- United States

- /

- Chemicals

- /

- NYSE:UAN

CVR Partners (UAN): Valuation Insights Following Strong Earnings and Higher Cash Distribution

Reviewed by Simply Wall St

CVR Partners (NYSE:UAN) just released third quarter results that showed a sharp rise in both earnings and cash distribution compared to last year, giving investors plenty to talk about this week.

See our latest analysis for CVR Partners.

After such a jump in earnings and another bump to its distribution, it’s no surprise investors have taken notice. CVR Partners’ share price is up 27.3% year-to-date, while the one-year total shareholder return stands at an impressive 63.3%. Momentum has built noticeably in recent months, reflecting optimism around its stronger financials and outlook.

If the latest developments have you exploring what’s on the move, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

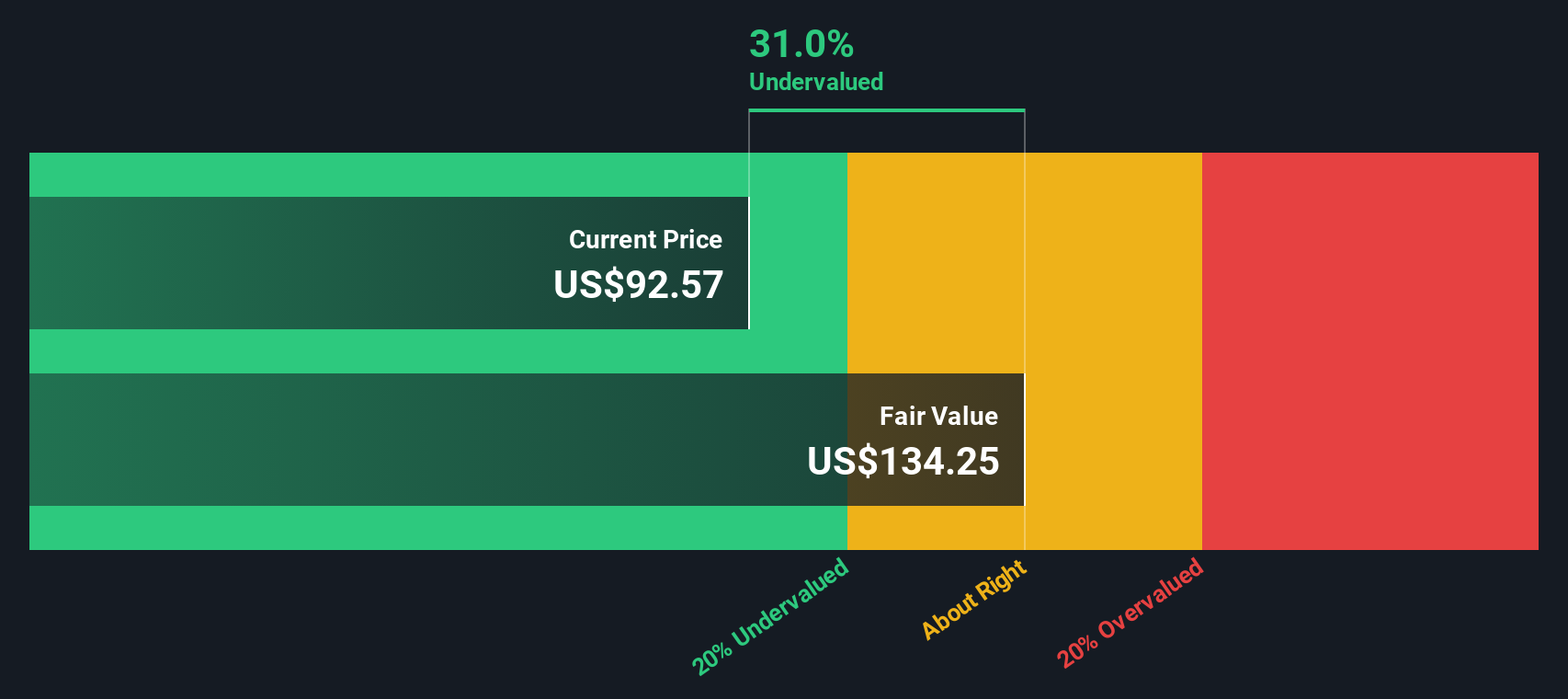

But with shares soaring and third quarter results smashing expectations, the big question now is whether CVR Partners is actually undervalued or if all that growth is already priced in for investors sizing up a potential opportunity.

Price-to-Earnings of 8.1x: Is it justified?

CVR Partners currently trades at a price-to-earnings (P/E) ratio of 8.1x, which is significantly lower than its closest peers and the broader sector. At the last close price of $98.07, investors are paying far less for each dollar of earnings compared to the typical chemicals company.

The P/E ratio is widely used to weigh the market's expectations of a company's future performance based on present and historical earnings. For companies like CVR Partners, a lower P/E might imply the market is cautious about the sustainability of recent profit growth or has concerns about future prospects.

However, unlike most in its industry, CVR Partners’ recent earnings growth has been explosive and well above peers. Over the past year, earnings surged by 142%, dramatically outpacing the US Chemicals industry’s decline of 1.3%. With a P/E ratio of 8.1x compared to the industry average of 24.7x and peer average of 25.5x, the stock is trading at a steep discount. If the market eventually recognizes the sustainability of these profits, the multiple could climb toward sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8.1x (UNDERVALUED)

However, sustained profit growth is never guaranteed. Demand volatility or changes in fertilizer prices could quickly shift the outlook for CVR Partners.

Find out about the key risks to this CVR Partners narrative.

Another View: Discounted Cash Flow Perspective

Taking a different angle, our DCF model puts CVR Partners’ fair value at $170.17 per share, which is well above the recent trading price of $98.07. This suggests shares are trading at a substantial discount, hinting there may be more upside than the P/E ratio alone reveals. However, can this estimated value hold up against the unpredictable realities of the fertilizer business?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CVR Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 844 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CVR Partners Narrative

If you have your own perspective, or enjoy digging into the numbers yourself, you can assemble a personalized view in just a few minutes. Do it your way

A great starting point for your CVR Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on what's next. Don’t miss your chance to uncover new market leaders with unique strengths right now.

- Uncover fresh opportunities in digital finance by reviewing these 82 cryptocurrency and blockchain stocks, which is shaping tomorrow’s payment networks and blockchain solutions.

- Chase high potential income streams with these 20 dividend stocks with yields > 3%, offering stable yields above 3% for your portfolio’s peace of mind.

- Gain an edge in healthcare innovation by checking out these 33 healthcare AI stocks, which is transforming medicine with AI-driven breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UAN

CVR Partners

Engages in the production and sale of nitrogen fertilizer in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives