- United States

- /

- Media

- /

- NasdaqGS:ADV

Top US Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the U.S. stock market shows signs of a modest recovery, with major indices inching higher ahead of key earnings reports, investors are keenly observing smaller sectors for potential opportunities. Penny stocks, despite their somewhat outdated moniker, continue to attract attention as they often represent emerging companies that could offer growth at lower entry points. This article explores three penny stocks that stand out for their financial resilience and potential to provide compelling investment opportunities amidst current market dynamics.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.827 | $6.01M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $144.65M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.56 | $133.43M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $90.8M | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.27 | $9.77M | ★★★★★★ |

| Puma Biotechnology (NasdaqGS:PBYI) | $2.74 | $134.5M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.63 | $2.97M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8799 | $79.14M | ★★★★★☆ |

Click here to see the full list of 738 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Aldeyra Therapeutics (NasdaqCM:ALDX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aldeyra Therapeutics, Inc. is a biotechnology company focused on developing and commercializing medicines for immune-mediated diseases, with a market cap of approximately $294.18 million.

Operations: Aldeyra Therapeutics does not report any specific revenue segments.

Market Cap: $294.18M

Aldeyra Therapeutics is a pre-revenue biotech company with a market cap of approximately US$294.18 million, focusing on developing treatments for immune-mediated diseases. Despite being unprofitable, the company has reduced its debt-to-equity ratio from 28.3% to 18% over five years and maintains more cash than total debt. Recent earnings reports show increased losses; however, Aldeyra's short-term assets significantly exceed its liabilities, providing financial stability. The company's management team and board are experienced, supporting strategic initiatives like the resubmission of an NDA for reproxalap to treat dry eye disease, potentially enhancing future growth prospects.

- Click here to discover the nuances of Aldeyra Therapeutics with our detailed analytical financial health report.

- Assess Aldeyra Therapeutics' future earnings estimates with our detailed growth reports.

Advantage Solutions (NasdaqGS:ADV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Advantage Solutions Inc. offers business solutions to consumer goods manufacturers and retailers both in North America and internationally, with a market cap of approximately $1.08 billion.

Operations: Advantage Solutions Inc. has not reported specific revenue segments, but it provides business solutions to consumer goods manufacturers and retailers across North America and internationally.

Market Cap: $1.08B

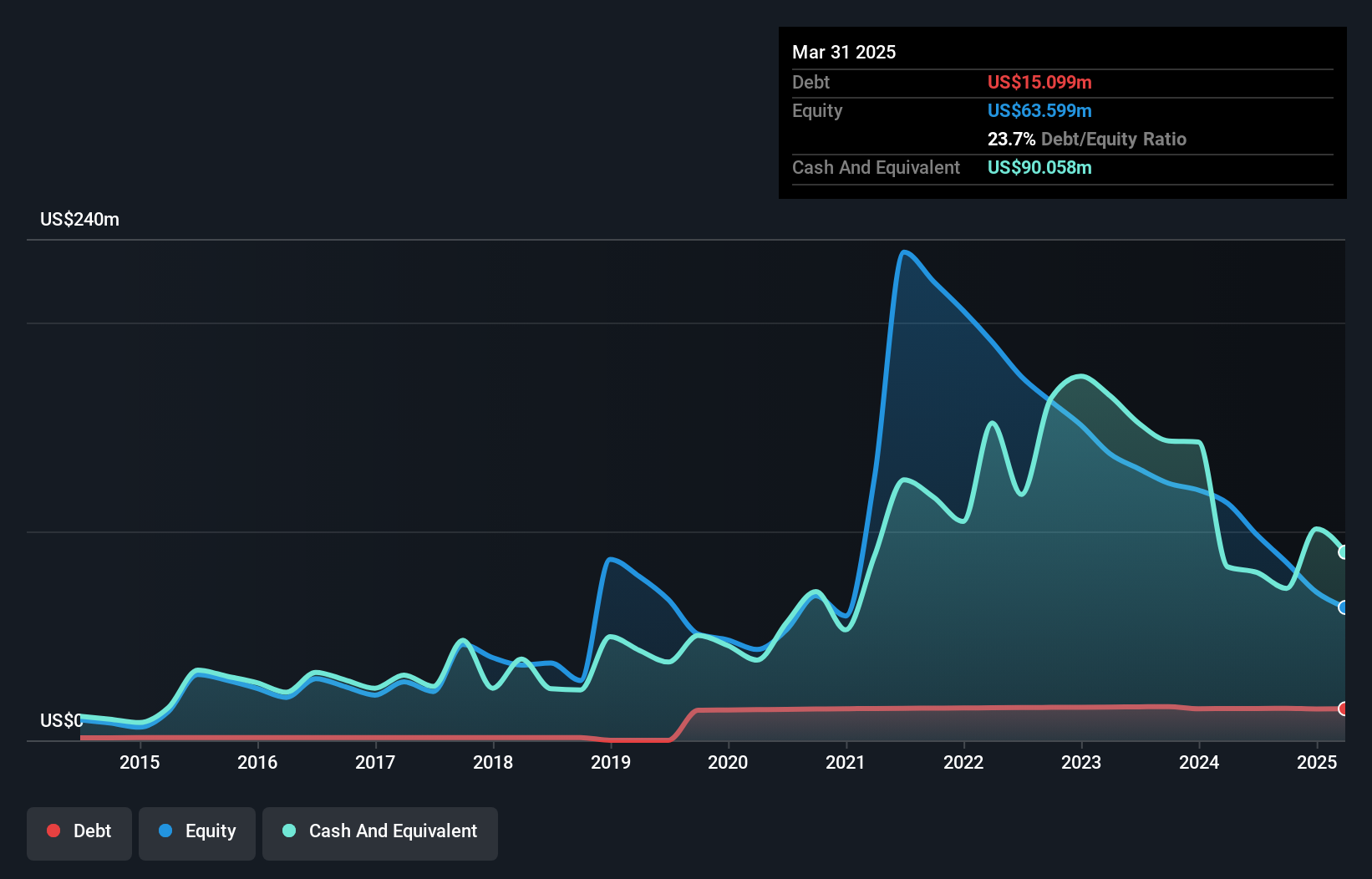

Advantage Solutions Inc., with a market cap of US$1.08 billion, faces challenges typical of penny stocks, including unprofitability and increasing losses over the past five years. Despite this, the company maintains a positive cash runway for over three years due to its sufficient short-term assets exceeding short-term liabilities by US$462.3 million. However, it struggles with high net debt to equity at 161% and long-term liabilities surpassing its short-term assets. Recent earnings reveal declining sales and increased net loss, but analysts expect significant earnings growth moving forward as Advantage continues its strategic transformation efforts.

- Unlock comprehensive insights into our analysis of Advantage Solutions stock in this financial health report.

- Evaluate Advantage Solutions' prospects by accessing our earnings growth report.

Hyliion Holdings (NYSEAM:HYLN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hyliion Holdings Corp. develops sustainable electricity-producing technology focused on clean and efficient energy solutions, with a market cap of approximately $540.31 million.

Operations: Hyliion Holdings Corp. has not reported any specific revenue segments.

Market Cap: $540.31M

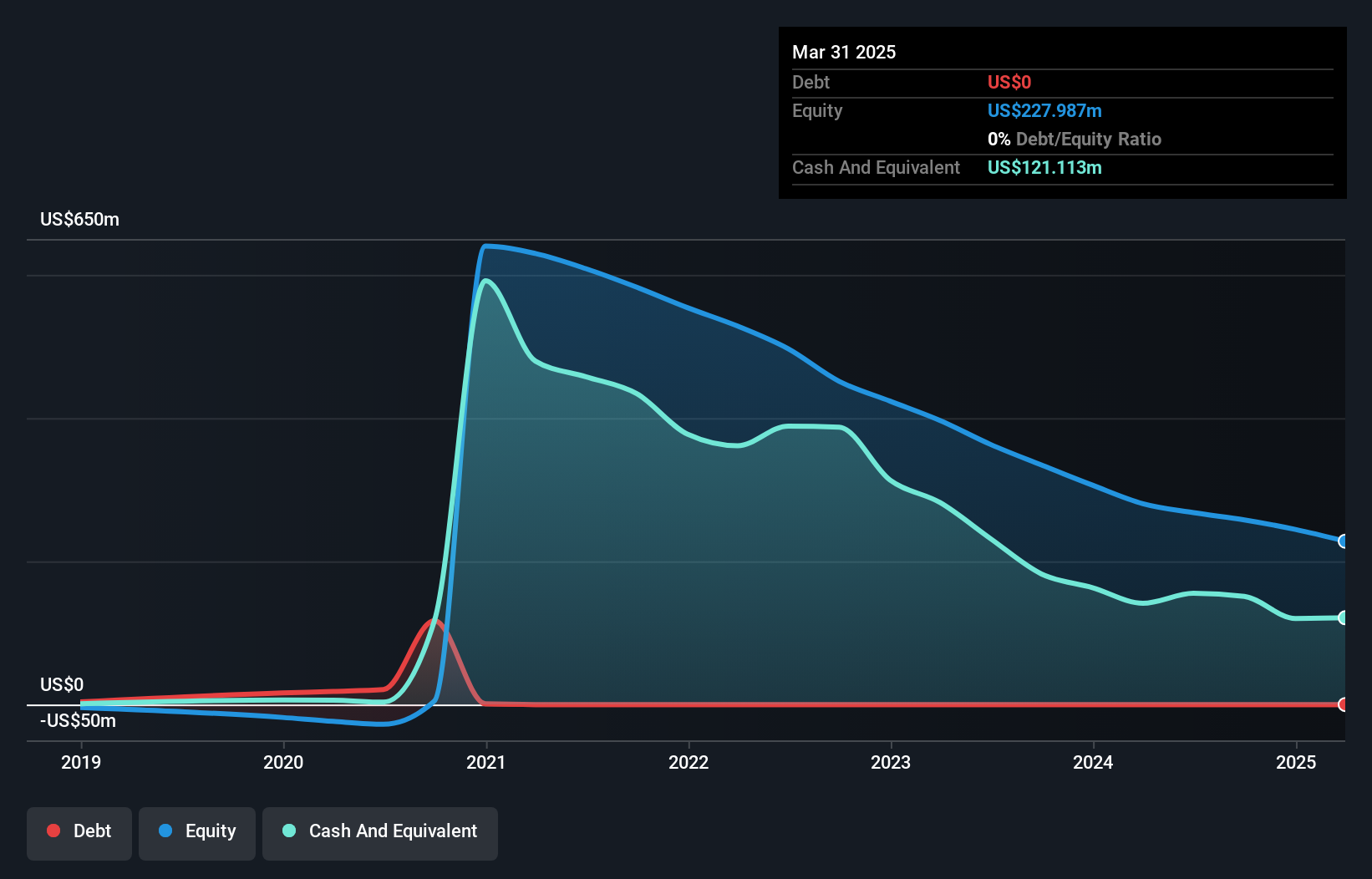

Hyliion Holdings Corp., with a market cap of US$540.31 million, exemplifies the challenges and potential of penny stocks. The company is pre-revenue, focusing on innovative energy solutions like the KARNO generator, which recently demonstrated its versatile fuel capabilities. Despite being debt-free and having short-term assets of US$161.4 million exceeding liabilities, Hyliion faces financial hurdles with less than a year of cash runway if free cash flow continues to decline at historical rates. While unprofitable with a negative return on equity, its revenue is forecasted to grow significantly in the coming years as it targets sectors such as EV charging and data centers.

- Navigate through the intricacies of Hyliion Holdings with our comprehensive balance sheet health report here.

- Understand Hyliion Holdings' earnings outlook by examining our growth report.

Summing It All Up

- Jump into our full catalog of 738 US Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADV

Advantage Solutions

Provides business solutions to consumer packaged goods companies and retailers in North America, Asia Pacific, and Europe.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives