- United States

- /

- Metals and Mining

- /

- NYSEAM:UAMY

Can UAMY’s Flexible Shelf Registration Accelerate Its Critical Minerals Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, United States Antimony Corporation filed a Shelf Registration allowing it to issue various securities, including debt, common and preferred stock, depositary shares, warrants, rights, and units, providing the company with enhanced flexibility for future capital raising activities.

- This move comes as United States Antimony seeks to expand its role as the only domestic antimony processor amid supply constraints and heightened government and analyst attention on critical minerals sourcing.

- We'll now explore how the shelf registration positions United States Antimony to capitalize on expanding domestic supply and defense sector partnerships.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

United States Antimony Investment Narrative Recap

To own United States Antimony shares, you need to believe in a future where domestic processing of critical minerals becomes essential due to global supply disruptions, particularly from China. The newly filed shelf registration, giving flexibility to raise capital via various securities, is arguably neutral for the stock’s main near-term catalyst, the company’s ability to lock in long-term government contracts, while the largest immediate risk remains regulatory and supply chain uncertainty at its Alaska and Ontario projects.

Among recent announcements, the company’s $25 million capital raise through a securities purchase agreement is especially relevant. This influx supports inventory build, expansion of mineral positions, and increases in smelter capacity, critical moves to underpin US Antimony’s push for supply chain reliability and to position for government-backed defense sector demand.

However, despite the expansion potential, investors should also be mindful that regulatory delays at key projects may...

Read the full narrative on United States Antimony (it's free!)

United States Antimony's narrative projects $208.1 million in revenue and $82.5 million in earnings by 2028. This requires 100.7% yearly revenue growth and an $83.4 million increase in earnings from current earnings of -$889.8 thousand.

Uncover how United States Antimony's forecasts yield a $7.50 fair value, a 38% downside to its current price.

Exploring Other Perspectives

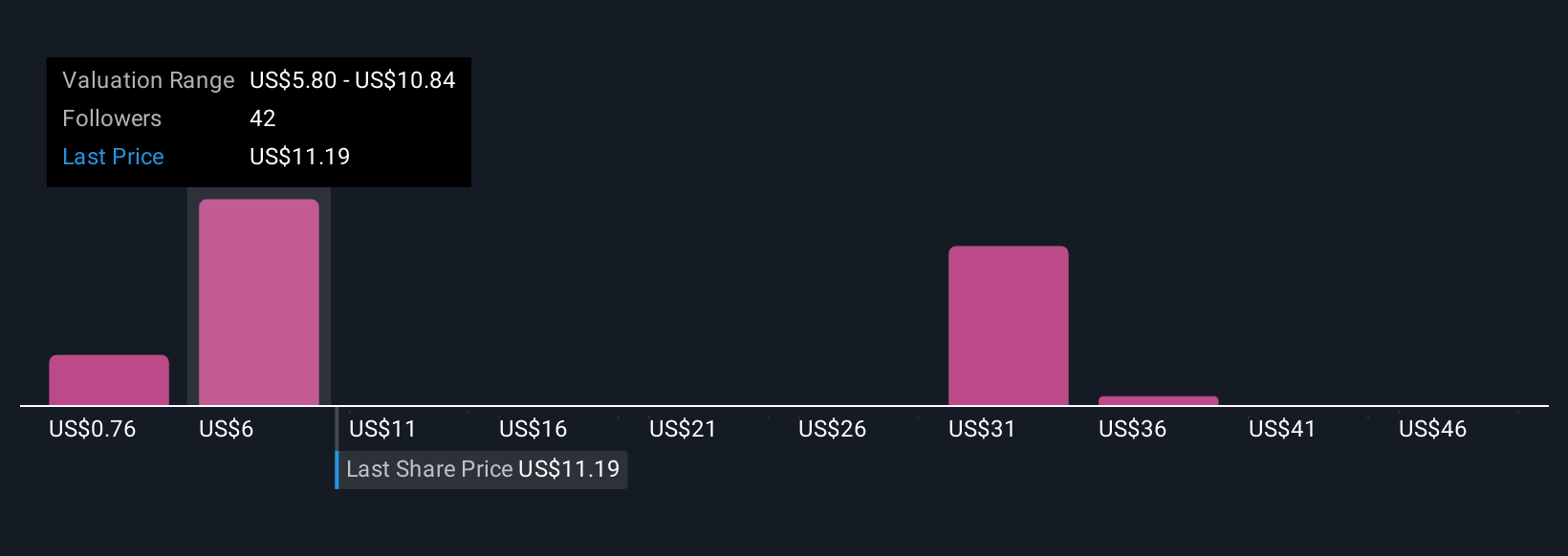

Simply Wall St Community members have set fair value estimates for UAMY from just US$0.76 to as high as US$51.17, using 21 distinct forecasts. With UAMY’s ambitious domestic capacity build underway, differing outlooks highlight just how much opinions can vary, so consider multiple viewpoints before making up your mind.

Explore 21 other fair value estimates on United States Antimony - why the stock might be worth over 4x more than the current price!

Build Your Own United States Antimony Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United States Antimony research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free United States Antimony research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United States Antimony's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UAMY

United States Antimony

Produces and sells antimony, zeolite, and precious metals in the United States and Canada.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives