- United States

- /

- Chemicals

- /

- NYSE:UAN

CVR Partners (UAN) Is Up 7.6% After Dividend Hike and Earnings Growth Has The Bull Case Changed?

Reviewed by Simply Wall St

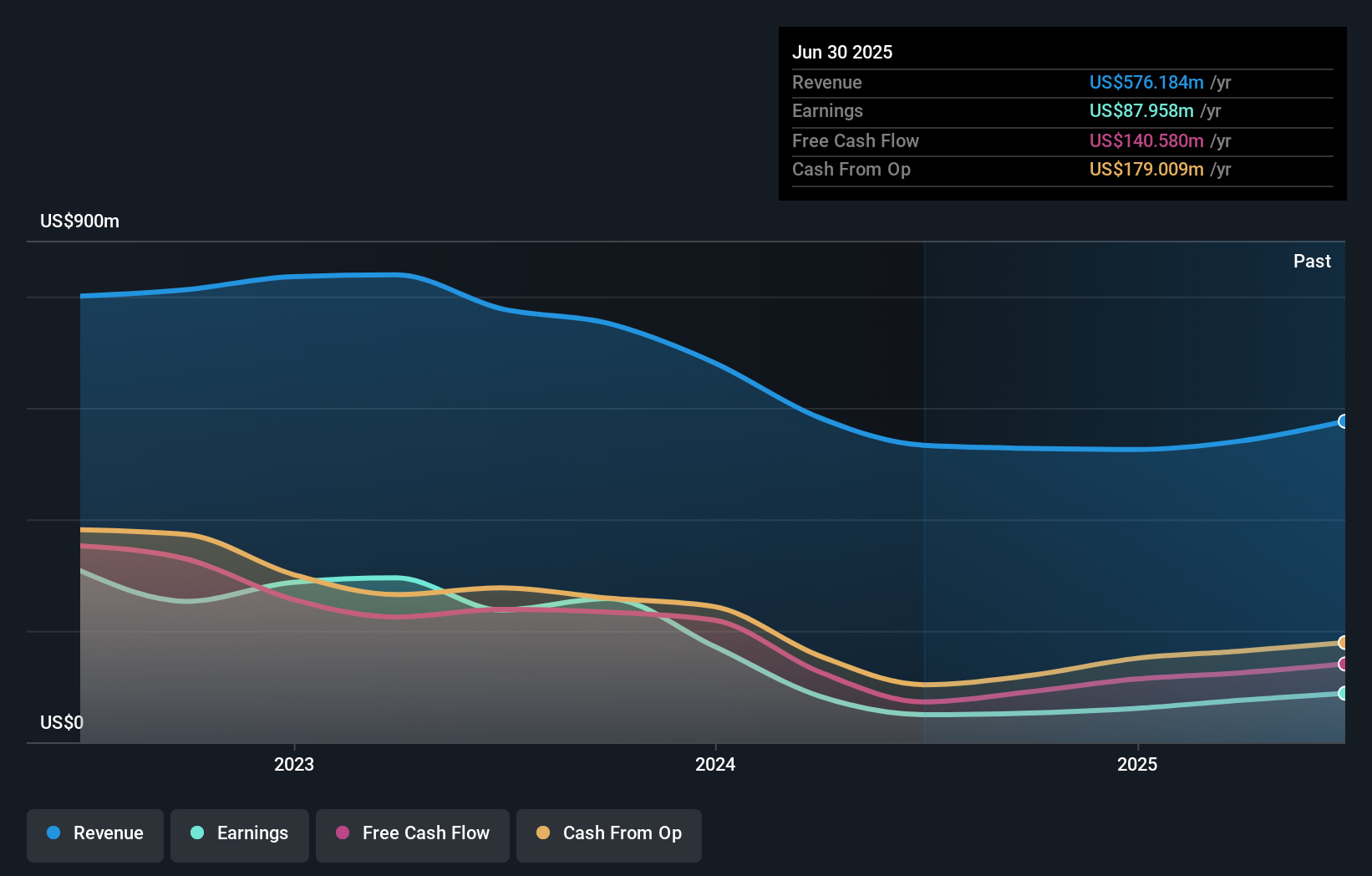

- CVR Partners announced past quarterly results showing increased sales and net income, alongside declaring a higher second quarter 2025 cash distribution of $3.89 per common unit to be paid in August.

- Despite a year-over-year dip in some production volumes, the company achieved improved earnings and sales for both the quarter and half-year periods.

- We'll now explore how the distribution boost and higher earnings may shape CVR Partners' future investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is CVR Partners' Investment Narrative?

To own CVR Partners, investors generally need to believe the company can sustain its strong cash distributions and capitalize on robust nitrogen fertilizer demand, even as production volumes fluctuate. The latest news of a higher quarterly distribution, alongside improved earnings and sales, underscores management’s ongoing focus on rewarding unitholders and finding operational efficiencies. In the short term, this distribution boost acts as a clear catalyst, helping support the investment case by bolstering yield appeal and contributing to a recent upswing in the unit price. However, the production figures, while somewhat softer year-on-year, put the spotlight on operational consistency as a key risk, particularly since debt levels are elevated and coverage of distributions by earnings appears thin. While the recent results are encouraging and may temporarily ease concerns, that payout coverage risk has not disappeared if margins come under pressure. But there’s more to this story, distribution coverage is something investors should keep top of mind.

CVR Partners' shares have been on the rise but are still potentially undervalued by 30%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on CVR Partners - why the stock might be worth 41% less than the current price!

Build Your Own CVR Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVR Partners research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free CVR Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVR Partners' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UAN

CVR Partners

Engages in the production and sale of nitrogen fertilizer in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives