- United States

- /

- Chemicals

- /

- NYSE:PPG

Is PPG’s CFO and Digital Leadership Transition Reshaping the Investment Case for PPG Industries (PPG)?

Reviewed by Sasha Jovanovic

- In December 2025, PPG Industries announced that long-serving chief financial officer and senior vice president Vincent J. Morales plans to retire on July 1, 2026, after more than 40 years with the company, and has begun a global internal and external search for his successor.

- Because Morales also oversees corporate development and information technology, his planned departure marks a broad leadership transition across finance, M&A and digital capabilities at PPG.

- We’ll now examine how PPG’s planned CFO succession and leadership shift across finance and technology could influence its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

PPG Industries Investment Narrative Recap

To own PPG Industries, you need to believe in its position as a global coatings leader with resilient cash generation and disciplined capital returns, even as revenue growth has recently lagged the wider market. The announced retirement of long-time CFO Vincent Morales in 2026 looks orderly and does not materially change the near term focus on managing foreign exchange headwinds and price pressure in Industrial Coatings.

Against this backdrop, PPG’s ongoing share repurchases in 2025, totaling more than US$531.56 million by mid year, matter because they amplify the importance of stable cash flows and disciplined financial oversight during a multi year leadership transition. These buybacks sit alongside a rising dividend, which together frame how the next CFO could influence capital allocation priorities in the face of currency and pricing risks.

Yet investors should be aware that unfavorable foreign currency trends, particularly in Global Architectural Coatings, could still...

Read the full narrative on PPG Industries (it's free!)

PPG Industries’ narrative projects $16.9 billion revenue and $2.0 billion earnings by 2028. This requires 2.7% yearly revenue growth and an earnings increase of about $0.7 billion from $1.3 billion today.

Uncover how PPG Industries' forecasts yield a $119.80 fair value, a 18% upside to its current price.

Exploring Other Perspectives

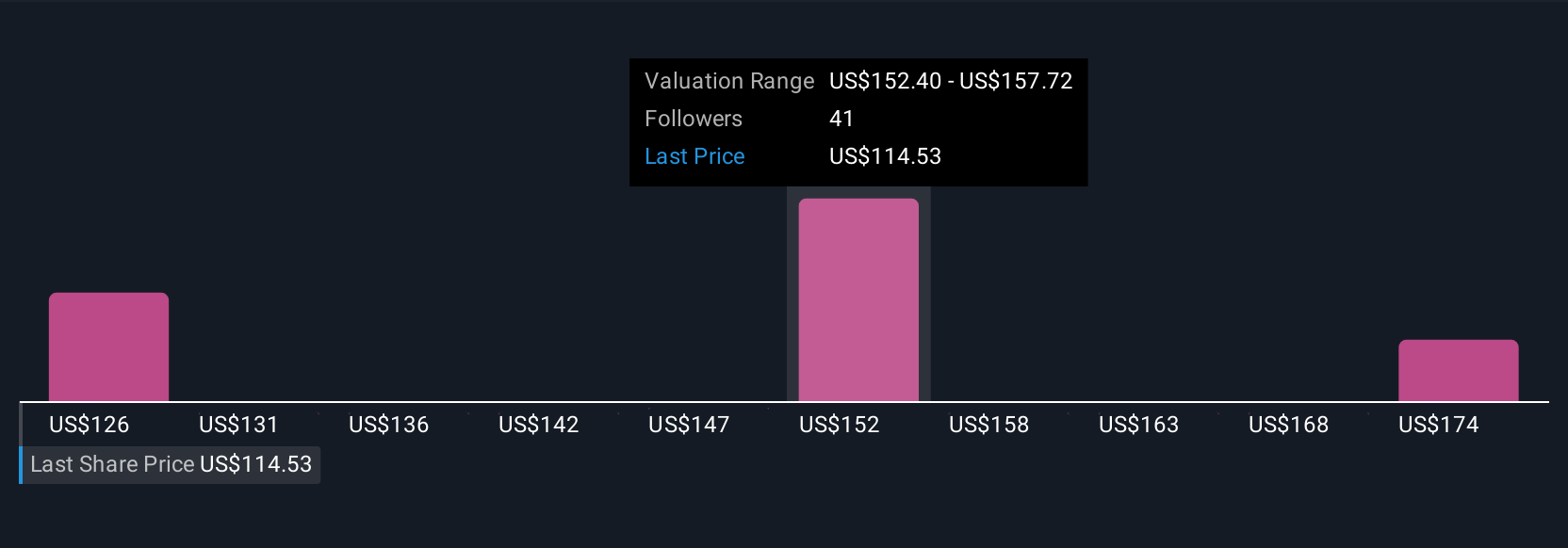

Three members of the Simply Wall St Community value PPG between US$119.80 and US$163.43 per share, underscoring how far opinions can spread. You may want to weigh those views against the risk that persistent FX pressure and weaker automotive production could constrain margins and test the company’s ability to sustain its current capital return profile.

Explore 3 other fair value estimates on PPG Industries - why the stock might be worth as much as 61% more than the current price!

Build Your Own PPG Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PPG Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PPG Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PPG Industries' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPG

PPG Industries

Manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026