- United States

- /

- Metals and Mining

- /

- NYSE:TX

Can Ternium's (TX) Dividend Commitment Reveal Its Long-Term Capital Discipline?

Reviewed by Sasha Jovanovic

- Ternium S.A. recently reported third quarter 2025 earnings, noting sales of US$3,955 million and net income of US$21 million, alongside the approval of an interim dividend of US$0.90 per ADS to be paid in November.

- While quarterly sales and net income declined year-over-year, the company returned to profitability over the nine-month period and maintained shareholder distributions through its dividend declaration.

- To better understand the implications of Ternium’s continued dividend payout amid mixed results, we’ll examine its latest impact on the investment outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ternium Investment Narrative Recap

To be a Ternium shareholder, you need to believe in the company's ability to withstand cyclical steel markets and maintain financial flexibility through challenging periods. The recent combination of declining quarterly sales and a continued dividend payout does not materially shift the main short-term catalyst: stabilization in Ternium’s core Latin American markets and improved local pricing. However, the biggest current risk, global steel overcapacity and rising imports undermining regional pricing, remains unchanged by these results.

The board’s approval of a US$0.90 per ADS interim dividend for November stands out, especially given mixed earnings figures. This continued distribution is relevant, as it signals management’s confidence in Ternium’s liquidity during a period when free cash flow could be pressured by high capital expenditures and fluctuating market demand. Despite this, investors should pay particular attention to …

Read the full narrative on Ternium (it's free!)

Ternium's outlook anticipates $18.4 billion in revenue and $828.7 million in earnings by 2028. This scenario assumes a 4.2% annual revenue growth rate and an increase of $233.8 million in earnings from the current level of $594.9 million.

Uncover how Ternium's forecasts yield a $35.65 fair value, in line with its current price.

Exploring Other Perspectives

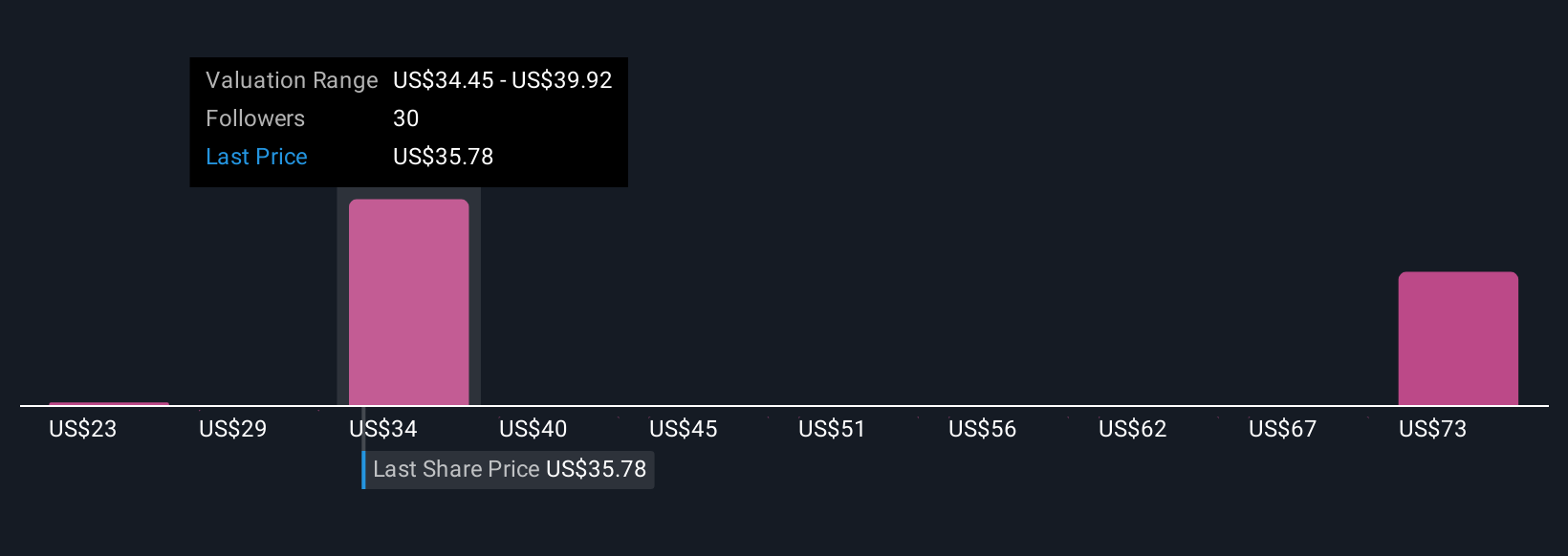

Five private investors from the Simply Wall St Community estimated Ternium’s fair value between US$23.49 and US$78.82 per share. Against this backdrop, ongoing global overcapacity and increasing competition highlight just how varied performance expectations can be, explore a spectrum of reasoning behind these viewpoints.

Explore 5 other fair value estimates on Ternium - why the stock might be worth 35% less than the current price!

Build Your Own Ternium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ternium research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ternium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ternium's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ternium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TX

Ternium

Manufactures and distributes steel products in Mexico, Southern Region, Brazil, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives