- United States

- /

- Metals and Mining

- /

- NYSE:NUE

Has Nucor’s 205.7% Five Year Surge Already Priced In Future Growth?

Reviewed by Bailey Pemberton

- If you are wondering whether Nucor at around $159 a share still offers value after a big multi year run, this section will walk through what the current price really implies and whether there is still upside on the table.

- The stock has climbed 9.8% over the last month and is up 39.3% year to date, building on a powerful 205.7% gain over five years that has investors asking if they are late to the party or right on time.

- Recent moves have been shaped by ongoing optimism around US steel demand and infrastructure spending, as well as Nucor's position as a low cost, relatively efficient producer in a traditionally cyclical industry. In addition, long term themes like reshoring of manufacturing and higher spending on energy transition projects have reinforced the idea that strong margins might be more durable than in past cycles.

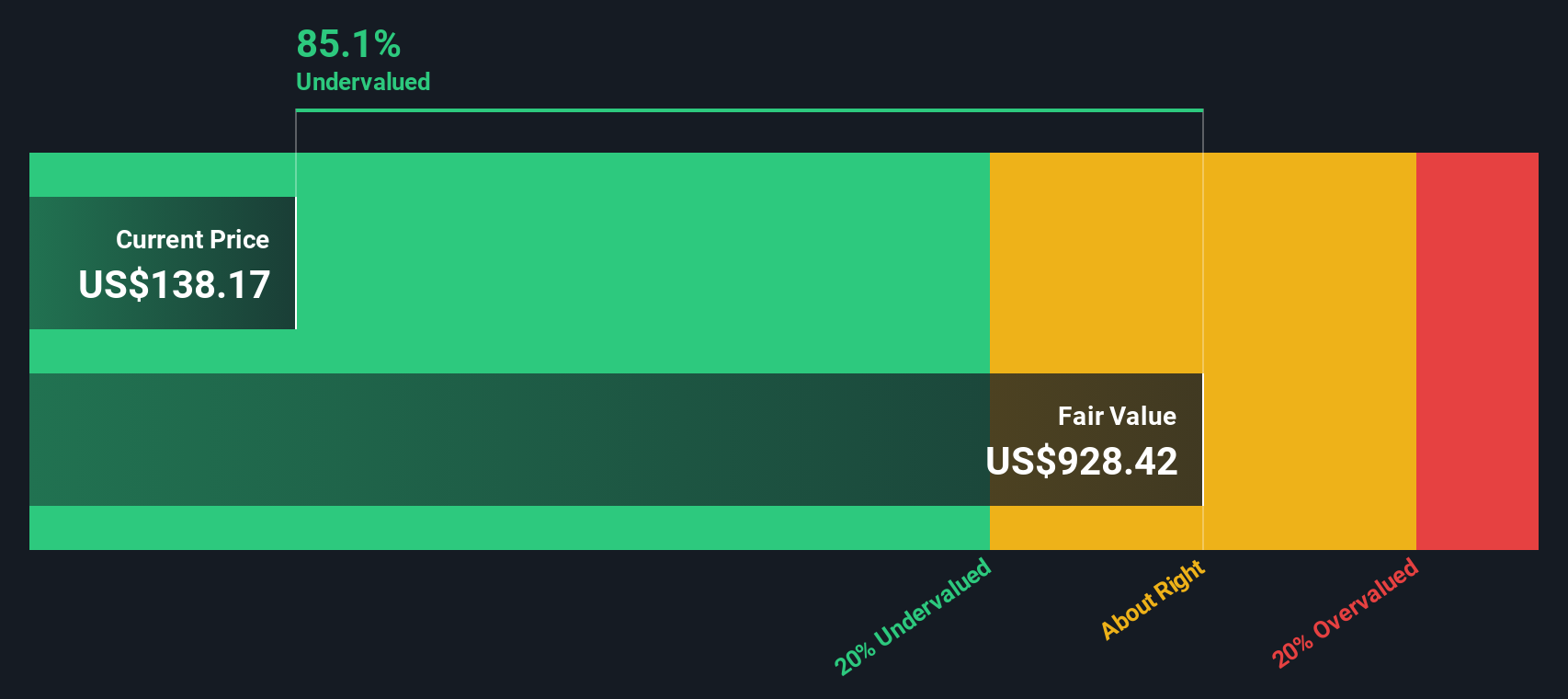

- Right now Nucor scores a 4/6 valuation check score, suggesting it still looks undervalued on several metrics. Next, we will unpack what different valuation approaches say about that price tag and introduce a potentially better way to think about Nucor's true worth toward the end of the article.

Find out why Nucor's 13.8% return over the last year is lagging behind its peers.

Approach 1: Nucor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For Nucor, the latest twelve month Free Cash Flow is about $413.5 Million, and analysts expect this to ramp up significantly over the next decade.

The model used here is a 2 stage Free Cash Flow to Equity approach, starting with explicit analyst estimates through 2027 and then extrapolating further out. By 2026, Free Cash Flow is projected to reach roughly $1.54 Billion, rising to about $2.95 Billion in 2027, and eventually to around $10.9 Billion by 2035 according to Simply Wall St projections. When all of those future cash flows are discounted back, the DCF model suggests an intrinsic value of about $581.86 per share.

With the stock trading near $159, that implies it is roughly 72.6% undervalued on this basis, a very large margin of safety if the assumptions prove directionally right.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nucor is undervalued by 72.6%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Nucor Price vs Earnings

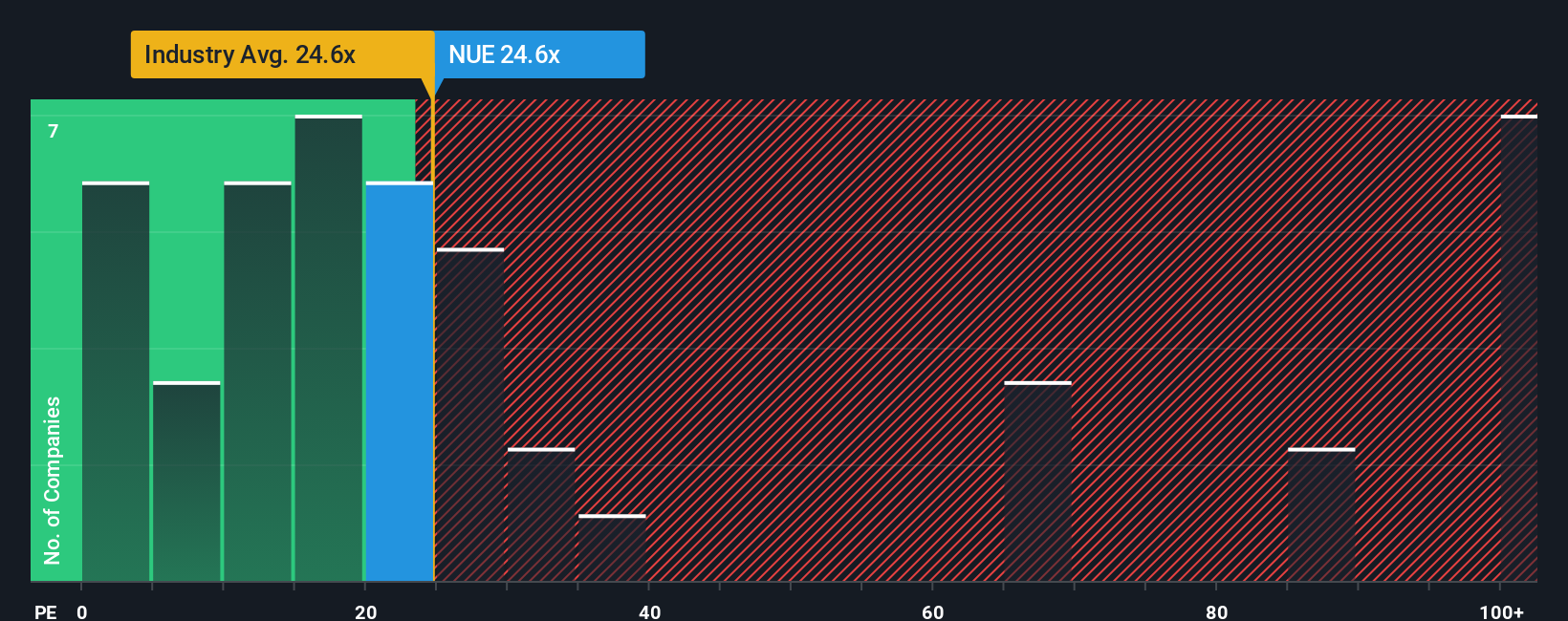

For a consistently profitable company like Nucor, the price to earnings (PE) ratio is a practical way to judge whether investors are paying a sensible price for each dollar of current earnings. In general, faster growth and lower risk justify a higher PE, while slower growth, more cyclicality or higher uncertainty should command a lower multiple.

Nucor is currently trading on a PE of about 22.2x. That is roughly in line with the broader Metals and Mining industry average of 22.2x, but sits well below the peer group average of around 35.6x, suggesting the market is applying a discount relative to some competitors. To refine this view, Simply Wall St calculates a proprietary “Fair Ratio” of 28.7x for Nucor, which is the PE one might expect given its earnings growth outlook, profitability, industry, market cap and risk profile.

This Fair Ratio framework is more robust than a simple peer or industry comparison because it explicitly adjusts for company specific growth drivers and risk factors, rather than assuming all steel producers deserve the same multiple. With the actual PE of 22.2x sitting meaningfully below the 28.7x Fair Ratio, Nucor still screens as undervalued on an earnings multiple basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

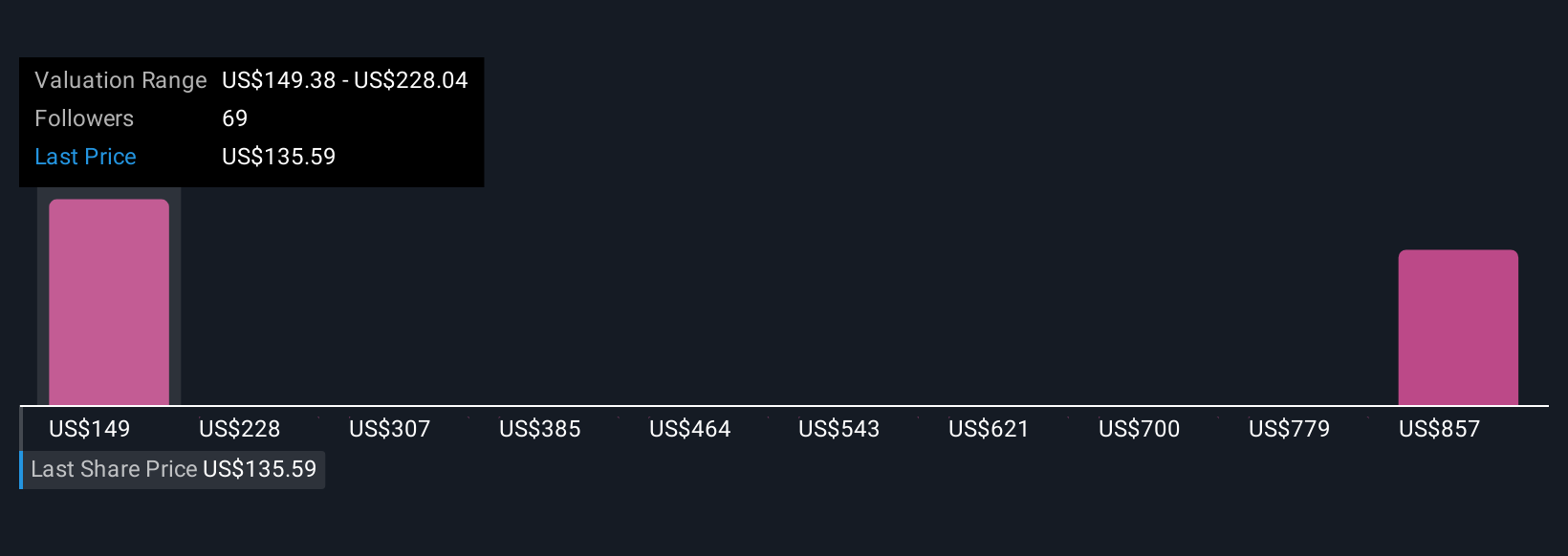

Upgrade Your Decision Making: Choose your Nucor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Nucor’s business with a concrete forecast and a Fair Value estimate. A Narrative is your story behind the numbers, where you outline how you think Nucor’s revenue, earnings and margins will evolve, and the platform then turns that story into a forward looking forecast and Fair Value that you can compare to today’s share price. On Simply Wall St, Narratives sit inside the Community page and are designed to be easy to use, letting millions of investors quickly see whether their Fair Value suggests Nucor is a buy, hold or sell at the current price, and then automatically updating those views as new news, earnings or guidance comes in. For example, one investor might believe that tariff protections, capacity expansions and margin gains justify a Fair Value near the top of the current analyst range around $182, while a more cautious investor, focused on macro risks and execution challenges, might anchor closer to the lower end near $145, and Narratives make those differences explicit and trackable over time.

Do you think there's more to the story for Nucor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nucor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUE

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026