- United States

- /

- Chemicals

- /

- NYSE:RPM

RPM International (RPM): Assessing Valuation After MAP 2025 Completion and Record Acquisition Investments

Reviewed by Simply Wall St

RPM International (RPM) just wrapped up its MAP 2025 initiative, which saw the company expand margins, improve working capital, and achieve record operational results. The real headline here is RPM’s major investment push. This was the company’s busiest year ever for acquisitions, a strategy designed to drive long-term growth by integrating new businesses and capabilities. Investors are taking notice as RPM’s latest moves signal a shift from building to harvesting, with attention on how quickly new synergies and expanded operations in Belgium and Malaysia might start delivering results.

This strategic pivot has clearly caught the market’s attention. RPM’s stock climbed 12% in the past year and delivered a 10% gain over the past three months, suggesting that optimism is building, not fading. This comes at a time when institutional investors are the dominant force. They hold about 85% of the shares, and many have just experienced a $550 million lift in market capitalization alongside the latest results. Over three and five years, RPM’s long-term returns have shown strong performance, hinting at continued momentum and resilience even as market conditions shift.

With so much activity now priced into RPM’s stock, the big question for investors is whether there is more value to unlock or if the market has already factored in the next wave of growth.

Most Popular Narrative: 5.1% Undervalued

According to community narrative, RPM International is viewed as modestly undervalued based on analyst projections for growth and profitability, with the current share price sitting slightly below estimated fair value.

Ongoing investment in turnkey systems and solutions for high-performance buildings, combined with a shift from component sales to integrated asset management offerings and expansion in developing markets, aligns well with the rising demand for renovation and maintenance of aging global infrastructure. This is likely to produce sustained top-line growth and support recurring revenues.

Want to know the secret behind this valuation call? One key assumption fuels the outlook: incremental profit margins and a new level of recurring revenue power. Be ready for revealing analyst forecasts that could change your perspective on how RPM gets priced for the future.

Result: Fair Value of $134.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in consumer demand or higher input costs could quickly undermine RPM's momentum and put pressure on margins in the period ahead.

Find out about the key risks to this RPM International narrative.Another View: What Does the DCF Model Say?

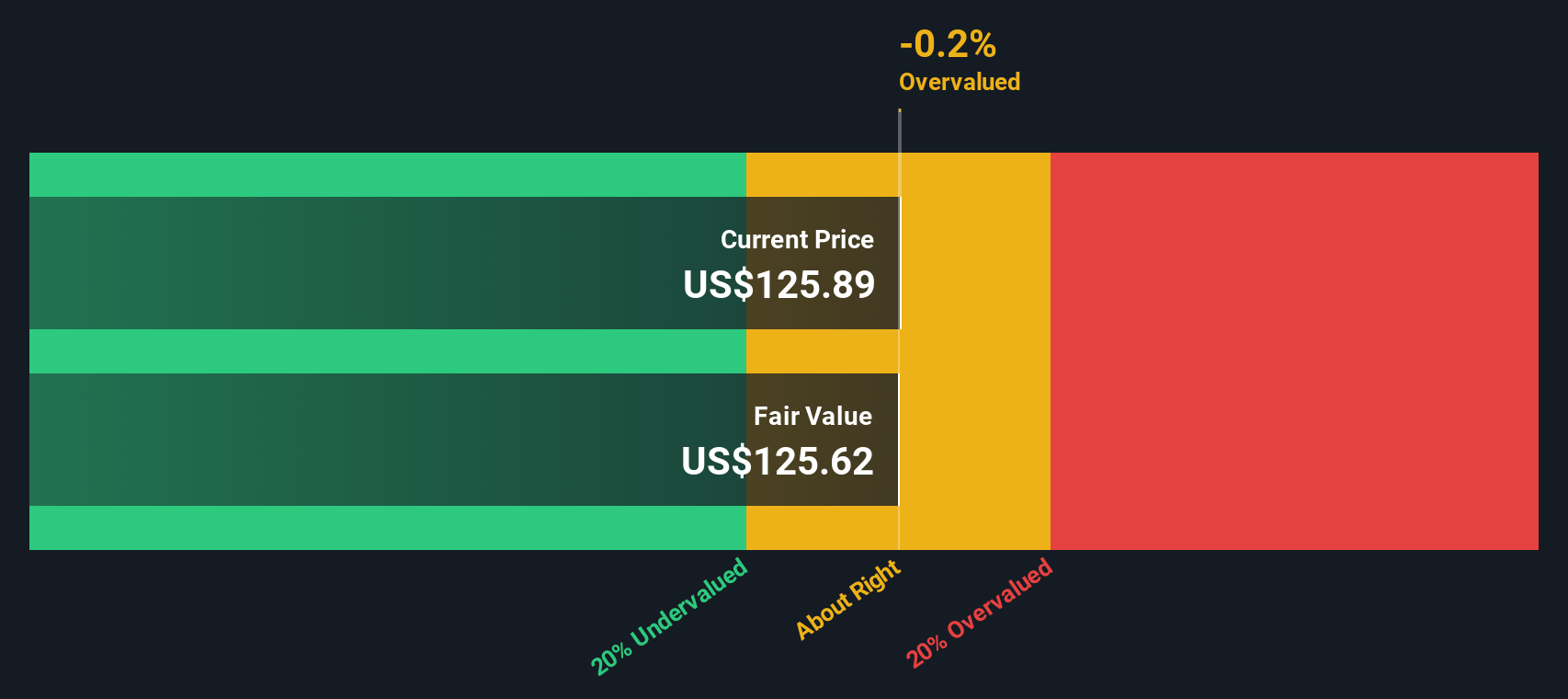

Looking at RPM International through the lens of our DCF model, a different story emerges. While the previous assessment found the stock undervalued, this approach suggests it may not be trading far from fair value. Could RPM’s future really be that predictable? Or is the market pricing in more uncertainty than meets the eye?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own RPM International Narrative

If these perspectives do not quite fit your viewpoint, or if you are keen to dig into the research firsthand, you can easily craft a personalized narrative for RPM International in just a few minutes, or even faster. Simply do it your way.

A great starting point for your RPM International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Investment Ideas?

Do not stop at RPM International if you want to unlock even greater investing potential. The market is full of untapped opportunities and unique themes, carefully filtered for you by Simply Wall Street. The right next move could be one click away, so do not let fresh ideas pass you by:

- Maximize your portfolio’s income stream with attractive opportunities in dividend stocks with yields > 3%, offering yields greater than 3%.

- Position yourself at the forefront of innovation by targeting AI penny stocks, which are poised for growth in artificial intelligence.

- Get ahead of the curve by assessing unbeatable value in undervalued stocks based on cash flows, supported by robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RPM

RPM International

Manufactures, markets, and sells various specialty chemicals for the construction, industrial, specialty, and consumer markets internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives