- United States

- /

- Packaging

- /

- NYSE:OI

These 4 Measures Indicate That O-I Glass (NYSE:OI) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that O-I Glass, Inc. (NYSE:OI) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for O-I Glass

What Is O-I Glass's Debt?

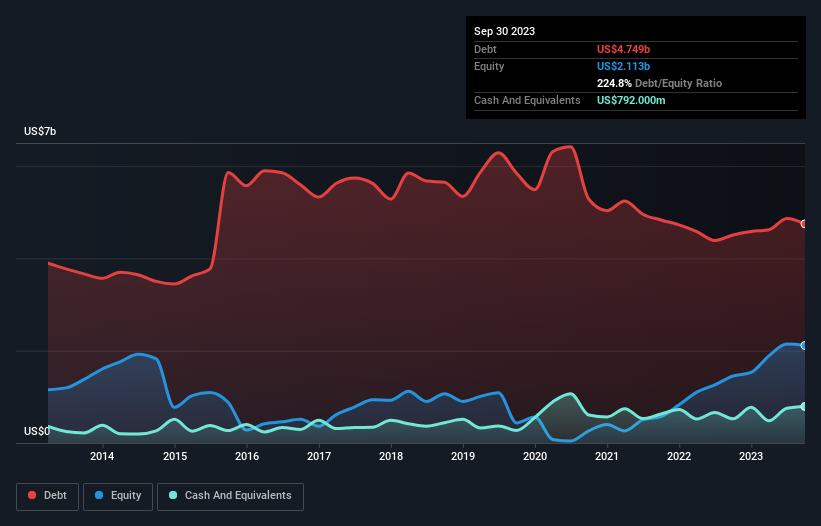

As you can see below, at the end of September 2023, O-I Glass had US$4.75b of debt, up from US$4.51b a year ago. Click the image for more detail. However, it also had US$792.0m in cash, and so its net debt is US$3.96b.

How Healthy Is O-I Glass' Balance Sheet?

According to the last reported balance sheet, O-I Glass had liabilities of US$2.07b due within 12 months, and liabilities of US$5.55b due beyond 12 months. Offsetting these obligations, it had cash of US$792.0m as well as receivables valued at US$766.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$6.06b.

The deficiency here weighs heavily on the US$2.31b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, O-I Glass would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

O-I Glass's debt is 3.1 times its EBITDA, and its EBIT cover its interest expense 3.0 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Looking on the bright side, O-I Glass boosted its EBIT by a silky 36% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if O-I Glass can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, O-I Glass created free cash flow amounting to 6.8% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Mulling over O-I Glass's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, it seems to us that O-I Glass's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for O-I Glass you should be aware of, and 1 of them shouldn't be ignored.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OI

O-I Glass

Through its subsidiaries, engages in the manufacture and sale of glass containers to food and beverage manufacturers primarily in the Americas, Europe, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.