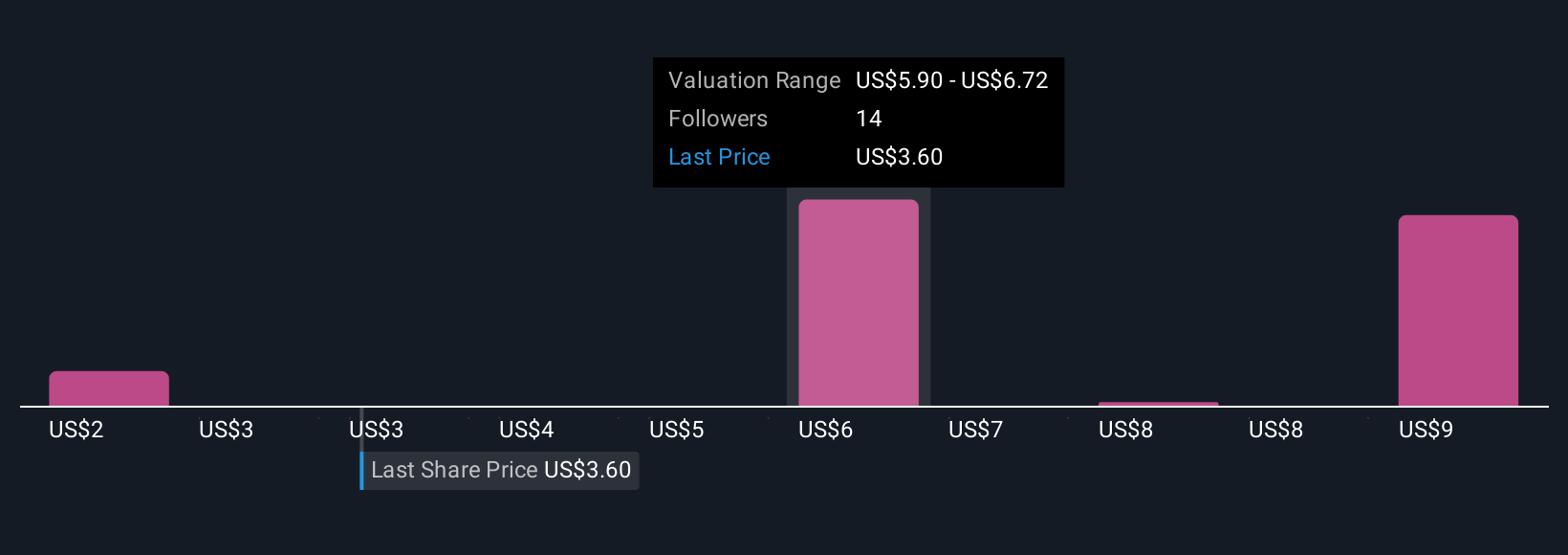

Uncover how Bumble's forecasts yield a $6.10 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates for Bumble ranging from US$1.76 to US$12.52 per share. While views are wide-ranging, recent user and revenue declines point to continued uncertainty that could weigh on performance; explore how your outlook stacks up against these differing perspectives.

Explore 4 other fair value estimates on Bumble - why the stock might be worth over 2x more than the current price!

Build Your Own Bumble Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bumble research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bumble research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bumble's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BMBL

Bumble

Provides online dating and social networking applications in North America, Europe, internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives