- United States

- /

- Media

- /

- NasdaqCM:ABLV

Shareholders Can Be Confident That Able View Global's (NASDAQ:ABLV) Earnings Are High Quality

Even though Able View Global Inc.'s (NASDAQ:ABLV) recent earnings release was robust, the market didn't seem to notice. Investors are probably missing some underlying factors which are encouraging for the future of the company.

Check out our latest analysis for Able View Global

Zooming In On Able View Global's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

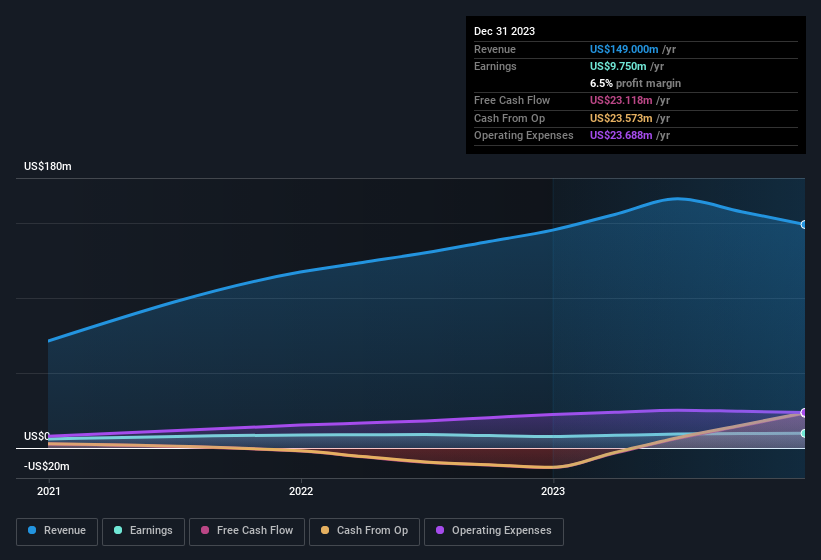

Able View Global has an accrual ratio of -0.95 for the year to December 2023. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of US$23m, well over the US$9.75m it reported in profit. Notably, Able View Global had negative free cash flow last year, so the US$23m it produced this year was a welcome improvement.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Able View Global.

Our Take On Able View Global's Profit Performance

Happily for shareholders, Able View Global produced plenty of free cash flow to back up its statutory profit numbers. Based on this observation, we consider it possible that Able View Global's statutory profit actually understates its earnings potential! Unfortunately, though, its earnings per share actually fell back over the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Able View Global as a business, it's important to be aware of any risks it's facing. You'd be interested to know, that we found 2 warning signs for Able View Global and you'll want to know about these bad boys.

Today we've zoomed in on a single data point to better understand the nature of Able View Global's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ABLV

Able View Global

Operates as a brand management partner of beauty and personal care brands in China.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.