- United States

- /

- Metals and Mining

- /

- NYSE:NUE

Leadership Shuffle And Dividend Hike At Nucor (NUE) Could Be A Game Changer For Investors

Reviewed by Sasha Jovanovic

- Nucor Corporation has announced that Chief Financial Officer and Executive Vice President Stephen D. Laxton will be promoted to President and Chief Operating Officer on January 1, 2026, succeeding retiring COO David A. Sumoski, while the board also approved an increased regular quarterly dividend of US$0.56 per share payable in February 2026.

- This combination of an internally sourced leadership transition and a higher cash dividend signals management’s focus on continuity while continuing to return cash to shareholders.

- We’ll now examine how Laxton’s move from CFO to President and COO, alongside the dividend increase, may influence Nucor’s investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Nucor Investment Narrative Recap

Nucor appeals to investors who believe in a large, U.S. focused steel producer reinvesting heavily in new mills and products while maintaining disciplined balance sheet and capital returns. The Laxton promotion and dividend bump do not materially change the near term story, where the most important catalyst remains execution on new projects, and a key risk is that management transitions across the C suite could disrupt that execution at a critical point in the investment cycle.

Among recent announcements, the increased regular quarterly dividend to US$0.56 per share from early 2026 stands out, because it sits alongside Nucor’s sizeable reinvestment program. For investors, that pairing reinforces the idea that the company is trying to balance funding new capacity and product initiatives with returning cash, even as it works through a series of leadership changes that could influence how effectively those new facilities are brought online.

However, investors should also be aware of the risk that multiple overlapping executive retirements and promotions could...

Read the full narrative on Nucor (it's free!)

Nucor’s narrative projects $37.2 billion revenue and $3.7 billion earnings by 2028.

Uncover how Nucor's forecasts yield a $169.69 fair value, a 6% upside to its current price.

Exploring Other Perspectives

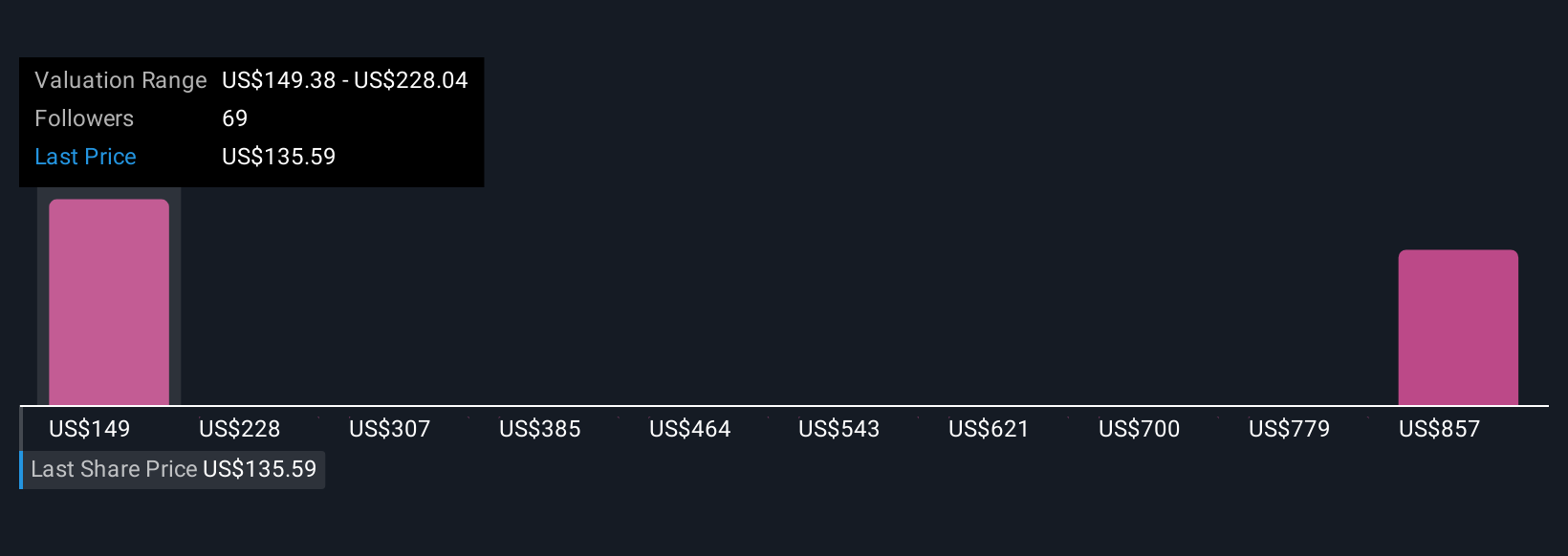

Seven members of the Simply Wall St Community value Nucor between US$140 and about US$597 per share, showing very different expectations. You can weigh those views against the execution risk around new projects coming online and decide how that could shape Nucor’s future performance.

Explore 7 other fair value estimates on Nucor - why the stock might be worth 12% less than the current price!

Build Your Own Nucor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nucor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nucor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nucor's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nucor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUE

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026