- United States

- /

- Metals and Mining

- /

- NYSE:NUE

Electra Low-Carbon Iron Partnership Could Be a Game Changer for Nucor (NUE)

Reviewed by Sasha Jovanovic

- Electra, a low-carbon iron startup, recently announced advance purchase agreements with Nucor and Toyota Tsusho to support its new demonstration facility in Colorado, aiming for up to 500 tons of low-carbon iron output annually by mid-2026.

- This collaboration positions Nucor at the forefront of adopting innovative, environmentally conscious steelmaking solutions amid heightened global demand for green technologies and increasing regulatory pressures.

- We will examine how Nucor’s move into low-carbon iron through this partnership could influence its long-term investment outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Nucor Investment Narrative Recap

To own Nucor, I believe an investor needs conviction in the long-term health of the steel sector and Nucor’s ability to successfully innovate and scale amid evolving regulatory and technological pressures. While the agreement with Electra signals intent towards lower-carbon steelmaking, the partnership alone does not materially change the near-term picture, the most immediate catalyst remains Nucor's capacity expansions, while margin volatility and execution risks on upcoming projects are the main risks to watch.

Among Nucor’s recent announcements, its continued investment in new mills and coatings complexes is closely tied to its growth outlook and ability to meet shifting industry demands. This expansion remains the most relevant development, as it has a more immediate impact on operational capacity and earnings potential compared to the initial phases of the Electra partnership.

However, with steel market momentum and regulatory enthusiasm for green steel on one side, investors should especially be alert to the risk that...

Read the full narrative on Nucor (it's free!)

Nucor's narrative projects $37.2 billion revenue and $3.7 billion earnings by 2028. This requires 6.5% yearly revenue growth and a $2.4 billion earnings increase from $1.3 billion today.

Uncover how Nucor's forecasts yield a $159.75 fair value, a 17% upside to its current price.

Exploring Other Perspectives

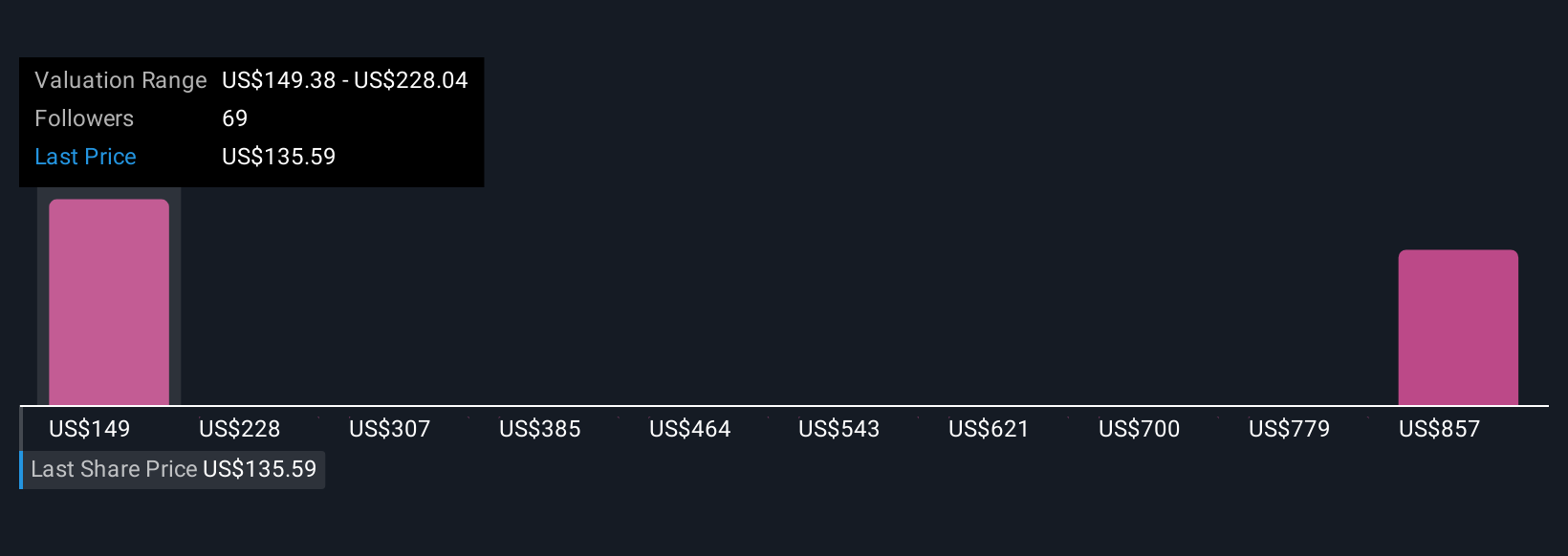

Eight Simply Wall St Community valuations set Nucor's fair value anywhere from US$140.34 to US$806.28 per share. This range reflects mixed views on execution risk as new projects ramp up, and how that could affect future profitability.

Explore 8 other fair value estimates on Nucor - why the stock might be worth over 5x more than the current price!

Build Your Own Nucor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nucor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nucor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nucor's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nucor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUE

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives