- United States

- /

- Metals and Mining

- /

- NYSE:SXC

Some SunCoke Energy (NYSE:SXC) Shareholders Have Taken A Painful 74% Share Price Drop

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding SunCoke Energy, Inc. (NYSE:SXC) during the five years that saw its share price drop a whopping 74%. And we doubt long term believers are the only worried holders, since the stock price has declined 43% over the last twelve months. Unfortunately the share price momentum is still quite negative, with prices down 29% in thirty days. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

See our latest analysis for SunCoke Energy

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

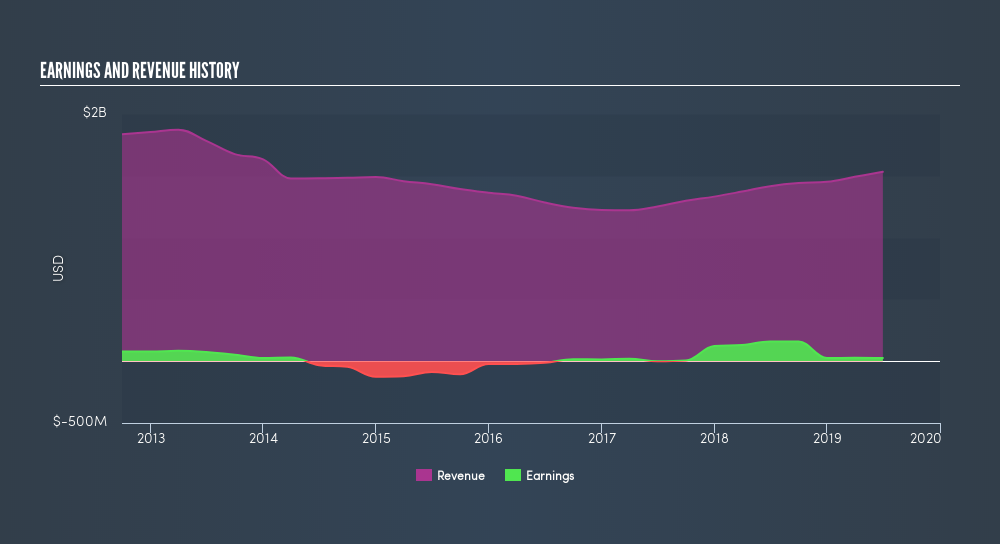

During five years of share price growth, SunCoke Energy moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

The revenue fall of 0.1% per year for five years is neither good nor terrible. But if the market expected durable top line growth, then that could explain the share price weakness.

It is of course excellent to see how SunCoke Energy has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling SunCoke Energy stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

SunCoke Energy shareholders are down 43% for the year, but the market itself is up 2.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 23% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before forming an opinion on SunCoke Energy you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:SXC

SunCoke Energy

Operates as an independent producer of coke in the Americas and Brazil.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives