- United States

- /

- Entertainment

- /

- NasdaqGS:ATVI

The Volatility may Allow Activision Blizzard, Inc. (NASDAQ:ATVI) to Converge Down to Value

Activision Blizzard, Inc. ( NASDAQ:ATVI ) has had quite some turbulence lately, with the price tumbling some 3.7% this week, and experiencing a slow 6-month decline of 18.8%. The internal activities have already resulted with some management members leaving ( 1 , 2 ), and litigation seems to be piling up. This additional uncertainty is putting a strain on the stock, and might provide long-term investors with an opportunity to tap into the gaming industry.

When investors are buying Activision Blizzard, they are buying the game-chains from three main brands:

- Activision: Leading with the Call Of Duty Franchise

- Blizzard: Leading with the World of Warcraft, Diablo 2 & 3, Hearthstone, Overwatch

- King: Leading with Candy Crush

These are known new and legacy titles that are bringing the majority of revenues for the company at a significant 29% net profit margin , making the company valuable for investors.

If the uncertainty surrounding the company clears with minimal impact, then investors might have a moment of opportunity on their hands.

In this article we are going to estimate the intrinsic value of Activision Blizzardby projecting its future cash flows and then discounting them to today's value.One way to achieve this is by employing the Discounted Cash Flow (DCF) model.

We would caution that there are many ways of valuing a company and, like the DCF, each technique has advantages and disadvantages in certain scenarios. If you want to learn more about discounted cash flow, the rationale behind this calculation can be read in detail in the Simply Wall St analysis model .

Check out our latest analysis for Activision Blizzard

What's the estimated valuation?

A DCF is all about the idea that a dollar in the future is less valuable than a dollar today,so we need to project how much cash flows will Activision Blizzard make and discount the sum of these future cash flows to arrive at a present value estimate:

Present Value of 10-year Cash Flow (PVCF) = US$25b

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage.

Terminal Value (TV) = US$81b

Present Value of Terminal Value (PVTV) = US$42b

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is US$67b.

This is effectively what the business is worth today! The intrinsic value is usually different from the current market price. When investors are looking at a company that is trading below its intrinsic value, they may feel more confident that the price may rise to what the cash flows are worth, giving them a better chance to profit from a stock.

To get the intrinsic value per share, we divide this by the total number of shares outstanding.

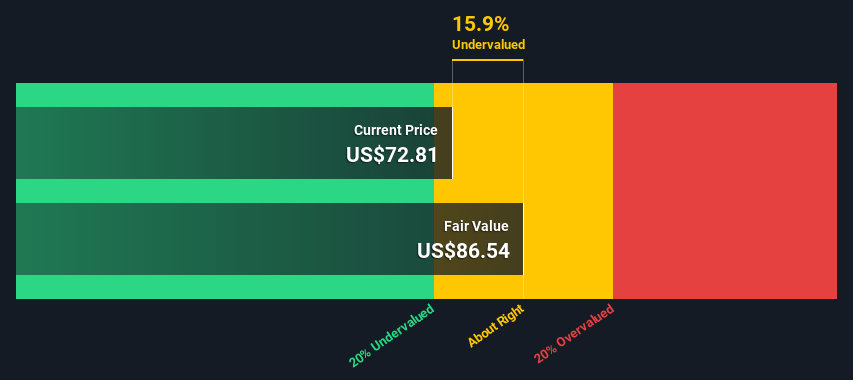

Compared to the current share price of US$74.7, the company appears about fair value at a 14% discount to where the stock price trades currently.

The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent.

There are many important assumptions based upon which we build a DCF model, you can view all the details of our model by visiting our valuation section , and clicking on the "View Data" button on the bottom right.

Key Takeaways & Next Steps:

The DCF model is not a perfect stock valuation tool, and our rough estimate shows that the company may be >10% undervalued, which warrants a deeper dive to see if the stock is right for investment.

When thinking about Activision Blizzard, investors should ask themselves some essential questions:

- What will be the financial impact of the current internal crisis? Will the problems cripple the company on the long term, or will they open an opportunity to invest while the price is lower?

- How do the long-term growth prospects look for the company?

- Will something like the new rollout of Diablo 2 Remastered energize players and revitalize the franchise?

- What is the growth potential of the new Call of Duty and Overwatch titles?

- The mobile segment is catching up at high speed, is there an untapped potential for mobile games done right (unlike Diablo for mobile)?

- Does the company have a strategy to sow the seeds of new promising titles or to grow by acquisitions?

There are also quantitative factors to consider, and we've compiled threeimportantaspectsyou should further research:

- Risks : For example, we've discovered 1 warning sign for Activision Blizzard that you should be aware of before investing here.

- Future Earnings : How does ATVI's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart .

- Other High Quality Alternatives : Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NASDAQGS every day. If you want to find the calculation for other stocks justsearch here .

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:ATVI

Activision Blizzard

Activision Blizzard, Inc., together with its subsidiaries, develops and publishes interactive entertainment content and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives