- United States

- /

- Chemicals

- /

- NYSE:NGVT

Will Ingevity's (NGVT) New Leadership Drive a Strategic Shift in Its Performance Materials Segment?

Reviewed by Sasha Jovanovic

- Ingevity Corporation recently announced the appointment of Ruth Castillo as Senior Vice President and President of its Performance Materials segment, effective November 10, 2025, with Ms. Castillo reporting directly to the company’s President and CEO.

- Ms. Castillo brings over 25 years of leadership in chemicals, specialty materials, and life sciences, with a strong record at Avantor and Celanese, highlighting a focus on operational transformation and global expansion.

- We'll examine how Castillo's experience in steering large-scale transformation could influence Ingevity’s investment narrative and future growth initiatives.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ingevity Investment Narrative Recap

To own shares in Ingevity, you have to believe in the company’s ability to transform its portfolio and drive profitable growth, especially through its Performance Materials segment. The recent appointment of Ruth Castillo brings deep industry expertise but is unlikely to materially change the main near-term catalyst, portfolio divestitures targeting margin improvement, or the top risk of prolonged demand weakness and tariff uncertainty impacting APT segment margins.

Among recent events, the reaffirmation of Ingevity's 2025 earnings guidance stands out, as it provides investors with some clarity regarding management’s expectations despite external headwinds. This guidance, together with ongoing leadership transitions, will be key to watch as the company steers through revenue pressures and business model shifts.

By contrast, investors should not overlook the continued risk from weak global demand and tariff pressures, which...

Read the full narrative on Ingevity (it's free!)

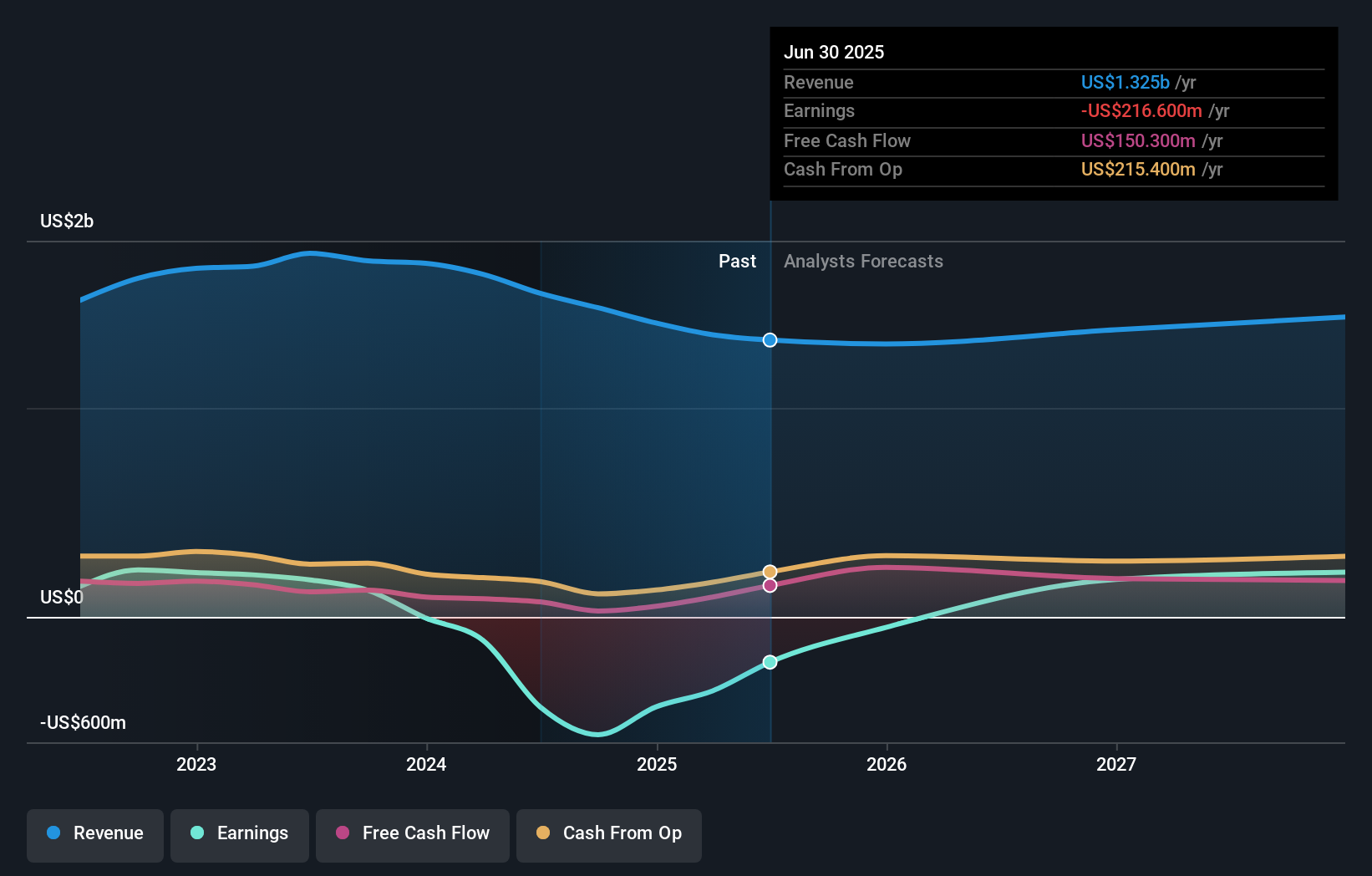

Ingevity's outlook anticipates $1.5 billion in revenue and $412.8 million in earnings by 2028. This scenario is based on a 3.1% annual revenue growth and a $629.4 million increase in earnings from the current level of -$216.6 million.

Uncover how Ingevity's forecasts yield a $65.25 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Only one Simply Wall St Community member has valued Ingevity, estimating a fair value of US$65.25 per share. With consensus still focused on the company's margin improvement plans, you may find that other community views offer sharply different takes on Ingevity’s path from here.

Explore another fair value estimate on Ingevity - why the stock might be worth just $65.25!

Build Your Own Ingevity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingevity research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ingevity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingevity's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NGVT

Ingevity

Manufactures and sells activated carbon products, derivative specialty chemicals, and engineered polymers in North America, the Asia Pacific, Europe, the Middle East, Africa, and South America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives