- United States

- /

- Metals and Mining

- /

- OTCPK:AAGF.F

Can Aftermath Silver's (AAGF.F) European Investor Push Unlock Broader Support for Its Growth Plans?

Reviewed by Sasha Jovanovic

- Aftermath Silver Ltd. recently presented at both the Munich Mining Conference 2025 on October 3 and at Nordic Funds & Mines 2025 on October 8, showcasing its projects to investors in Munich and Stockholm.

- These back-to-back European conference appearances provided Aftermath Silver critical exposure to international investors, potentially sparking broader interest in its silver development portfolio and growth plans.

- Now, we'll explore how this renewed investor engagement in Europe shapes Aftermath Silver's investment narrative and future outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Aftermath Silver's Investment Narrative?

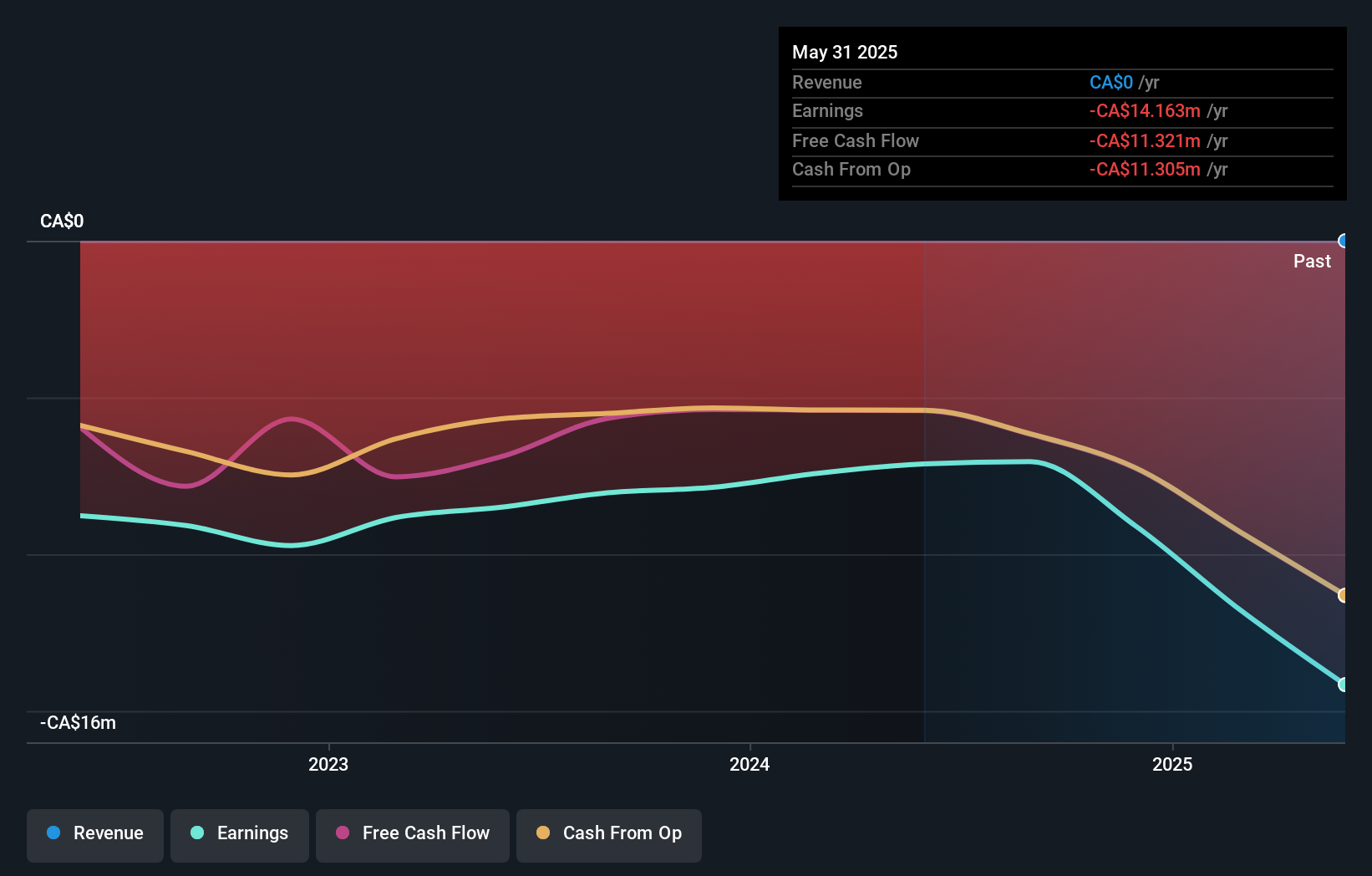

Owning Aftermath Silver stock comes down to a belief in its ability to transform resource-rich projects like Challacollo and Berenguela into future production stories, despite its current lack of revenue and mounting losses (CA$14.16 million for the year to May 2025). The company has prioritized project advancement, announcing new drilling programs and reporting strong drill results, yet persistent questions regarding its ability to continue as a going concern remain a serious risk. The recent investor roadshow in Munich and Stockholm could influence short-term catalysts by attracting new capital or partnerships, but so far, there’s no concrete evidence the exposure has materially altered the immediate funding risk or offset concerns raised in the latest financial filings. While the potential for resource expansion is part of the pitch, current volatility and dilution risks should not be overlooked. On the flip side, the recent auditor warning is something every investor should keep front of mind.

Our expertly prepared valuation report on Aftermath Silver implies its share price may be too high.Exploring Other Perspectives

Build Your Own Aftermath Silver Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aftermath Silver research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Aftermath Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aftermath Silver's overall financial health at a glance.

No Opportunity In Aftermath Silver?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:AAGF.F

Aftermath Silver

An exploration stage company, acquires, explores, and develops mineral properties in Chile and Peru.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)