- United States

- /

- Packaging

- /

- NYSE:SEE

Does Sealed Air’s Recent 8% Rally Signal a Shift in Market Value for 2025?

Reviewed by Bailey Pemberton

If you have ever found yourself staring at Sealed Air’s stock chart, wondering whether it is time to buy, hold, or move on, you are definitely not alone. Sealed Air has been quietly drawing attention with its recent uptick. The stock has gained 8.1% over the last month and is up 6.3% year to date. That recent momentum comes even as its longer-term track record has been a bit more mixed, with a 3.9% gain over the past year but still showing red over a three- and five-year window. In a market where packaging and materials companies are sometimes overlooked, this kind of performance hints at improving sentiment, perhaps even a turning point for Sealed Air.

Of course, everyone wants to know if the stock is undervalued, overpriced, or right where it should be. Most investors turn to the numbers to help answer that, and Sealed Air’s latest value score comes in at 4 out of 6. That means, by a variety of standard valuation checks such as price-to-earnings, price-to-book, and others, the company looks undervalued in four key ways. It is not just a single metric painting the picture here; the numbers back up a theme of growing investor optimism and possible upside ahead.

What do those valuation methods actually mean, and how should you weigh them when you are making a decision? Here is a breakdown of each approach, a discussion of where Sealed Air stands out, and a hint at an even smarter way to look at the company’s value before we wrap up.

Approach 1: Sealed Air Discounted Cash Flow (DCF) Analysis

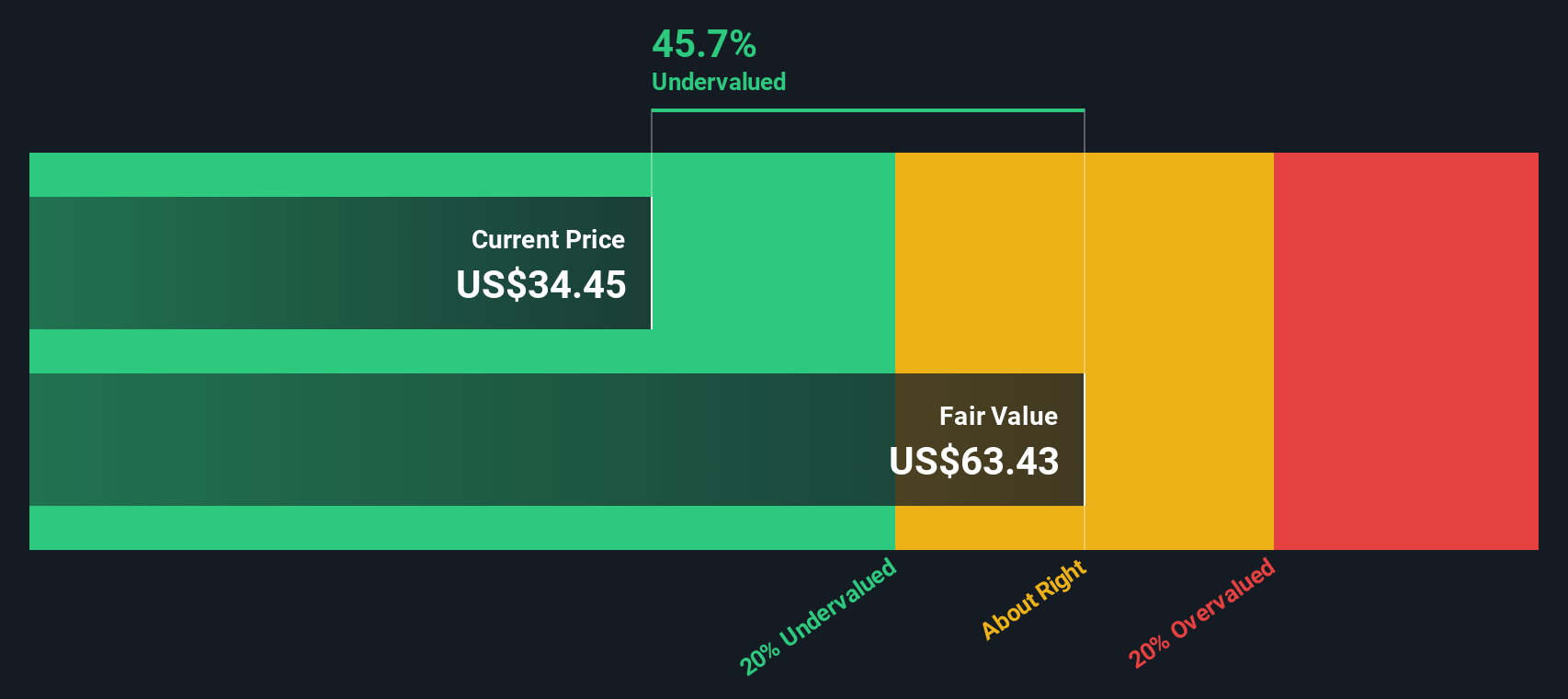

A Discounted Cash Flow (DCF) model helps estimate a company's true value by projecting its future cash flows and discounting them back to today's dollars. This approach gives investors a sense of what the business is really worth based on the money it can potentially generate in the future.

For Sealed Air, the latest reported Free Cash Flow (FCF) is $364 million. Analyst estimates and projections indicate that by 2027, the company's annual FCF could reach around $492 million. Further projections suggest FCF could steadily rise each year to over $613 million by 2035. These cash flows are all calculated in USD and take into account both near-term analyst estimates and longer-term growth extrapolated by independent evaluators.

Bringing all these projected cash flows back to present value, the model arrives at an intrinsic "fair value" of $64.14 per share. This figure is 44.8% higher than Sealed Air's recent market price, implying that the stock is significantly undervalued based on what its future cash generation could be worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sealed Air is undervalued by 44.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sealed Air Price vs Earnings

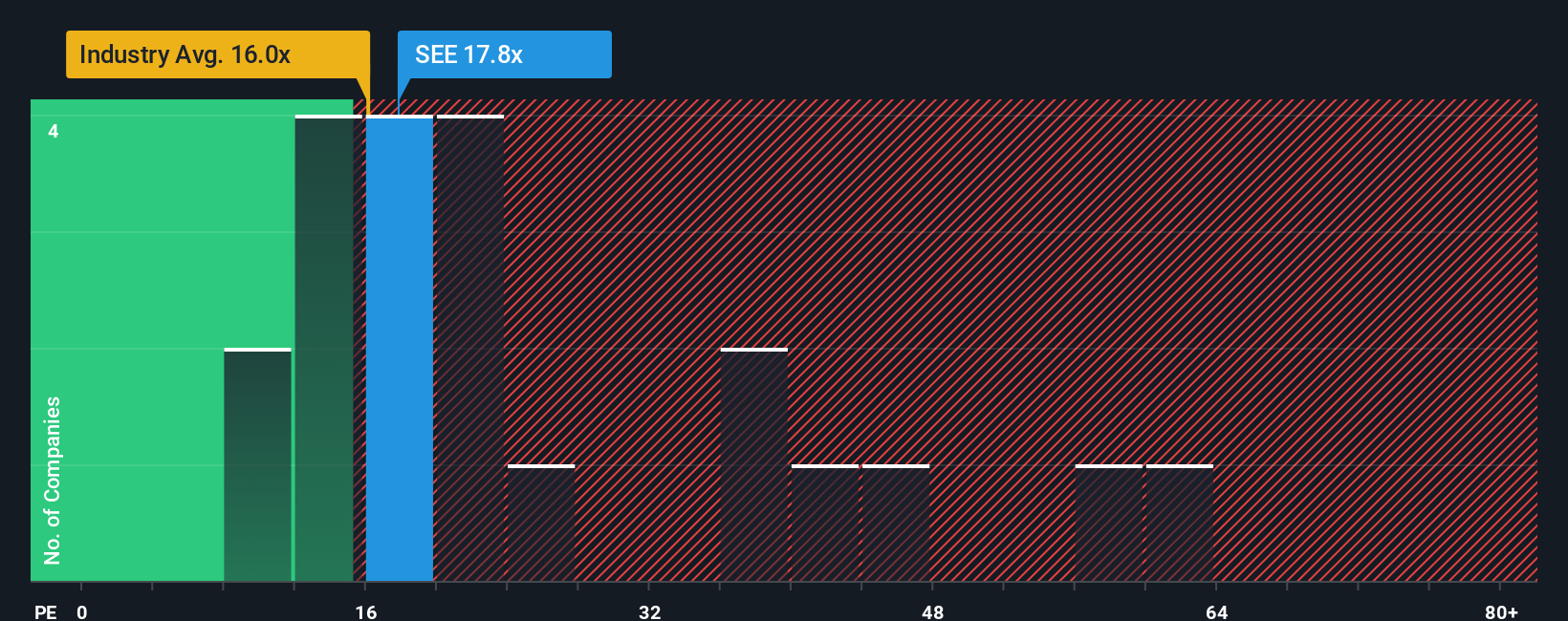

For profitable companies like Sealed Air, the price-to-earnings (PE) ratio is a widely trusted valuation tool. The PE ratio helps investors understand how much the market is willing to pay for every dollar of company earnings, making it a direct and practical way to compare valuations across different companies in the same industry.

The "normal" or fair PE ratio for a stock depends on both expected earnings growth and the level of risk investors perceive. Higher growth typically justifies a higher PE ratio, while more risk tends to push it lower. Therefore, comparing a company’s PE to the industry average, its direct peers, and to what its growth profile deserves provides a fuller picture.

Sealed Air currently trades at a 17.38x PE ratio. This is slightly above the packaging industry's average of 16.02x, but well below the peer group’s 27.31x. Importantly, Simply Wall St’s proprietary Fair Ratio for Sealed Air is 20.62x, which factors in not only its growth and risk profile but also profit margins, industry context, and market cap.

The Fair Ratio offers a more tailored perspective than just looking at industry averages or peers, as it is based on what investors should reasonably pay for Sealed Air’s real opportunities and challenges. Comparing Sealed Air’s actual PE of 17.38x to its Fair Ratio of 20.62x suggests the stock is undervalued using this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sealed Air Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, story-driven forecast that lets you add your unique perspective on a company, including your assumptions for Sealed Air's future revenue, earnings, and profit margins. These forecasts are then linked directly to a personalized fair value estimate.

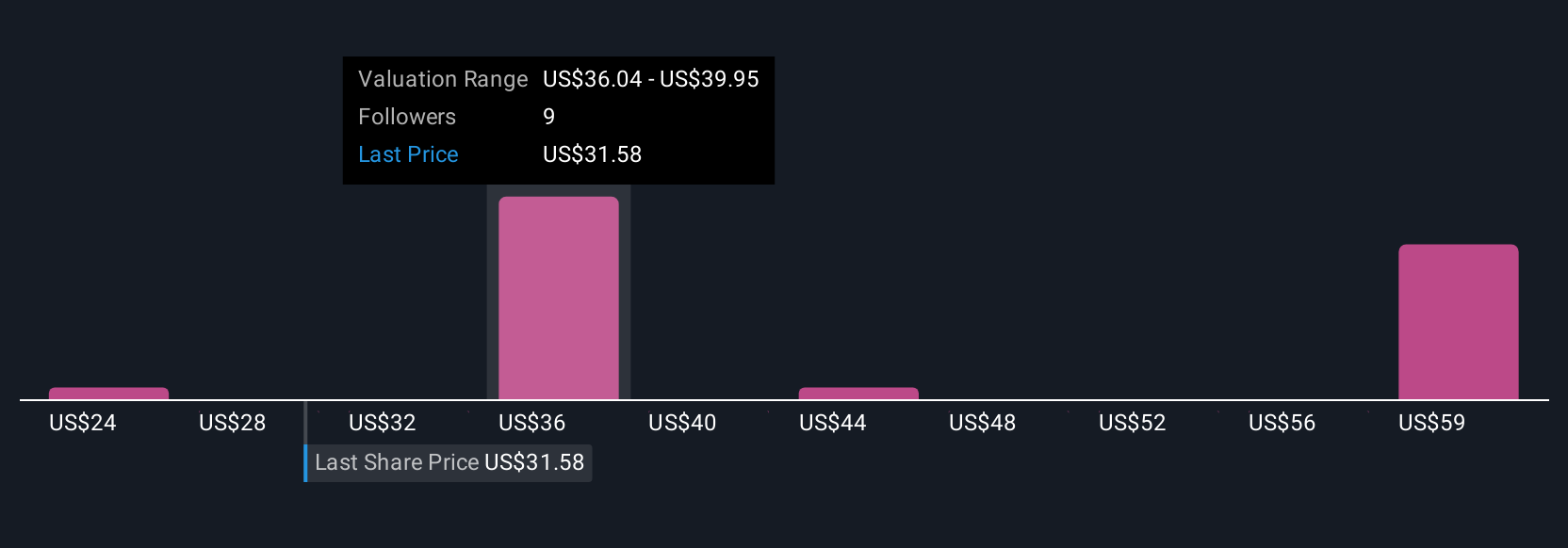

Narratives connect the big picture story, such as global expansion, new leadership, or sustainability trends, directly to numbers, so you can compare what you think the company is worth to its current price. This helps you decide if now is the time to buy or sell. Accessible to everyone on Simply Wall St’s Community page, which is used by millions, Narratives update dynamically whenever new earnings or news break, so your fair value always reflects the latest information.

For Sealed Air, for example, some investors have crafted bullish Narratives targeting a fair value of $50 per share based on aggressive automation and global growth forecasts, while others set much lower targets, down to $31, focusing on margin pressure and supply risks. By choosing and customizing your Narrative, you get a valuation that truly fits your own outlook and helps you navigate any market conditions with confidence.

Do you think there's more to the story for Sealed Air? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEE

Sealed Air

Provides packaging solutions in the United States and internationally, Europe, the Middle East, Africa, and Asia Pacific.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives