- United States

- /

- Metals and Mining

- /

- NYSEAM:CMCL

Can Caledonia Mining’s (CMCL) Reaffirmed Output Target Strengthen Management’s Case for Steady Gold Leadership?

Reviewed by Sasha Jovanovic

- Caledonia Mining Corporation Plc recently reported gold production of 19,106 ounces for the third quarter of 2025 and reiterated its increased 2025 annual production guidance of 75,500 to 79,500 ounces.

- This consistent operational performance and reaffirmed outlook highlight management’s confidence in delivering stable gold output despite previous periods of investor scrutiny.

- We'll explore how the company's reaffirmed 2025 gold production guidance could shape Caledonia Mining's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Caledonia Mining Investment Narrative Recap

Owning shares in Caledonia Mining means believing in the company's ability to deliver stable gold output from its Blanket Mine, leverage strong dividend policies, and manage the operational and regulatory uncertainties inherent in Zimbabwe. The latest production update and reaffirmed 2025 gold guidance strengthen confidence in the company's consistency, but do not fundamentally alter the most important short-term catalyst, which is sustained operational performance and the company's ability to meet production targets; the main risk remains concentration at Blanket Mine, with limited diversification if any disruption occurs.

Among recent developments, the company's steady dividend declarations, most recently in August 2025, stand out. This is directly relevant in the context of operational catalysts, as the ability to maintain reliable dividends is closely tied to the company's continued production delivery, stable cash flow, and prudent capital allocation, especially as investors look for predictable income amidst sector volatility.

By contrast, investors should be aware that heavy reliance on a single asset creates vulnerabilities if unforeseen events disrupt operations at Blanket Mine…

Read the full narrative on Caledonia Mining (it's free!)

Caledonia Mining's outlook forecasts $201.2 million in revenue and $39.4 million in earnings by 2028. This is based on an annual revenue decline of 0.6% and an increase in earnings of $2.4 million from the current $37.0 million.

Uncover how Caledonia Mining's forecasts yield a $37.50 fair value, a 18% upside to its current price.

Exploring Other Perspectives

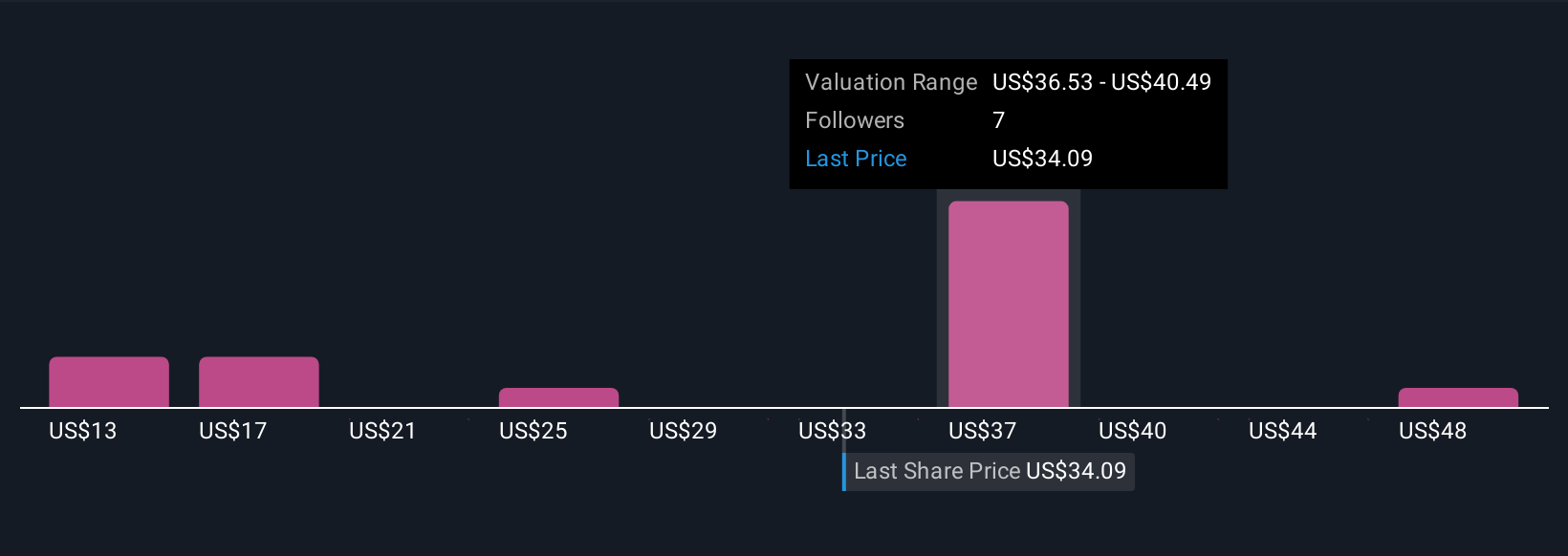

Simply Wall St Community members provided eight fair value estimates for Caledonia Mining, ranging from US$10.32 to US$52.35 per share. With such varied opinions, your own perspective on the importance of operational reliability and asset concentration could significantly influence how you interpret these numbers and the company’s risk profile.

Explore 8 other fair value estimates on Caledonia Mining - why the stock might be worth less than half the current price!

Build Your Own Caledonia Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caledonia Mining research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Caledonia Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caledonia Mining's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CMCL

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion