- United States

- /

- Chemicals

- /

- NYSE:SMG

Is Scotts Miracle-Gro a Good Investment After Recent 2.8% Price Rebound in 2025?

Reviewed by Bailey Pemberton

If you are standing at the crossroads, wondering whether Scotts Miracle-Gro deserves a spot in your portfolio, you are not alone. This stock has seen its fair share of ups and downs lately, keeping even seasoned investors on their toes. Just in the past week, the price managed a modest rebound of 2.8%, offering a glimmer of optimism. But step back a bit, and the picture gets more complicated. The past month brought a 9.0% dip, and year-to-date, shares are still down over 12.7%. Looking even further, the 1-year return hovers at negative 28.9%, and the 5-year drop is a striking 58.6%. However, there is a twist: if you go back three years, Scotts Miracle-Gro is actually up by an impressive 59.3%. It is a classic tale of short-term turbulence alongside pockets of long-term growth potential.

Some of these moves have lined up with changes in the wider consumer products sector and shifting market interest in lawn and garden care, especially as economic conditions evolved. Investors are clearly weighing future prospects and past volatility with every price movement, trying to decide just how much risk or potential the company still offers.

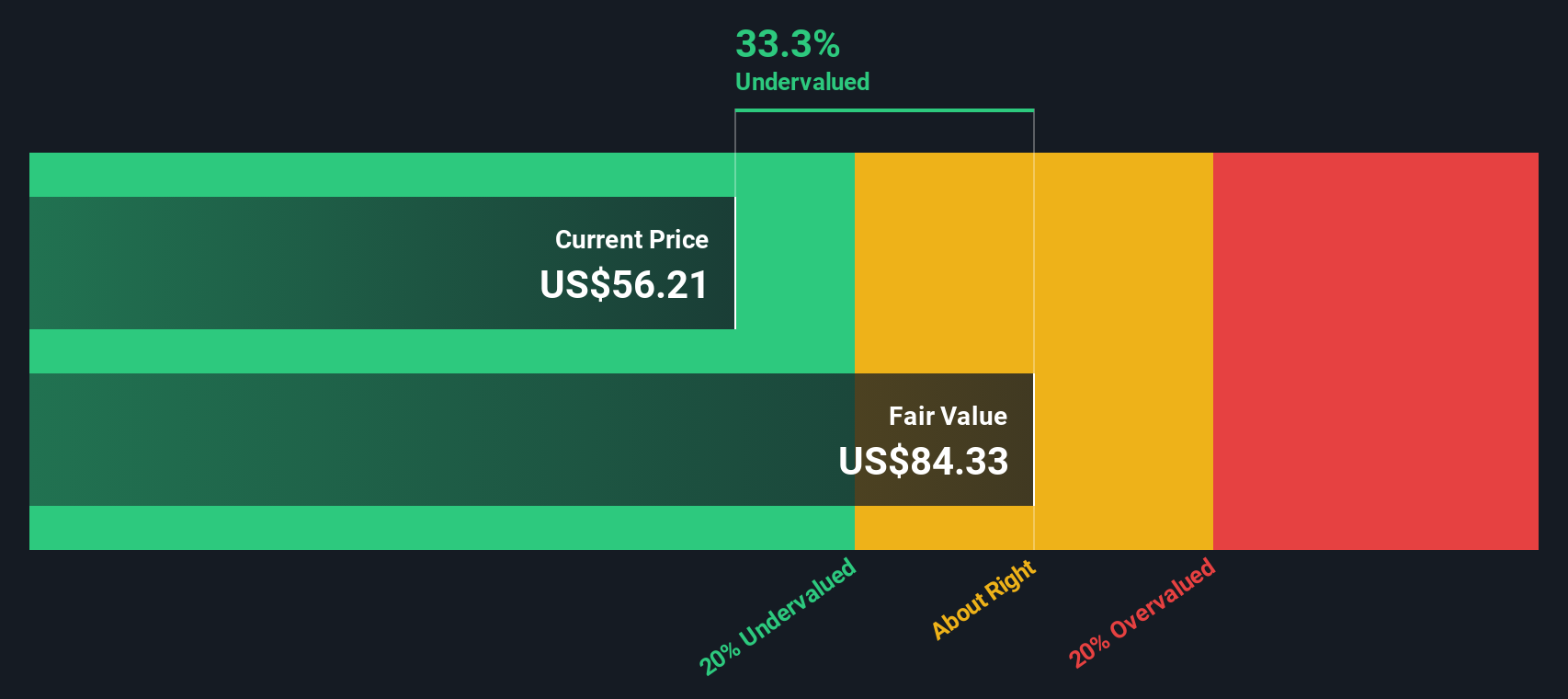

Valuation is always front and center when a stock shows this kind of mixed performance. By traditional measures, Scotts Miracle-Gro scores a 3 out of 6 on our undervaluation checks, suggesting that the stock is attractively priced based on three key metrics but still facing challenges in others. The standard valuation approaches are a great place to start, but stick around as we explore several methods to see where Scotts Miracle-Gro stands, and wrap up with a more insightful way to think about valuation that investors often overlook.

Why Scotts Miracle-Gro is lagging behind its peers

Approach 1: Scotts Miracle-Gro Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting all its future free cash flows and then discounting those values back to today. This approach tries to determine how much all those future dollars are worth in today's terms, giving investors a sense of a stock's fair value based on its ability to generate cash moving forward.

For Scotts Miracle-Gro, recent data shows annual free cash flow sits at $235.96 million. Analysts offer projections up to five years ahead, after which the forecasts are extended using reasonable growth rates. By the end of 2027, free cash flow is forecast to reach $299 million. Extending to 2035, discounted cash flow projections continue to climb, relying on expected gradual growth yearly. The majority of value comes from the next several years.

When these projected cash flows are all added up and discounted, the DCF model yields an intrinsic value of $85.28 per share. With the DCF indicating the stock is trading at a 32.7% discount to this value, Scotts Miracle-Gro currently looks notably undervalued using this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Scotts Miracle-Gro is undervalued by 32.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Scotts Miracle-Gro Price vs Earnings

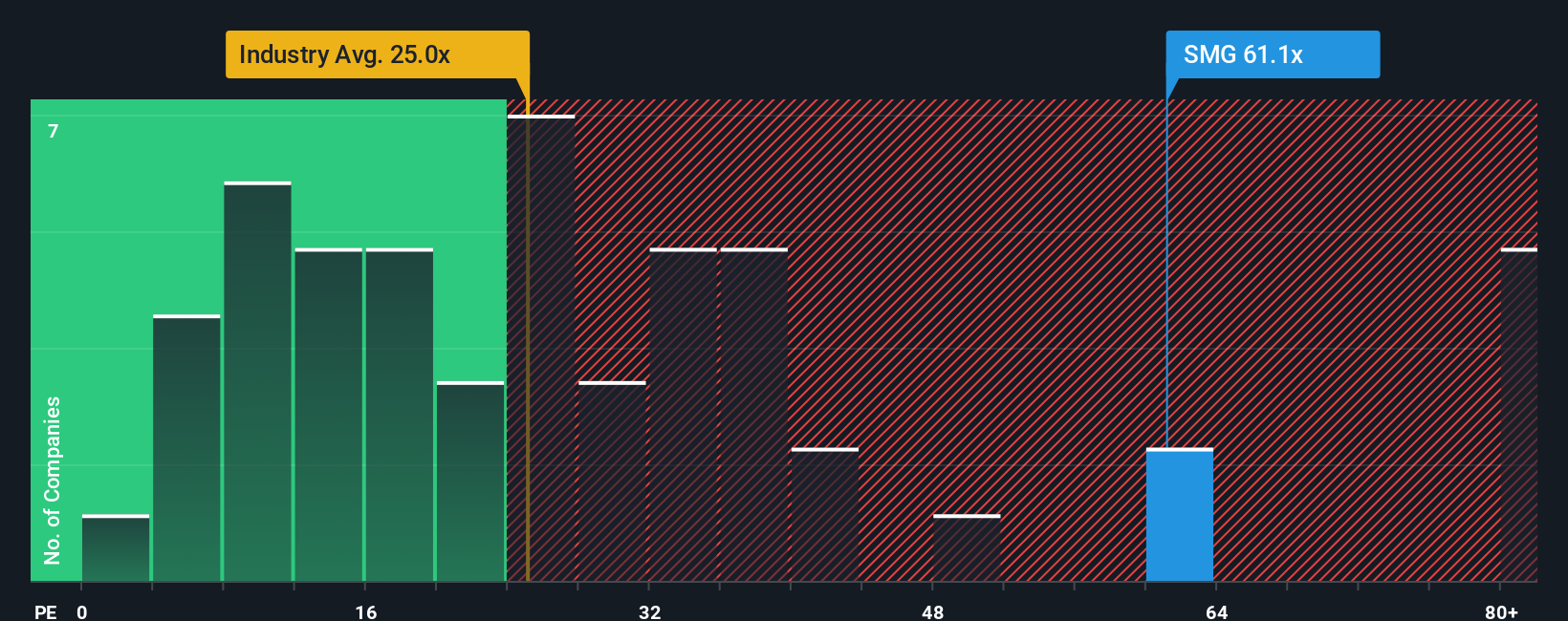

For companies that generate steady profits like Scotts Miracle-Gro, the price-to-earnings (PE) ratio is a time-tested tool for gauging value. The PE ratio captures what investors are willing to pay for each dollar of earnings, so it is especially helpful when the business is profitable and expectations for its growth are top-of-mind.

The right PE ratio for a company depends on its growth prospects and risk profile. Simply put, fast-growing or more stable companies usually command higher PE ratios as investors anticipate bigger future profits. By contrast, companies with limited growth or more uncertainty tend to trade at a discount.

Currently, Scotts Miracle-Gro trades at 62.4x earnings, a significant premium to both the industry average of 26.5x and the peer group's 19.0x. However, benchmarks alone do not tell the whole story, since each company's situation is distinct. To address this, the Simply Wall St proprietary Fair Ratio blends critical factors such as earnings growth, industry characteristics, profit margin, market cap, and risk, arriving at a tailored benchmark for this stock.

The Fair Ratio for Scotts Miracle-Gro comes in at 25.5x. Since this is well below the company's current 62.4x multiple, the stock appears overvalued when viewed through this lens, even after considering company-specific strengths and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Scotts Miracle-Gro Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are simply the story behind the numbers, capturing your outlook on a company's future revenue, earnings, and margins, and turning that perspective into a personalized fair value. By crafting a Narrative, you link Scotts Miracle-Gro’s unique business developments and industry trends with your own assumptions, creating a clear path from story to forecast to valuation.

Narratives are easy to use and readily available on Simply Wall St’s Community page, where millions of investors share and compare ideas. With a Narrative, you can quickly check if your fair value suggests buying or selling compared to today’s price. The calculation updates dynamically whenever new news or earnings are released, keeping your analysis current. For example, some investors may build a Narrative expecting major growth from digital and organic trends, backing a price target as high as $90.00, while others may see ongoing risks from the Hawthorne segment and arrive at a more cautious value of $68.00. Narratives let you make confident, informed decisions that reflect your own investing beliefs.

Do you think there's more to the story for Scotts Miracle-Gro? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMG

Scotts Miracle-Gro

Engages in the manufacture, marketing, and sale of products for lawn, garden care, and indoor and hydroponic gardening in the United States and internationally.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives