- United States

- /

- Chemicals

- /

- NYSE:SXT

Will Sensient Technologies’ (SXT) Recent Outreach Reveal a Shift in Its Clean-Label Strategy?

Reviewed by Simply Wall St

- Sensient Technologies recently participated in Baird's Investor Day in St. Louis and held a special company call, both events taking place earlier this week.

- These activities have raised expectations among investors for potential new disclosures or updates that could signal meaningful shifts in the company's direction.

- We'll explore how Sensient's investor conference participation and special call may influence its outlook for natural colors and clean-label growth.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sensient Technologies Investment Narrative Recap

To be a shareholder in Sensient Technologies, you need to believe in the company's ability to lead as regulatory changes drive a shift to natural colors and clean-label products. The recent participation in Baird’s Investor Day and the special company call brought investor attention, but there is no indication so far of any material short-term developments affecting the biggest near-term catalyst, meeting demand spikes ahead of the 2028 synthetic-to-natural conversion deadline, or addressing top risks such as scaling up supply without margin impact.

Most relevant to this outlook, Sensient reaffirmed its capital expenditure plans for 2025, targeting around US$100 million primarily for expanding natural color production. This commitment could help position the company to benefit as demand for natural colors climbs due to regulatory changes, though investors continue to weigh this against the risk of supply constraints, cost inflation, and returns on this elevated investment.

However, one key factor investors should watch for is whether ongoing cost pressures from agricultural inputs could squeeze margins if...

Read the full narrative on Sensient Technologies (it's free!)

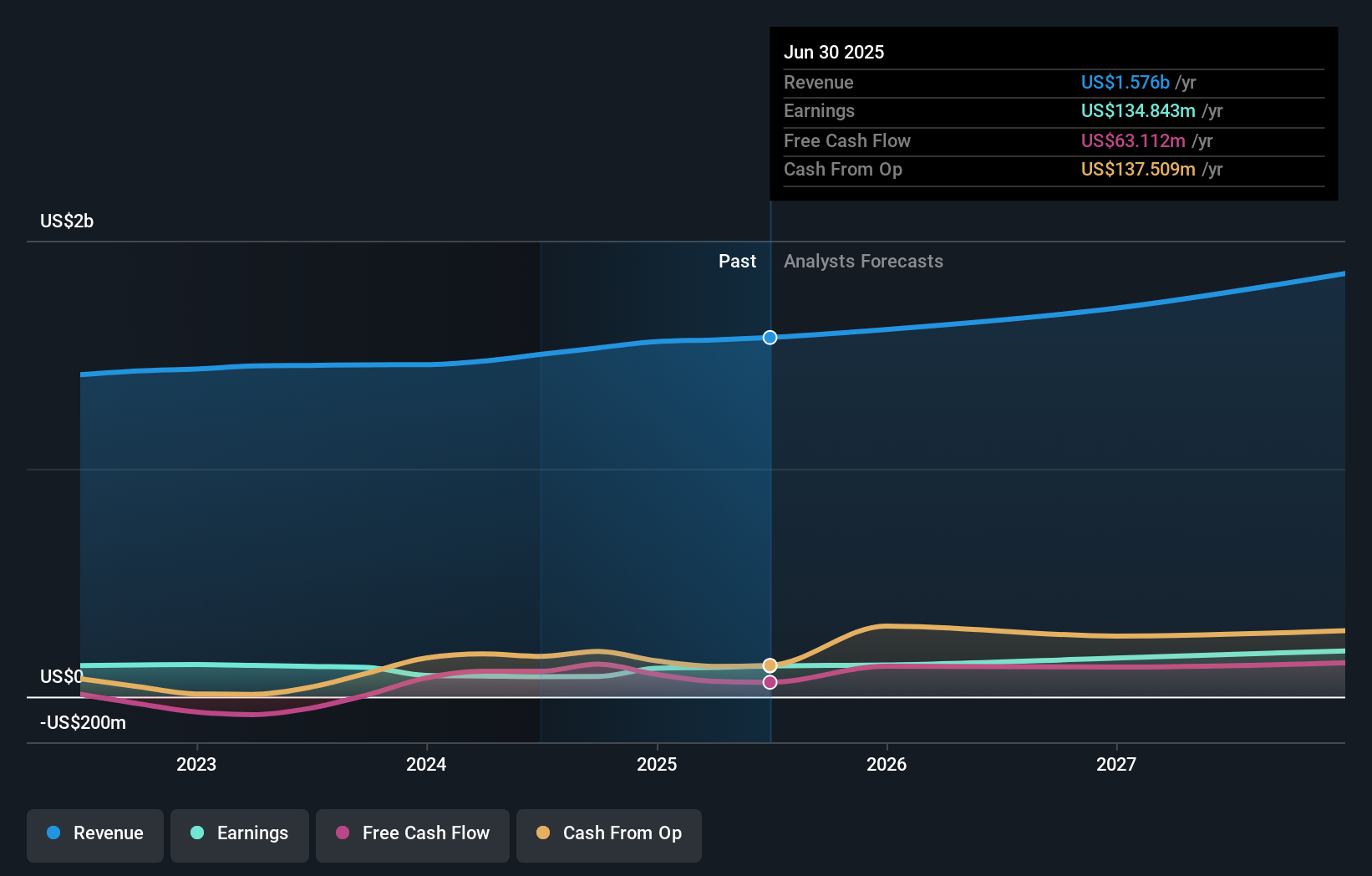

Sensient Technologies' narrative projects $1.9 billion revenue and $216.5 million earnings by 2028. This requires 6.3% yearly revenue growth and a $81.7 million increase in earnings from the current $134.8 million.

Uncover how Sensient Technologies' forecasts yield a $121.67 fair value, a 3% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community offers just 1 fair value perspective at US$97.78, which is below recent analyst targets. As spending on natural colors rises, your view on the company's ability to offset costs may shape your assessment of future value, explore how different opinions reflect a range of expectations for Sensient’s growth.

Explore another fair value estimate on Sensient Technologies - why the stock might be worth 17% less than the current price!

Build Your Own Sensient Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sensient Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sensient Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sensient Technologies' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXT

Sensient Technologies

Manufactures and markets colors, flavors, and other specialty ingredients worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives