- United States

- /

- Chemicals

- /

- NYSE:SMG

Scotts Miracle-Gro (SMG): Assessing Valuation After New $2 Billion Credit Deal and Columbus Crew Partnership Expansion

Reviewed by Simply Wall St

Scotts Miracle-Gro (SMG) just lined up a fresh five year, $2 billion credit agreement and expanded its long running Columbus Crew partnership, moves that shape both its balance sheet and brand reach.

See our latest analysis for Scotts Miracle-Gro.

Those moves come after a choppy stretch for investors, with a roughly 2.9 percent 1 month share price return but a much weaker year to date share price return and a notably negative 1 year total shareholder return. This suggests sentiment is still cautious even as management shores up financing and brand exposure.

If this kind of turnaround story has your attention, it might be worth scanning other consumer focused names via our fast growing stocks with high insider ownership for fresh ideas where insiders have real skin in the game.

With profits ticking higher but the share price still lagging analysts’ targets, is Scotts Miracle-Gro a quietly undervalued turnaround, or are investors already baking future growth into today’s valuation and limiting the upside?

Most Popular Narrative: 24.6% Undervalued

With Scotts Miracle-Gro last closing at $55.59 against a narrative fair value near $73.71, the story hinges on profitability snapping back much faster than revenue.

Significant ongoing investments in supply chain technology, automation, and process efficiencies are unlocking approximately $75 million in cost savings for fiscal '25 and another approximately $75 million planned for '26/'27. These initiatives are directly driving gross margin recovery (with a target of 35%+), boosting EBITDA, and improving long-term net margins.

Curious how modest top line expectations can still justify a big valuation gap? The narrative focuses on sharp margin expansion and a richer earnings multiple. Want to see how those moving parts fit together and which profit outlook underpins that higher fair value? Dive into the full narrative to unpack the assumptions behind this call.

Result: Fair Value of $73.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer preferences toward organic products, along with ongoing uncertainty around the delayed Hawthorne separation, could easily derail that margin driven recovery story.

Find out about the key risks to this Scotts Miracle-Gro narrative.

Another Angle on Value

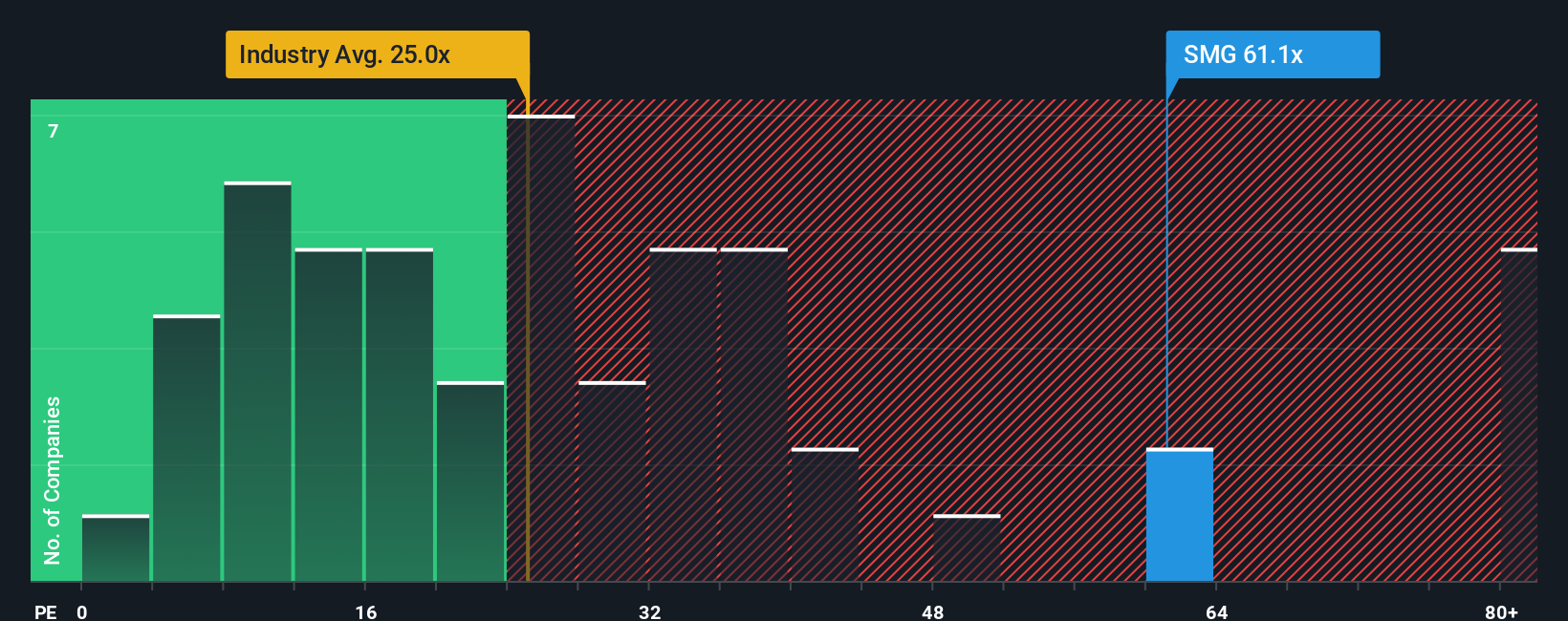

On earnings, the picture looks less generous. Scotts Miracle-Gro trades on a 22.2 times price to earnings ratio, richer than its peer average of 10.7 times and even above its own 20.5 times fair ratio. This hints more at valuation risk than hidden upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Scotts Miracle-Gro Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes. Get started with Do it your way.

A great starting point for your Scotts Miracle-Gro research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to uncover stocks that match your strategy, not the crowd’s.

- Explore these 14 dividend stocks with yields > 3% that may provide income alongside potential capital growth.

- Look into these 25 AI penny stocks that are involved in real world AI adoption.

- Review these 929 undervalued stocks based on cash flows where current prices are compared with their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMG

Scotts Miracle-Gro

Engages in the manufacture, marketing, and sale of products for lawn, garden care, and indoor and hydroponic gardening in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026