- United States

- /

- Entertainment

- /

- NasdaqGS:ATVI

Activision Blizzard, Inc. (NASDAQ:ATVI) Seems to be Peaking Growth in the Short Term, but their Value lies in High Margins

While everyone is focused on the legal issues at Activision Blizzard, Inc. ( NASDAQ:ATVI ), let's see if the financial fundamentals present investors with an opportunity.

Investors in Activision Blizzard had a good week, as its shares rose 4.3% to close at US$85.00 pre-market following the release of its second-quarter results. It looks like a credible result overall - although revenues of US$1.9b were what the analysts expected, Activision Blizzard surprised by delivering a (statutory) profit of US$1.12 per share, an impressive 37% above what was forecast.

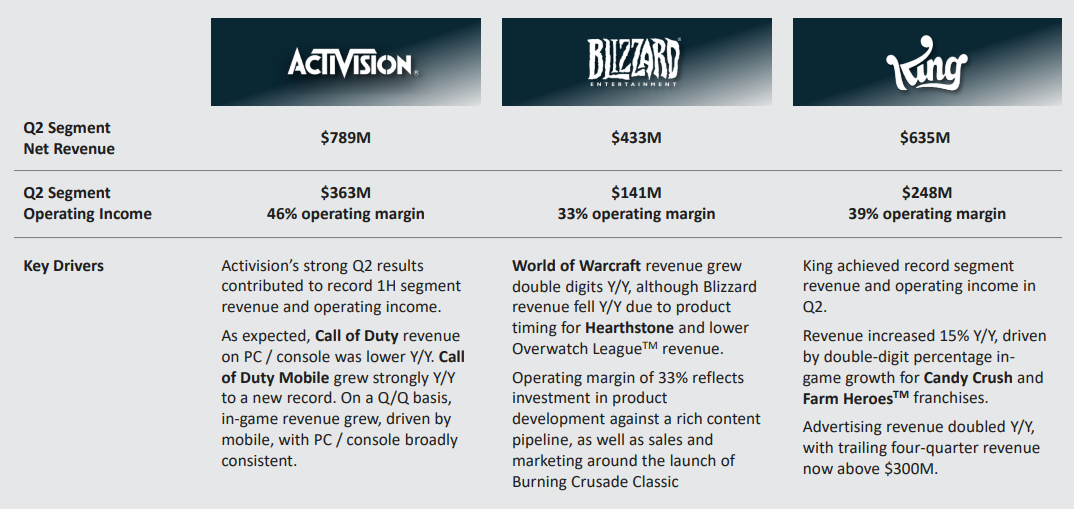

Their income was impacted by multiple titles:

- The Call of Duty title saw a decrease on PC, but a large uptake on mobile

- World of Warcraft Revenue grew double digits, but Blizzard's revenue was reduced because of their failure to time Hearthstone, and a general loss of interest in Overwatch League

- King is achieving double-digit growth for Candy Crush and Farm Heroes

It seems that the company is generating a substantive and growing portion of revenues from their mobile segment and spin-offs. This can be a confusing point of reference as management may start reasoning that the mobile segment is where they should be developing titles, while in-fact the original lore-rich titles are the backbone for client reach and engagement.

Here are the three key segments from their Q2 presentation :

One more crucial point we have to make while interpreting the company performance, is that the titles have very high profit margins. This is where the attractiveness lies for investors.

The titles are established and offer some security because of their brand name, but they do have a lifecycle of their own and will expire from the client's radar eventually. We are already seeing the downfall of the World of Warcraft MMO, as Blizzard is massively investing in re-iterations of the game, but the reduction in margin means that it costs a lot more money to reach the same effect.

Now let's take a look at what analysts estimate for the future of the company.

View our latest analysis for Activision Blizzard

Taking into account the latest results, Activision Blizzard's 30 analysts currently expect revenues in 2021 to be US$8.78b, approximately in line with the last 12 months. It seems that the company is expected to peak in significant revenue growth, and investors will have to rely on future growth from innovation, or additional acquisitions if the company can find ways to run more efficient corporate operations.

Statutory earnings per share are forecast to decrease 4.1% to US$3.23 in the same period.

There's been no major changes to the consensus price target of US$115, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation.

We would highlight that sales are expected to reverse, with a forecast 3.4% annualized revenue decline to the end of 2021. That is a notable change from historical growth of 5.2% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 16% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Activision Blizzard is expected to lag the wider industry.

Conclusion

Activision Blizzard is a healthy company with high revenues and very good margins.

Their titles seem to be running out of steam, and their mobile games are starting to outperform some of their traditional games. Investors are engaging Activision Blizzard at the height of their performance, which could be well priced in the current stock price.

The company's short term outlook is great, but it must consider a well though out strategy for long term growth either by innovation or acquisitions, both of which are risky ventures.

There was also no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Activision Blizzard going out to 2023, and you can see them free on our platform here.

Before you take the next step you should know about the 1 warning sign for Activision Blizzard that we have uncovered.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:ATVI

Activision Blizzard

Activision Blizzard, Inc., together with its subsidiaries, develops and publishes interactive entertainment content and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026