- United States

- /

- Chemicals

- /

- NYSE:OLN

Olin (OLN): Reassessing Valuation After a Choppy Share Price Pullback and Ongoing Earnings Reset

Reviewed by Simply Wall St

Recent performance sets the stage

Olin (OLN) has quietly slipped over the past week but is still up over the past month, a choppy setup that makes its longer slide this year more interesting for value minded investors.

See our latest analysis for Olin.

That recent pullback comes on top of a much steeper year to date share price decline, while multi year total shareholder returns remain deeply negative. This pattern signals fading momentum and persistent market skepticism about Olin’s earnings power.

If Olin’s mixed momentum has you reassessing your watchlist, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With shares down sharply this year yet trading well below some valuation estimates, investors face a key question: Is Olin a temporarily mispriced cyclical, or is the market correctly discounting its future growth prospects?

Most Popular Narrative Narrative: 18% Undervalued

With Olin last closing at $20.39 against a most popular narrative fair value near the mid 20s, the story hinges on a powerful earnings reset.

Structural cost reduction initiatives (Beyond250 and Epoxy cost optimization) are expected to deliver significant operational savings, yielding an estimated $70-90 million run rate benefit by the end of 2025 and additional structural cost reductions from the Stade, Germany facility in 2026; this should improve net margins and boost earnings quality.

Curious how modest top line growth can still support a sizeable uplift in earnings power, share count, and valuation multiples over the next few years? The narrative quietly weaves together margin rebuilding, capital returns, and a discounted future profit base into one ambitious fair value story that is far from obvious in today’s headline numbers.

Result: Fair Value of $24.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global overcapacity and weaker Winchester ammunition margins could undermine pricing power, delay margin recovery, and challenge the earnings reset underpinning that fair value story.

Find out about the key risks to this Olin narrative.

Another angle on valuation

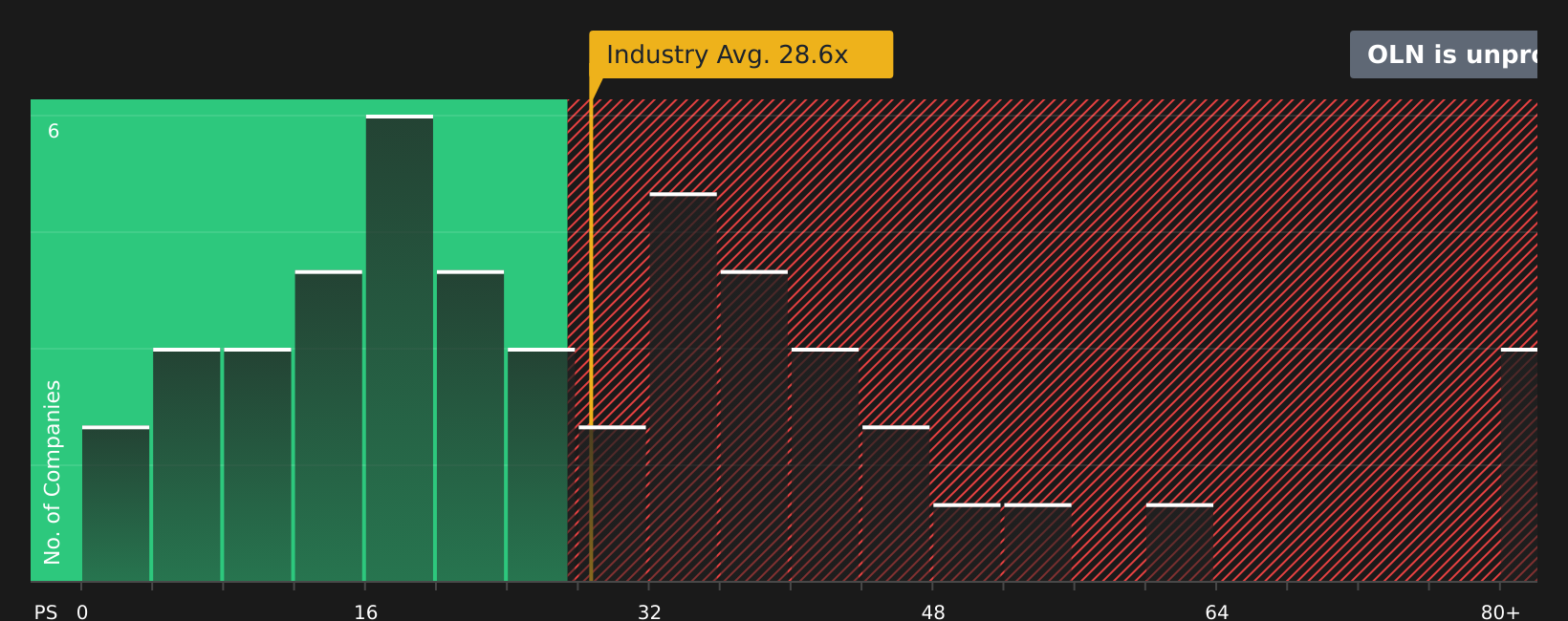

On earnings based multiples, the picture flips. Olin trades at a steep 43.4 times earnings, richer than both the US Chemicals sector at 23.6 times and its own 35.4 times fair ratio. This suggests valuation risk if profits do not ramp quickly enough to close that gap.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Olin Narrative

If you would rather challenge these assumptions or lean on your own due diligence, you can build a personalized take in just a few minutes: Do it your way.

A great starting point for your Olin research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next edge by using the Simply Wall St Screener to uncover fresh opportunities that most investors are still overlooking.

- Capture overlooked value by targeting these 914 undervalued stocks based on cash flows that pair strong cash flows with attractive entry prices.

- Ride the next wave of innovation by zeroing in on these 25 AI penny stocks at the heart of the AI transformation.

- Strengthen your income game by focusing on these 13 dividend stocks with yields > 3% that can support reliable, above average payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OLN

Olin

Manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion