- United States

- /

- Chemicals

- /

- NYSE:SQM

Sociedad Química y Minera de Chile S.A.'s (NYSE:SQM) Shares Climb 25% But Its Business Is Yet to Catch Up

Sociedad Química y Minera de Chile S.A. (NYSE:SQM) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

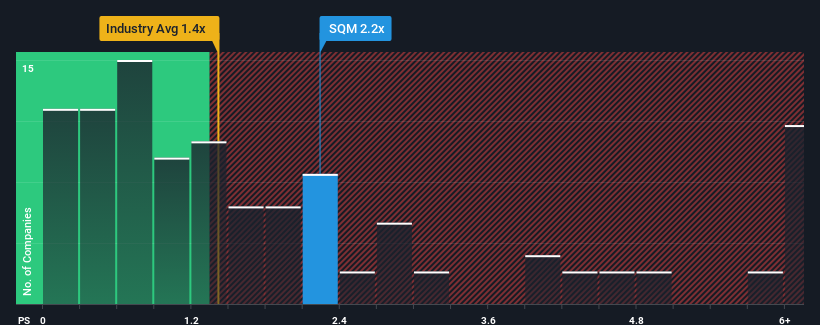

Following the firm bounce in price, given close to half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Sociedad Química y Minera de Chile as a stock to potentially avoid with its 2.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Sociedad Química y Minera de Chile

How Sociedad Química y Minera de Chile Has Been Performing

Recent times haven't been great for Sociedad Química y Minera de Chile as its revenue has been falling quicker than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Sociedad Química y Minera de Chile's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Sociedad Química y Minera de Chile's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 47%. Even so, admirably revenue has lifted 165% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 7.4% per annum as estimated by the analysts watching the company. That's shaping up to be similar to the 6.6% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Sociedad Química y Minera de Chile's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Sociedad Química y Minera de Chile's P/S

The large bounce in Sociedad Química y Minera de Chile's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Sociedad Química y Minera de Chile's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Sociedad Química y Minera de Chile (2 make us uncomfortable) you should be aware of.

If these risks are making you reconsider your opinion on Sociedad Química y Minera de Chile, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SQM

Sociedad Química y Minera de Chile

Operates as a mining company worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives