- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

A Look at Baidu (NasdaqGS:BIDU) Valuation Following Landmark Autonomous Vehicle Permit in Dubai

Reviewed by Kshitija Bhandaru

Baidu (NasdaqGS:BIDU) just made headlines as the first company granted authorization to run autonomous vehicle trials on Dubai’s urban roads, using a 50-car Apollo Go fleet. This move highlights Baidu’s growing international reach in self-driving technology.

See our latest analysis for Baidu.

Baidu’s exclusive permit to operate autonomous vehicles in Dubai comes at a time when momentum has clearly picked up. Recent months have seen the stock post sustained gains, with investor optimism underscored by new partnerships and ongoing strategic moves in AI and mobility. While short-term share price returns have been modest, the company’s advances in autonomous driving and increasing institutional interest have helped build a stronger outlook, keeping longer-term total shareholder returns in positive territory.

If Baidu’s progress has you watching what’s next for technology leaders, consider exploring See the full list for free. for other compelling opportunities in tech and AI innovation.

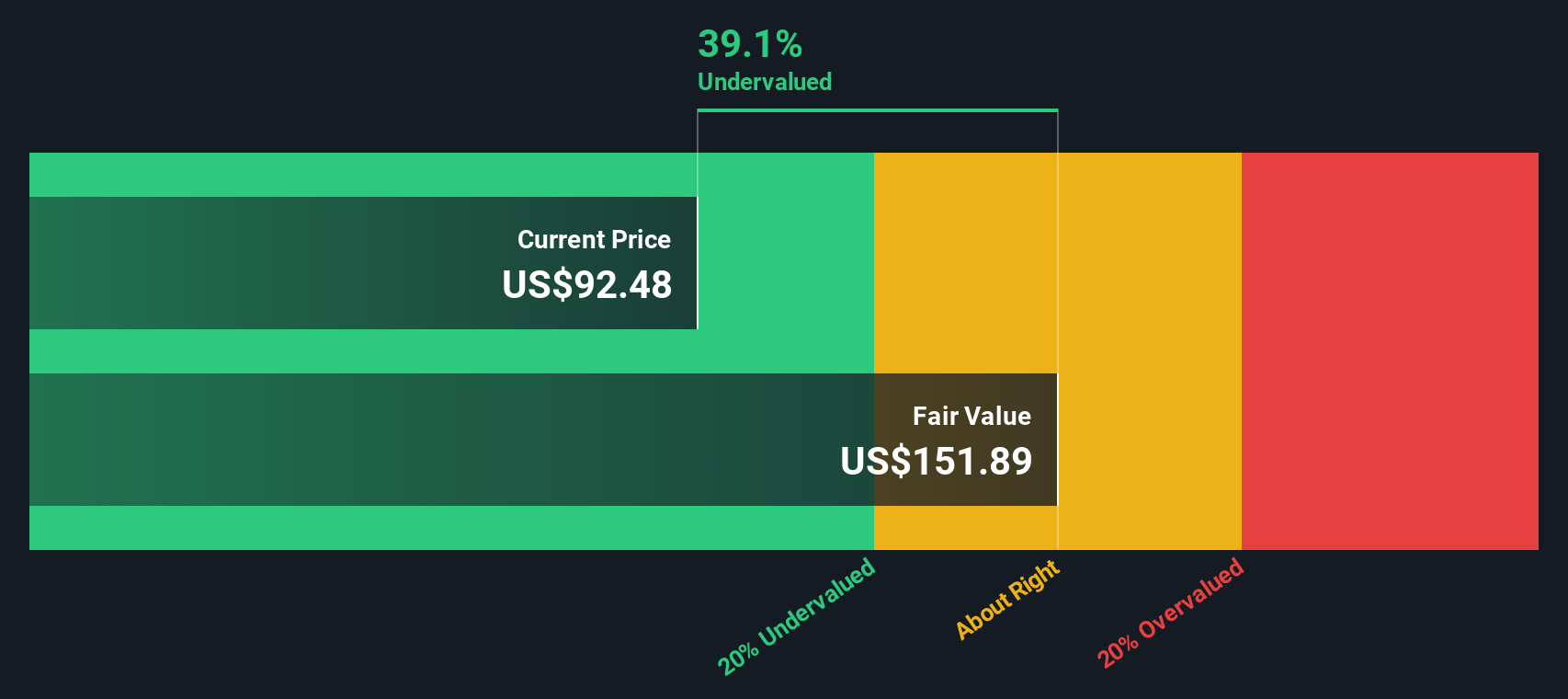

With shares on the rise and new business lines gaining traction, the key question now is whether Baidu’s recent gains signal an undervalued opportunity for investors, or if future growth is already fully reflected in the price.

Most Popular Narrative: 20.7% Undervalued

Compared to Baidu's last close at $142, the most widely followed narrative pegs its fair value significantly lower at $117.66. This paints a picture of a stock that may be running ahead of its fundamentals. This view is shaped by analyst assumptions on future revenues, margins, and market multiples, offering crucial context for investors weighing the current price action.

The commercialization and global expansion of Apollo Go (autonomous driving) through capital-efficient, asset-light partnerships with Uber, Lyft, and major international markets introduces high-margin, recurring revenue streams. Successful execution could diversify income, support higher net margins, and unlock significant long-term profit growth.

What is the real story behind these headline-driving projections? The valuation hinges on bold profitability shifts linked to China’s digital boom, with key numbers on future margins and revenue growth driving the narrative. They set an aggressive course. Find out what powers this fair value call.

Result: Fair Value of $117.66 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy spending on AI and margin pressure from stalled search monetization could challenge Baidu’s earnings outlook. These factors may create headwinds for analyst optimism.

Find out about the key risks to this Baidu narrative.

Another View: SWS DCF Model Points to Upside

While the most popular narrative sees Baidu as overvalued, our DCF model suggests otherwise. According to this approach, Baidu’s shares should be valued at $182.04, significantly above the current price. This method highlights potential upside. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Baidu Narrative

Keep in mind, if you see the story differently or want to dig into Baidu’s numbers yourself, you can craft your own view quickly and easily by using Do it your way.

A great starting point for your Baidu research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for ordinary investments when the next breakout could be just a click away. Step ahead and uncover your edge using unique stock screens:

- Capture steady income and shield your portfolio from volatility by tapping into these 19 dividend stocks with yields > 3% with high yields above 3%.

- Ride the momentum of digital innovation by spotting emerging opportunities among these 78 cryptocurrency and blockchain stocks paving the way in blockchain and future currency trends.

- Unleash the future of medicine by targeting these 32 healthcare AI stocks driving breakthroughs in AI-powered healthcare solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives