- United States

- /

- Packaging

- /

- NYSE:SW

Smurfit Westrock (SW): Reassessing Valuation After $1.3 Billion Debt Refinancing and Analyst Optimism

Reviewed by Simply Wall St

Smurfit Westrock (SW) just wrapped up a $1.3 billion notes issuance aimed squarely at refinancing debt, a move that can reshape its balance sheet and help investors reassess the stock’s recent slide.

See our latest analysis for Smurfit Westrock.

The $1.3 billion refinancing comes after a tough stretch, with the share price at $36.12 and a 90 day share price return of negative 21.77 percent, even though the three year total shareholder return is still positive. This suggests sentiment has cooled despite a longer term value creation story.

If this kind of balance sheet reset has you rethinking your portfolio, it might be a good moment to explore fast growing stocks with high insider ownership for other ideas where insiders have real “skin in the game.”

With the stock down sharply over the past year, yet still growing earnings and trading well below analyst targets, has Smurfit Westrock quietly slipped into undervalued territory, or is the market already discounting its future growth?

Most Popular Narrative: 32.8% Undervalued

Based on the most followed narrative, Smurfit Westrock’s fair value of $53.73 sits well above the last close at $36.12, framing a sizeable implied upside.

Ongoing realization of at least $400 million in identified synergies, with management highlighting a similar or greater opportunity from further commercial and operational improvements, should result in sustained increases in margins and operating leverage, materially boosting future earnings.

Want to see what justifies that kind of upside? The narrative leans on accelerating earnings, expanding margins, and a future valuation multiple that might surprise you.

Result: Fair Value of $53.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weak packaging demand or a slower than expected exit from loss making contracts could easily derail those margin and earnings assumptions.

Find out about the key risks to this Smurfit Westrock narrative.

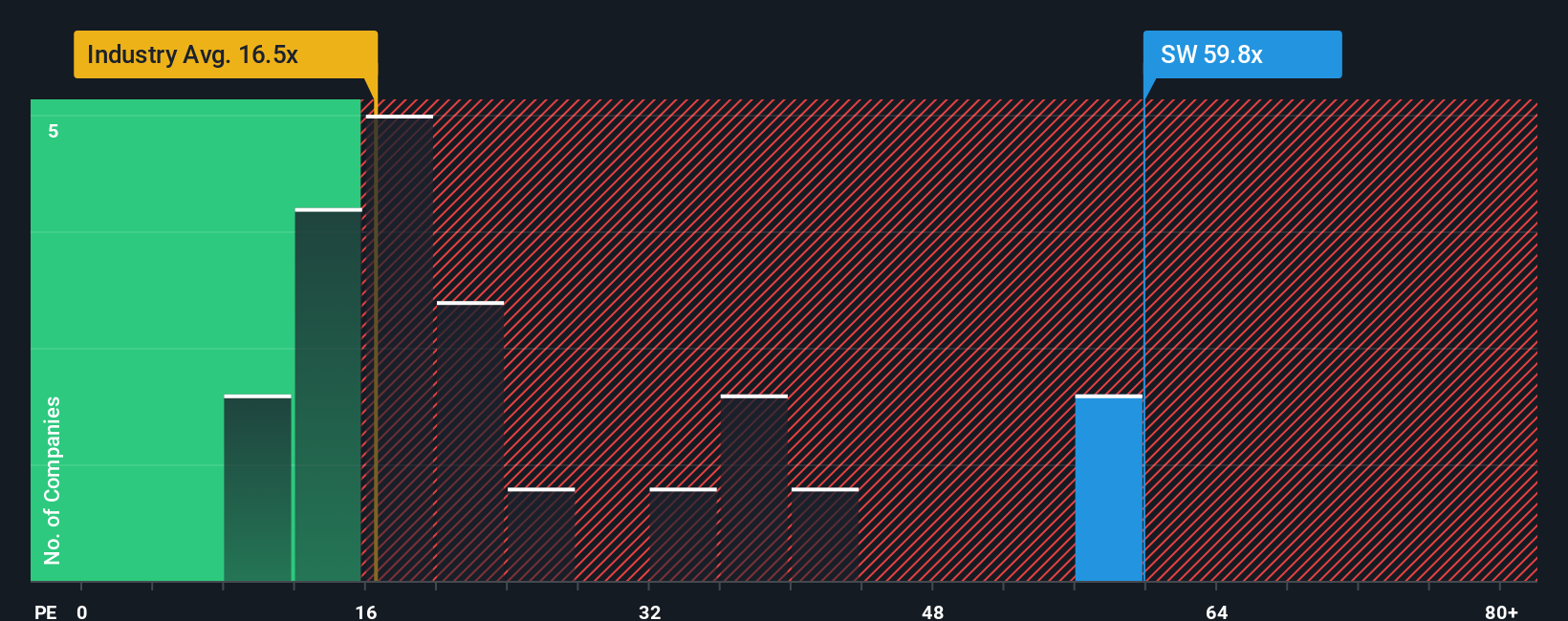

Another View: Earnings Multiple Paints a Tougher Picture

Look past the narrative and the stock looks less of a bargain. Smurfit Westrock trades on a 25.1x price to earnings ratio, richer than both North American packaging peers at 19.1x and the sector average at 22.2x, though still below its 28.8x fair ratio. This raises the question of whether upside is already largely priced into today’s multiple.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Smurfit Westrock Narrative

If this perspective does not fully match your own, dive into the numbers yourself, build a custom view in minutes, and Do it your way.

A great starting point for your Smurfit Westrock research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover fresh, data driven ideas that others might overlook.

- Capitalize on long term compounding potential by targeting companies from these 14 dividend stocks with yields > 3% that aim to reward patient shareholders with reliable income.

- Position yourself at the frontier of innovation by focusing on these 25 AI penny stocks that could transform industries with scalable, real world AI solutions.

- Strengthen your portfolio’s value core by zeroing in on these 915 undervalued stocks based on cash flows where market pessimism may have pushed quality businesses to attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SW

Smurfit Westrock

Manufactures, distributes, and sells containerboard, corrugated containers, and other paper-based packaging products.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026