- United States

- /

- Chemicals

- /

- NYSE:PPG

EV Battery Coating Innovations Might Change The Case For Investing In PPG Industries (PPG)

Reviewed by Sasha Jovanovic

- In recent weeks, PPG Industries announced ongoing cost-cutting and restructuring initiatives, a new non-methanol lens coating product, and its participation at The Battery Show North America to highlight advances in battery and electric vehicle solutions.

- While global demand remains uneven, PPG is emphasizing operational efficiency and growth in high-value battery coatings as it maintains full-year earnings guidance for 2025.

- We'll explore how PPG’s innovation in electric vehicle battery coatings could reshape its investment narrative beyond previous analyst expectations.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

PPG Industries Investment Narrative Recap

Owning PPG Industries means believing in the company’s ability to boost earnings through innovation and operational efficiency, even as global demand in key coatings segments remains choppy. Recent news around restructuring and cost control measures does not appear to materially change the immediate importance of global industrial production trends, which remain the biggest short-term catalyst and ongoing risk to PPG’s profitability outlook.

Among the latest announcements, PPG’s participation at The Battery Show North America stands out, showcasing solutions in electric vehicle battery coatings. This aligns closely with the ongoing industry shift and reflects how PPG is aiming to capture new growth as part of its broader focus on margin improvement in promising segments.

By contrast, investors should also stay alert to the potential impact of further weakness in global industrial production on short-term results and...

Read the full narrative on PPG Industries (it's free!)

PPG Industries' narrative projects $16.9 billion revenue and $2.0 billion earnings by 2028. This requires 2.7% yearly revenue growth and a $0.7 billion earnings increase from $1.3 billion today.

Uncover how PPG Industries' forecasts yield a $127.35 fair value, a 22% upside to its current price.

Exploring Other Perspectives

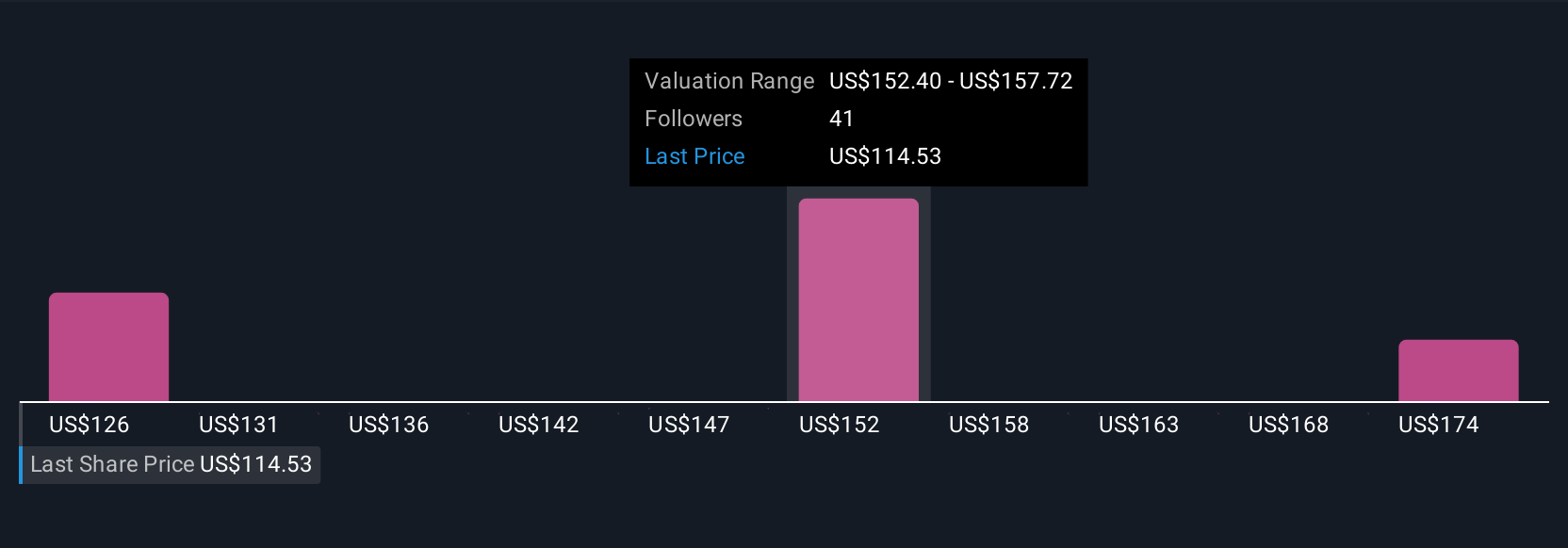

In the Simply Wall St Community, 3 retail investor fair value estimates for PPG range widely from US$127.35 to US$165.66 per share. While many see significant upside, the persistent volatility in PPG’s core industrial and architectural coatings demand remains a pressing consideration for future performance; consider these varying viewpoints as you weigh the outlook.

Explore 3 other fair value estimates on PPG Industries - why the stock might be worth just $127.35!

Build Your Own PPG Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PPG Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PPG Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PPG Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PPG

PPG Industries

Manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives