- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

What Baidu (BIDU)'s Robotaxi Milestone Means for Shareholders

Reviewed by Sasha Jovanovic

- In recent days, Baidu announced that its Apollo Go robotaxi service has surpassed 250,000 fully driverless rides per week globally, equaling the ride volume of leading competitor Waymo and operating a fleet of over 1,000 vehicles delivering more than 14 million rides to date.

- This achievement, coupled with a strong safety record and upcoming international launches, highlights Baidu’s advancing position in autonomous mobility as it seeks further global expansion.

- We’ll examine how Apollo Go’s scale and safety progress could influence Baidu’s broader investment narrative and prospects for margin improvement.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Baidu Investment Narrative Recap

For Baidu shareholders, the core belief centers on the company's ability to drive earnings growth by commercializing AI and autonomous technology, while offsetting pressure from a declining online marketing business. The news that Apollo Go’s fully driverless rides now rival Waymo’s adds operational momentum, supporting Baidu’s push for global leadership in autonomous mobility, yet doesn’t materially alter the immediate catalyst: accelerating AI-driven search monetization remains the key challenge, as delays could keep margins under pressure.

Among recent announcements, Baidu’s partnership with PostBus in Switzerland, set to launch full autonomous mobility operations in early 2027, directly ties into Apollo Go’s expansion story. This international move showcases Baidu’s approach to scaling its driverless technology and diversifying revenues, which is particularly relevant as investors weigh the potential for autonomous services to offset risks in core advertising businesses and stimulate future margin improvement.

But on the other hand, investors should be aware that Baidu’s ambitious AI shift exposes the company to the risk of...

Read the full narrative on Baidu (it's free!)

Baidu's narrative projects CN¥150.8 billion revenue and CN¥22.3 billion earnings by 2028. This requires 4.0% yearly revenue growth and a decline of CN¥3.1 billion in earnings from the current CN¥25.4 billion.

Uncover how Baidu's forecasts yield a $140.57 fair value, a 11% upside to its current price.

Exploring Other Perspectives

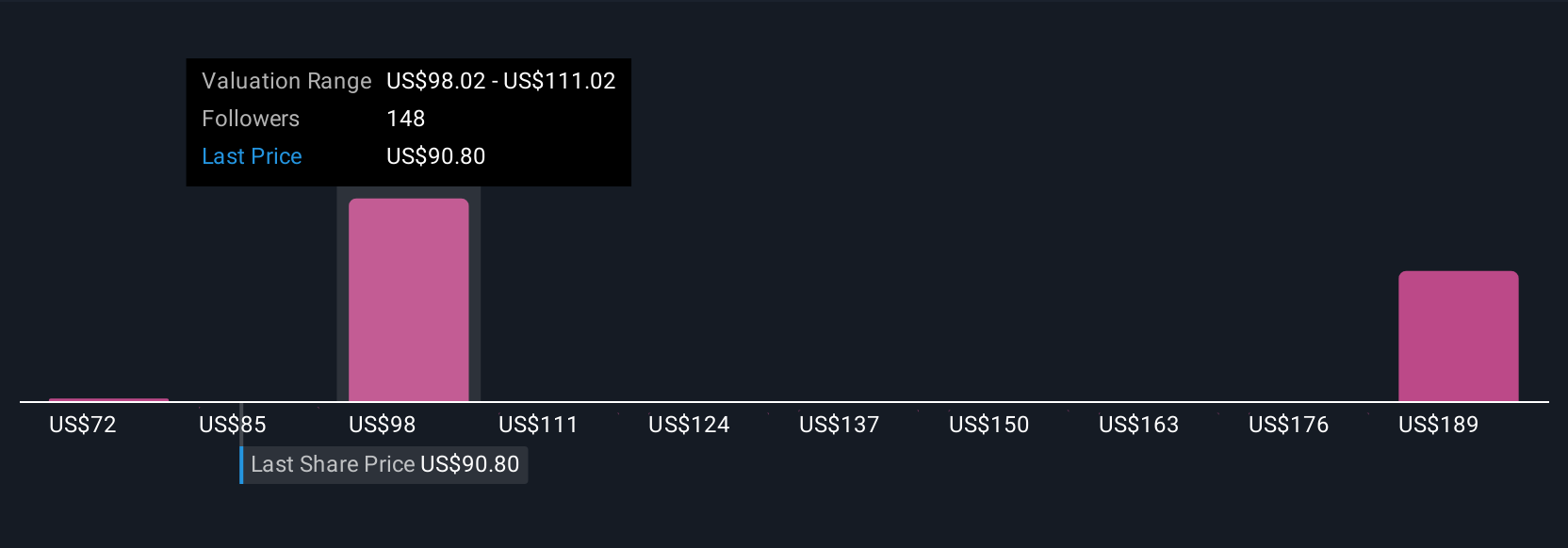

Fourteen Simply Wall St Community fair value estimates for Baidu span from CN¥71 to CN¥166 per share, highlighting wide variance in outlooks. As you explore these views, keep in mind that delays in monetizing Baidu’s AI-powered search could affect how the company manages margin pressures and future growth.

Explore 14 other fair value estimates on Baidu - why the stock might be worth 44% less than the current price!

Build Your Own Baidu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baidu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Baidu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baidu's overall financial health at a glance.

No Opportunity In Baidu?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives